Federal Reserve pumps $4.5 Trillion into Wall Street in just four weeks

"How are you going to pay for it?" Asks absolutely no one ever when it comes to the big banks.

Thursday early afternoon, the Fed announced in a surprise shock-and-awe move that it will use the repo market in a big way to try to prop up and inflate whatever needs propping up and inflating. It will offer a series of $500-billion term repos at least through April 13, amounting to $4.0 trillion in new money over the four-week period.

...On Friday, the Fed will offer $1 trillion in repos: $500 billion in three-month repos and $500 billion in one-month repos. That’s a heck of a lot of bucks to print in just one day. But no problem for the new mega-money printer. If anyone wants this much, it can print it.Next week (the week of March 16), the Fed will offer another $1 trillion: next Monday, $500 billion in one-month repos; and next Friday, $500 billion in three-month repos.

...

These repos would come on top of the other repos and on top of the $60 billion a month in purchases of Treasury securities, that the Fed said it will broaden to include Treasury securities of all types and maturities, not just T-Bills.

That's a massive tidal wave of money printing that needs to be put into perspective.

The size of the entire U.S. economy was at $20.58 trillion in 2018.

Eliminating tuition at all public colleges and universities would cost $79 billion a year, according to the most recent Department of Education data.

The Fed has refused to provide the public with the dollar amounts going to any specific banks.

The taxpayer may support the dollar, but it seems we don't get to know what we are supporting.

Another thing that needs to be pointed out is this Fed bailout of Wall Street didn't just start with the coronavirus.

Since the Fed began its repo loan operations on September 17, the tally of the Fed’s cumulative loans to Wall Street’s trading firms comes to more than $9 trillion (using the Fed’s own Excel spreadsheet of the data; you have to manually remove the Reverse Repo dollar amounts.)According to the Fed audit conducted by the Government Accountability Office (GAO), from December 12, 2007 to July 21, 2010, a period spanning more than 31 months during the worst financial crisis since the Great Depression, the Fed’s cumulative loans to Wall Street tallied up to $16.1 trillion. (See chart below from the GAO audit.)

And here we are today, when everyone from Fed Chairman Jerome Powell to bank analyst Mike Mayo is telling the public that the banks have plenty of capital and yet the Fed has pumped out 56 percent in six months of the amount it funneled to the Wall Street banks over 31 months during the 2008 financial crisis. At this rate, it is going to top the money it threw at the 2008 crisis in no time at all.

$9 Trllion. Half of which got sent to Wall Street before people began panicking over a pandemic.

Yet the markets crashed anyway!

Just how serious is this? Consider this headline.

Coronavirus-induced market mayhem has pushed so much liquidity out of U.S. Treasuries that the true value of more than $50 trillion in assets around the globe is in doubt.

...“Treasuries are the risk-free benchmark that anchors the over-$50 trillion in global dollar-denominated fixed-income securities,” said Joshua Younger, head of U.S. interest rate derivatives strategy at JPMorgan Chase & Co.“The level of volatility and lack of clarity in Treasuries makes it much harder to make sense of the value of all other assets,” added Younger, who has an astrophysics Ph.D. from Harvard University. “It can create a self-perpetuating flow of expectations that is not really reflective of financial markets and the true level of risk aversion.”

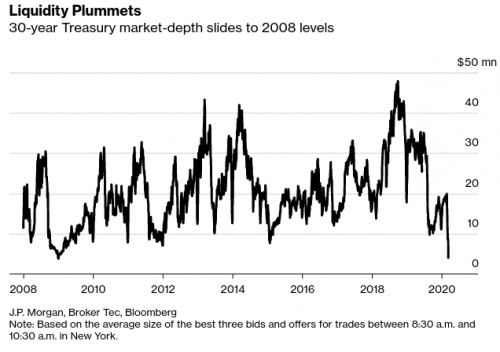

One key gauge of Treasury liquidity -- market depth, or the ability to trade without substantially moving prices -- has plunged to levels last seen during the 2008 financial crisis, according to data compiled by JPMorgan. That liquidity shortfall, JPMorgan says, is most profound in long-term Treasuries.

“I have never seen moves like this in 35 years of trading. I’ve never seen anything like it.”

- Tom di Galoma, managing director of Treasurys trading at Seaport Global Securities.

Forget the stock market. This is HUGE!

Last week someone made a comment that I summed up as "None of these unprecedented moves in the credit markets mean much...unless they mean financial End Of Days."

Well, when Bloomberg News starts calling into question the value of Treasuries, Financial End Of Days is no longer a non-significant possibility.

This is what it looks like.

“You couldn’t trade off-the-run Treasurys even if you begged people,” said Gang Hu, managing director of WinShore Capital Management, a fixed-income hedge fund.Faranello concurred. On Monday, there were times when traders could not find anyone willing to sell off-the-run 30-year bonds, a rare occasion in the most liquid financial asset in the world, he said.

