Wall Street is back to the same scams, but with different words

It doesn't take a genius to predict this outcome.

Almost no bankers got thrown in jail for systemic fraud, and few bankers lost their jobs for making stupid loans.

So with no consequences, why not do it all again but repackaged, amirite?

Remember the Financial Crash of 2008? It started out as the "subprime crisis" before it became an Everything Crisis.

How will Wall Street pitch it this time?

They were blamed for the biggest financial disaster in a century. Subprime mortgages – home loans to borrowers with sketchy credit who put little to no skin in the game. Following the epic housing crash, they disappeared, due to strong, new regulation, and zero demand from investors who were badly burned. Barely a decade later, they're coming back with a new name — nonprime — and, so far, some new standards.

...Sharga said Carrington will manually underwrite each loan, assessing the individual risks. But it will allow its borrowers to have FICO credit scores as low as 500. The current average for agency-backed mortgages is in the mid-700s. Borrowers can take out loans of up to $1.5 million on single-family homes, townhomes and condominiums. They can also do cash-out refinances, where borrowers tap extra equity in their homes, up to $500,000. Recent credit events, like a foreclosure, bankruptcy or a history of late payments are acceptable.

It's not subprime. It's nonprime. It's totally different.

So what are banks going to do with all these perfectly fine nonprime mortgages?

Put them into CDOs like in "The Big Short"?

Absolutely not!

Mention the term “collateralized debt obligation” and financial watchdogs immediately seize up. Real estate CDOs, or mortgages repackaged into bonds, were a big reason for the U.S. financial market’s meltdown in 2008. Following the Great Recession, they more or less disappeared from the scene. But they are now staging a comeback under a new name: collateralized loan obligation, or CLO.

In December, Blackstone Mortgage Trust issued what it called the biggest post-crisis commercial real estate CLO, at $1 billion. And last month TPG Real Estate Finance Trust, another mortgage REIT, followed suit with a $932.4 million issuance.

Collateralized loan obligation are at least four letters different from CDOs.

No matter what, the big banks wouldn't be foolish enough to keep all that nonprime debt on their books again.

Since the Financial Crisis, big banks have mostly avoided subprime lending. Instead, they're lending to the companies that then provide financing to subprime customers. And BofA is finding out just how much risk it was taking with its loan to Summit that was secured by now defaulting auto loans that were secured by cars that, once repossessed, are worth only a fraction of the loan value when they're sold at auction.

How much banks are exposed in this manner to subprime loans - not just auto loans, but also subprime mortgages, and subprime consumer loans - is somewhat of a mystery. But some clues are percolating to the surface. According to an analysis by the Wall Street Journal of regulatory filings, bank loans to nonbanks lenders have surged sixfold since the Financial Crisis to nearly $345 billion at the end of 2017.

Since 2009 subprime, I mean nonprime lenders have been making auto loans by the handfuls.

Not at all like before 2008. Because before 2008 those lenders went under.

Growing numbers of small subprime auto lenders are closing or shutting down after loan losses and slim margins spur banks and private equity owners to cut off funding.

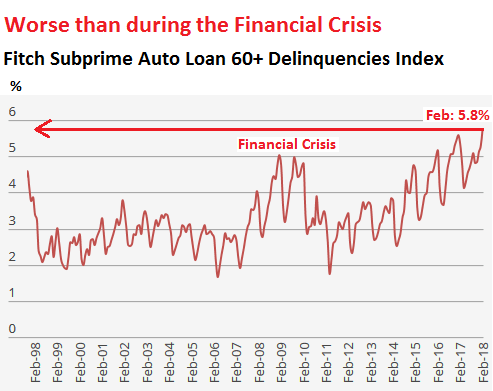

Yeah. It seems that auto loan delinquency rates are worse now than during the financial crisis.

Not to worry. Auto loans are a very small part of the bond market.

The thing is, the bond market has never been bigger. The U.S. debt to GDP ratio will pass Italy's in 2023.

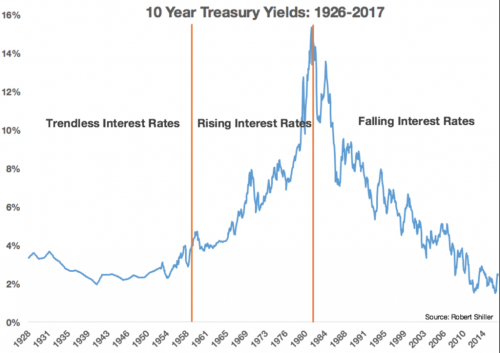

It's in the face of this huge pool of debt that a historically long bond bull market has ended, and a period of rising interest rates has started.

Interest rates have fallen for 36 year.

Let's put that into perspective.

We’re currently living through the second longest bond bull market in recorded history, and the longest since the 16th century, according to a new research paper from the Bank of England.

...“The average length of bond bull markets stands at 25.8 years, and the range falls between 61 years (1451-1511) and 12 years (1718-1729). Our present real rate bond bull market, at 34 years, is already the second longest ever recorded,” Schmelzing writes.

