The world is going negative

Just one week ago, the Bank of Japan promised not to use negative interest rates. Today the Bank of Japan Governor Haruhiko Kuroda broke that promise.

Bank of Japan Governor Haruhiko Kuroda sprung another surprise on investors Friday, adopting a negative interest-rate strategy to spur banks to lend in the face of a weakening economy.

...

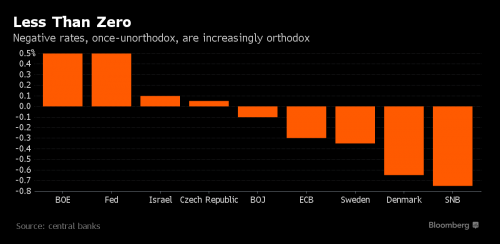

He declared that the BOJ was prepared to lower the interest rate further into negative territory if it decided this was necessary, and introduced examples of countries with large negative interest rates such as Switzerland (-0.75%) and Sweden (-1.1%)....

"When stocks are falling this much, it's hard to justify not acting," said one of the individuals, who has occasional contact with Kuroda.

There are all sorts of flashing red warning lights from this statement, including the fact that the BOJ would use stocks as an indicator for monetary policy. But they can be summed up with this sentence.

The move does speak to a certain degree of desperation.

And this sentence.

The Bank of Japan unexpectedly cut a benchmark interest rate below zero on Friday, stunning investors with another bold move to stimulate the economy as volatile markets and slowing global growth threaten its efforts to overcome deflation.

What is it?

Negative interest rates are exactly what they sound like.

Imagine a bank that pays negative interest. Depositors are actually charged to keep their money in an account. Crazy as it sounds, several of Europe’s central banks have cut key interest rates below zero and kept them there for more than a year. For some, it’s a bid to reinvigorate an economy with other options exhausted. Others want to push foreigners to move their money somewhere else. Either way, it’s an unorthodox choice that has distorted financial markets and triggered warnings that the strategy could backfire.

The Impossible

Let's be clear on something: negative interest rates are not supposed to happen. Period. The entire discussion of NIRP has been the domain of theoretical economics for generations.

The reason is obvious. Why loan money to someone at a negative interest rate when holding cash instead makes more sense?

Even during the deep deflation of the Great Depression, interest rates never went below zero.

The St Louis Federal Reserve said this just two years ago.

Conventional wisdom is that interest rates earned on investments are never less than zero because investors could alternatively hold currency.

It's more than conventional wisdom. There is an entire economic theory behind this called Zero Lower Bound.

Paul Krugman wrote, "the zero lower bound isn’t a theory, it’s a fact, and it’s a fact that we’ve been facing for five years now."

Zero Lower Bound is associated with the Keynesian economic problem of a Liquidity Trap.

Going to negative interest rates is totally uncharted territory. Absolutely no one knows what is going to happen, which in a sane world would make policy makers hesitant. However, we no longer live in a sane world.

To give you some idea of the size of this monetary experiment, check out this chart.

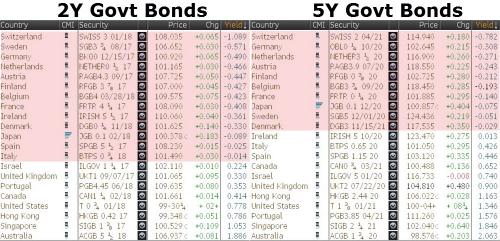

That $5.5 Trillion worth of government bonds for countries that make up 23% of the global GDP.

We are quickly reaching a point where it will be too late to back out of this monetary experiment if it should blow up.

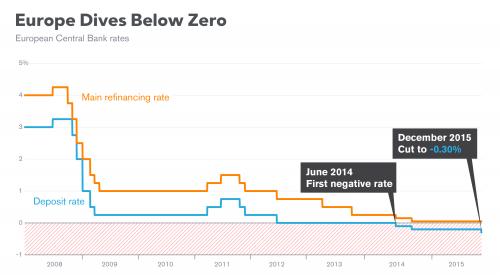

In the case of Europe, it's not just interest rates on deposits. It's extending even to refinance rates.

Stock markets certainly love NIRP, but that just shows that stock investors aren't that bright.

Negative interest rates are a sign of desperation, a signal that traditional policy options have proved ineffective and new limits need to be explored. They punish banks that hoard cash instead of extending loans to businesses or to weaker lenders. Rates below zero have never been used before in an economy as large as the euro area....Policy makers are trying to prevent a slide into deflation, or a spiral of falling prices that could derail the recovery.

In theory, interest rates below zero should reduce borrowing costs for companies and households, driving demand for loans. In practice, there’s a risk that the policy might do more harm than good. If banks make more customers pay to hold their money, cash may go under the mattress instead.... there’s still a worry that when banks absorb the cost themselves, it squeezes the profit margin between their lending and deposit rates, and might make them even less willing to lend. Ever-lower rates also fuel concern that countries are engaged in a currency war of competitive devaluations.

Yet despite these obvious dangers, some of which are more than likely, global central banks are pushing on. Already there is speculation that NIRP is coming to America.

Scandinavian countries have yet to see a flight to cash or a money market collapse, but is the idea to push interest rates down until the market breaks? Or fix what is causing the economies to drag?

The revolution may be here to stay. The further rates go below zero the longer the rise back to normalcy will take and the greater likelihood central banks will resume the policy in future downturns, said Stein at Oxford Economics.

Negative rates once “sounded illogical,” said Stein. “We now know what we thought was true isn’t.”

They sounded illogical because they are illogical. Just because something becomes reality doesn't mean it stops being illogical.

Comments

I don't know what to say at this point....

They're forced to sprinkle the lint from the bottom of their magic bag o' tricks over everything and declare it fairy dust. Just the latest in a desperate series of swindles to make this moribund economic system appear lively -- a Weekend at Bernie's scenario.

[video:https://www.youtube.com/watch?v=YCTgcZ6ImsQ]

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

That was fast

monetary blowback