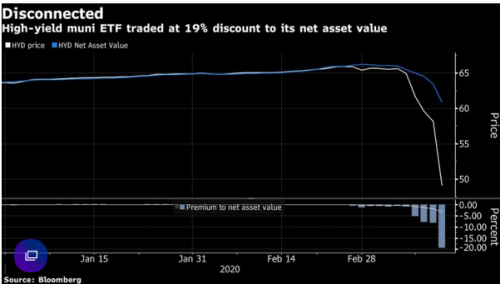

This illiquidity bleeds over into everything.

Ultra Long Term U.S. Treasury Bond Futures, which moved about 1.3 points per day on average in January, were down more than seven points on the day and off 36 points from Monday’s high. Italian sovereign debt had simply imploded. An index of costs to insure corporate debt with credit-default swaps surged the most since Lehman Brothers collapsed, and the CBOE Volatility Index measuring costs to hedge against losses in U.S. stocks was the highest since November 2008.In almost every single market, the difference between bid prices from buyers and ask prices from sellers was soaring. The spreads had become, Burdette said, “astonishingly wide.”

“There are so many flashing sirens on my monitors, I don’t know which is the worst,” said Burdette.

I expect the Fed to pump the market enough to unfreeze it, but only at the cost of Japanification of our economy, and making the markets even more illiquid in the future.

Comments

What does this mean for

tomorrow, next week...?

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

If I could answer that, I would be very rich

Too bad.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Stock crash hitting Wall Street banks hard

getting serious

The ponzi collapses...finally

This had to be coming. The market has been so over valued by banks/corporations using free money to buy their own stocks. Ponzi's always come to a bad end. Add in the COVID effect and the Russian Saudi oil price war squeezing the US over leveraged fracking industry and you have the perfect storm.

So what do get get? Bail out of the fracking industry https://www.commondreams.org/news/2020/03/13/shock-doctrine-press-confer...

and Wall Street https://www.nationalpriorities.org/blog/2020/03/12/trillion-wall-street-...

Let's make lemonade instead of being used yet again. Time to re-invent ourselves.

“Until justice rolls down like water and righteousness like a mighty stream.”

A couple charts

Here's a graph of interest...

Looks like a depression is coming to me...

“Until justice rolls down like water and righteousness like a mighty stream.”

Hey what you talk about Willis, no recession here

Senor, no recession aqui!

zerohedge.com

"Later in the year, obviously the economic activity will pick up as we confront this virus," Mnuchin told ABC News. "The real issue is not the economic situation today. The real issue is what economic tools are we going to use to make sure we get through this."

NEW: Despite forecasting an economic slowdown, Treasury Secretary Steve Mnuchin tells @jonkarl he does not think the coronavirus pandemic will cause a recession: "Later in the year, obviously the economic activity will pick up as we confront this virus." t.co pic.twitter.com/sBm0lCojMh

— This Week (@ThisWeekABC) March 15, 2020

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

obviously it is time for deregulation...

https://citizentruth.org/big-banks-call-for-wall-street-deregulation-to-...

what bastards...

“Until justice rolls down like water and righteousness like a mighty stream.”

The global total of all derivatives held by

banking, investment and insurance companies is close to 1 quadrillion US$. That is 1 thousand trillion dollars to put it into perspective for us proles.

We certainly are living in interesting times.

We are well and truly screwed

as a country. It's only going to get worse.

I took the maximum loan out of my 401k that I could, so at least I have that in cash, and the repayment schedule will reduce the shock of the losses (I may even benefit substantially, since the repayments are applied to the re-purchasing of possibly substantially lower-priced shares). I can protect myself in a down market. And yet, it's not enough. If I'm laid off, I'll either have to return all of that loan or charge it as an early distribution and pay taxes on it. If I'm not, I still have a new debt to service and possibly might simply be losing value more slowly due to inflationary concerns.

I'm in a better position than 90% of Americans. I've been in that 10%. I've been in worse, on the verge of homelessness so many times and my mother was homeless once before she got custody of me and my brother when I was a boy. This country doesn't give a shit about folks in that economic segment. I know: I've been there. And the fact that democrats are on track to nominate a disgusting old liar and fool is just sad.

And they just cut the interest rate

to 0 - .25%.

Zero interest rates will kill all savers. When it goes sub 0 the run is on.

My mattress may get a new stuffing.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Were is the moratorium on credit card, car, rent and mortage

payments or the 0 interest loans for human beings, the citizens paying for this government?

*That* we can’t pay for.

People just shouldn’t buy things they can’t afford and need to learn a lesson. /s

Idolizing a politician is like believing the stripper really likes you.