Interest rates have fallen for so long that last year they reached their lowest levels in 5,000 years of recorded civilization.

When you have to go back to the ice age to find lower interest rates, you know that they can't fall much further. At some point the charts will show that an absolute bottom has been reached.

They have.

Why does this matter?

For starters, interest rates have fallen for longer than a career on Wall Street.

There is no one left working on Wall Street that even knows how to trade a bond market in which interest rates are rising.

I think this is a very underappreciated dynamic.

Secondly, once-in-the-life-of-a-civilization low interest rates tends to encourage people to borrow money.

A loan at 2% interest may not make sense at 5%.

You can see the problem here.

Right now 10-year Treasury yields are just below 3%.

3 percent has also been cited by prominent fixed-income investors like Jeffrey Gundlach at DoubleLine Capital and Scott Minerd at Guggenheim Partners as critical to determining whether the three-decade bull market in bonds is at an end. In the mind of analysts who look at market patterns, once the yield breaks much beyond the 3.05 percent, to levels last reached in 2011, that threshold could flip to a floor from a ceiling.

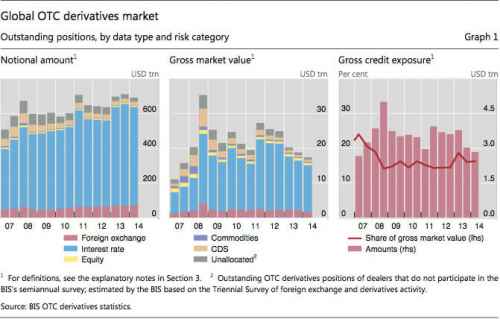

One other item to consider is derivatives.

What most people don't realize is that the interest rate swap market is far larger than the credit default swap market that scared so many people in 2008.

the global notional market for interest rate swaps was about $560 Trillion in 2014.

While using notional values dramatically overstates the actual amount of money at risk (unless there are systemic defaults), even a small fraction of that mountain of money dwarfs of the GDP's of the world.

What this means is that if interest rates were to rise, and rise quickly, it would trigger these interest rate swap contracts (i.e. someone would have to pay).

Do Wall Street and the other providers of interest-rate derivatives actually have the capital tucked away somewhere to cover the many trillions of dollars in increased interest payments for the entire nation (and the entire world), year after year, if rates were to rise by 5% or 10% or even more?

In practice, we know that Wall Street wasn't good for their promises on a little more than $1 trillion in subprime mortgage derivatives. There are more than 400 times as many interest-rate derivatives currently outstanding as there were subprime mortgage derivatives in 2008. There's no possible way. It would be an annihilation scenario, short of even greater levels of government interventions.

Of course that would only happen in an emergency scenario.

Surely in a much more mild event, such as the correction this February, the interest rate derivatives market would keep functioning.

Liquidity in the electronically traded US dollar interest rate swap market was so sparse during the bout of equity volatility on February 6 that the Ice swap rate was unable to be published.

Dealers pulled liquidity from central limit order books (Clobs), which supply the data used to calculate the rate, after the S&P 500 fell over 4% and CBOE Volatility Index surged 106% the previous day.

Comments

The global debt bubble is going

to be a very fine bonfire...soon. It will burn us all down to the ground and charcoal our nether regions.

The US Govt Debt is Whackjob at this point

~ $20 Trillion. And Pres Douchebag just signed the Tax Bill that will increase it a Trillion a year -- until The End. I assume we are the greatest debtor nation on earth. And we spend more on military than the next 10 countries combined. When does the world take away our credit card and watch this House Of Cards fall down. I recall the stories of the German currency crisis with people wallpapering their homes with their worthless paper money.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

If you can afford to wait it out with them,

they will rebound even if at the taxpayers' expense. Everyone in the market will be twice as rich. The hard part is what it does to the real estate market, which hasn't yet recovered imo. When homes and home equity are a major middle-class investment and it can't be liquidated, it is a huge, huge hit to those who can least afford the loss. Thanks to Obama and Holder, the beat goes on.

"Religion is what keeps the poor from murdering the rich."--Napoleon

More charts

Exactly, debt it's what for breakfast lunch and dinner .

essentially we are eating our future, one plastic swipe at a time. There is an arcane point to be made that we are in fact eating oil and plastic, with a side salad of fiat currency. Our GMO grain based food takes a lot of oil to make it grow. EROEI, thermodynamics, calories, etc, I'll let the academics figure out the specifics. Homo Carbonus. Heh!

Marx identified this 150 years ago

And Minsky expanded on it 40 years ago.

You can't have rock-bottom interest rates for a decade and not accumulate a lot of bad loans. Especially with a largely unregulated financial sector.

I keep wondering if I should change my .sig

But then we get stories like this one.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Student debt

Student debt has now exceeded $1.4 Trillion!!! This is the only kind of debt that cannot be discharged through bankruptcy. We have bankrupted our future.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Not only that

don't forget the neoliberal agenda of totally getting rid of public education so we can make a buck now.

That's eating your seed corn.