Tulsi wants to bailout the people

[video:https://www.youtube.com/watch?v=Jg6BQFdnA_U]

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

The effect of this bailout has tRump shitting his pants

ESH20

S&P 500 E-Mini (Mar '20)

2,567.50 -128.50

NQH20 Nasdaq 100 E-Mini (Mar '20)

7,556.00 -359.75

YMH20 Dow Futures Mini (Mar '20)

21,950 -1,038

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Speaking of that

thanks for making me look

tRump can't be happy

along with this guy

[video:https://www.youtube.com/watch?v=aPYrNM51MRc]

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

I picked a good time.

Three months ago I pulled all assets from the market. Didn't have a life savings in them anyways.

And to think they were just recently talking about giving a tax break for investing.

I'm sure they still will for those who have money to burn.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I'm damned near shitting mine.

I have just enough saved over a lifetime to maybe make it after being laid off at 58 and these bastards just can't have that. If my financial guy starts blowing smoke up my ass again he just might get cussed out. But what can he really do for me about it? Not one damned thing. I have been sort of regretting lately all the things I didn't buy with that damned money, at least I might have had something to show for it, something to sell if I needed to. It is after 4pm here, time for a good stiff drink.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

It could be we are now experiencing SHTF

just sayin

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Of course there us

no bailout for main street.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Still waiting for that run on the dollar.

I mean, why would anyone want to own dollars right now? At some point all of the big banks should let go of their reserves, and this place will be like Germany in 1923, except, y'know, with a pandemic. Here's a perspective from Wuhan, the epicenter of the COVID-19 crisis:

https://www.facebook.com/groups/peoplescoronavirusresponse/permalink/227...

“When there's no fight over programme, the election becomes a casting exercise. Trump's win is the unstoppable consequence of this situation.” - Jean-Luc Melanchon

Because we just had a $12 Trillion Margin Call

And everyone has borrowed in dollars.

That's why no one was selling Treasuries.

But an illiquid debt market also undermines the dollar-based financial system.

So a run on the dollar will be the LAST event in a collapse of dollar hegemony.

Some big owner of dollars --

will pay off all debts, and start selling the rest. And it will be over.

Seriously. If there's nothing to buy with dollars because the whole fkn country is either in quarantine or waiting to get into the ICU, then why bother with them?

“When there's no fight over programme, the election becomes a casting exercise. Trump's win is the unstoppable consequence of this situation.” - Jean-Luc Melanchon

Stay calm our leaders are in control

https://www.zerohedge.com/markets/mnuchin-says-covid-19-pandemic-wont-tr...

"Later in the year, obviously the economic activity will pick up as we confront this virus," Mnuchin told ABC News. "The real issue is not the economic situation today. The real issue is what economic tools are we going to use to make sure we get through this."

NEW: Despite forecasting an economic slowdown, Treasury Secretary Steve Mnuchin tells @jonkarl he does not think the coronavirus pandemic will cause a recession: "Later in the year, obviously the economic activity will pick up as we confront this virus." https://t.co/XkLFkSaaAp pic.twitter.com/sBm0lCojMh

— This Week (@ThisWeekABC) March 15, 2020

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

At around Super Tuesday --

it must have been blatantly apparent to most of the rest of the world that our political class was, both each individually and as a group, not the sort of thing you'd want to see on the bottom of your shoe. If I had an option I would run, run, run, away from the US and its financial and military tentacles, as far as possible.

“When there's no fight over programme, the election becomes a casting exercise. Trump's win is the unstoppable consequence of this situation.” - Jean-Luc Melanchon

But Cassiodores

what really caused this latest meltdown? Seems to me that the stock market globally is unhooked from real life, real economics and is all about funny money. Can't say I'd be sorry to see all these traders, hedge funders, entrepreneurs (savvy businessmen) bite the dust and go away, but will they? In the meantime they own the world's too real false economy. Add in global panic and fear and it seems a perfect storm over which humanity and the planet have no re3course other then propping up this dying 'inevitable' New/Old World Order. Nobody likes the four horseman even if they carry toilet paper on their ungodly march around the world.

I read the headline

And my first thought was "but we can't afford paid sick leave or medical care for everyone??!!" I read the whole essay. Thanks for telling us.

When do we get the free chicks?

[video:https://www.youtube.com/watch?v=JRDgihVDEko]

So how long before

Jubilee and/or helicopter money?

It’s a pity we humans are so reactive; or simply without vision (at least in the power-holding class.) This was foreseeable when we started to make financial economy more important than real economy. The "Black Swan Event" was inevitable, though it's shape and time was unknown. Maybe someone has a plan for this, but I've not seen anyone with it (and that could just be my ignorance.)

Orwell: Where's the omelette?