A strong economy? Not so fast

Everyone has heard of GDP, but most don't know how it is calculated.

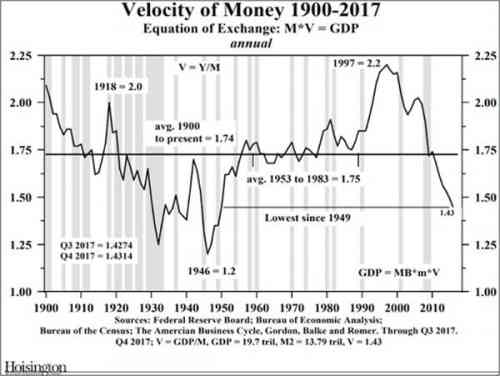

As a simple mathematical equation, it is written as M * V = P * Q, where M is money supply, V is velocity, P is price inflation and Q is real GDP.

The two numbers on the right side of the equation (the outputs) have been mostly stable for nearly a decade, but the first two numbers (the inputs) are seriously distorted, and indicate that something is chronically amiss.

Money velocity has been falling for 20 years, and is now at the same levels as registered during the Great Depression.

What is money velocity?

In simple terms, it’s the frequency with which the same dollar changes hands when the holder buys something.Higher velocity means more economic activity, which usually means higher growth. So it is somewhat disturbing to see velocity now at its lowest point since 1949, and at levels associated with the Great Depression.

Logically if the velocity rate keeps falling, the economy will collapse. Either way, it's a sign of something very, very wrong with the real economy.

So far the Fed has been able to literally paper-over the problem with an unprecedented increase in the money supply.

Economic models will tell you that people are simply saving more, so there's nothing to worry about.

The problem is that this isn't true.

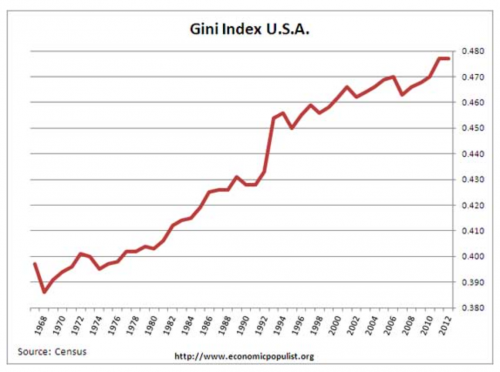

So if all this money being created isn't being spent, and it isn't being saved, then where is it going?

To answer that you have to look at something that economists refuse to put into their models - class.

If you print a mountain of money, and then give it to people who are already wealthy, what do you think they will do with it?

money velocity is falling almost everywhere. When that happens, it’s a clear sign of speculation in investment and the inflation of debt and financial asset bubbles.This scenario NEVER ends well.

Unlike the working class, the wealthy don't need to spend any new income. Instead they put additional money into investments that generate a return.

Which is OK, if they were building factories and things that created jobs. But they aren't doing that.

I don't know how this will end, but I can say that the underlying problems in the economy are barely even being acknowledged.

Obviously it's Putin's fault.

Comments

It is very scary - thanks for the analysis and the links

provided. I read them. And magically I think I understood them. You really did a great job explaining the role of velocity of money and the money supply.

Is it correct to say that the only variable in the equation, we have control over is M, the money supply? I don't understand what would happen if M were not allowed to increase in the amount it is done. Which part of the right hand side of the equation would decrease? Price inflation or real GDP?

Please give Putin a shellacking. He should answer all the questions. /s

So, what will help the poor to survive? Is it land ownership (land that is paid off and debt free) and homestaeding? Put your cash savings into gold? Why would that help? Or doesn't it?

I wonder how we will survive the coming depression?

https://www.euronews.com/live

GDP doesn't take into account the usefulness of transactions

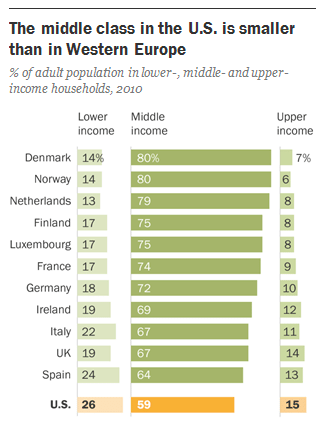

I can sell you 100 pictures of Donald Trump and you can sell me 100 pictures of Ronald Reagan, and that's all counted as part of the GDP. Or you can have an enormous, mostly useless, predatory financial sector that mostly aggregates wealth to the top .1%, an enormous war machine that produces nothing but death and chaos, and a phenomenally expensive healthcare sector, well beyond its utility, and have a gargantuan GDP. But does it mean anything for society or the median worker? The tell here is that in the 1960s a single worker could raise a family, own a house, put good food on the table, have vacations and put two kids through college. That's impossible today for a middle class family. I believe that in terms of useful goods and services to the median family we have had no gains since 1967 and arguably have gone backwards.

My other point here is that a dollar measure of exchange of the economy is useless. The real value of an economy is in it's technology, infrastructure and extraction industries and I include agriculture here. So how do you measure that? And how do we compare to other countries? I'll give you one measure, the amount of cement produced since that is necessary to make concrete, the most basic construction material today. Are you ready for this? US - 83 million metric tons, China - 2,500 metric tons, in 2014. So who has a bigger economy? My answer, China by a lot. They also feed 1.3 billion people and export food. But by raw GDP numbers in dollars, the US is ahead by a very small margin. Many people who have done business in both countries, myself included, feel that China's economy is at least twice as big as the US. In the smartphone sector a mew product must be successful in China - the US market is a fraction of China's. Good luck with Trump's trade war with China! The tables have been turned. Not only does China have a bigger manufacturing sector, but now a bigger consumer sector, which was the critical component of China's meteoric economic rise.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

And this is why there has been no inflation,

despite the fact that the Fed has been on a money printing binge for years.

The free money never trickled down.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

@Azazello I just don't get the

I just don't get the whole "no inflation" notion.

My market basket, which is mainly food, paper products, and cleaning items have all been increasing in price over at least the decade.

What is combined with everyday regular consumption that is negating this inflation? Is oil and electronics included with this market basket?

dfarrah

Well we sure haven't seen wage inflation.

I don't know who calculates it, or how, but the official inflation rate has been 3% or under since '08. Source

Not at all what you'd expect given the increase in the money supply shown above.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Yes.

I was talking about purchases rather than wages.

But the money supply versus inflation doesn't make sense like you say.

Supposedly, there has been a small uptick in wages in 2018. The fed has been raising interest rates, which really irritates me. Sure, go ahead, snuff out whatever good the economy has been doing (but I guess those on fixed incomes are glad).

dfarrah

Yes. That and one more reason

Globalism has crushed labor unions

I've often wondered what our "GDP" would look like

If you took out the war sector and the financial sector.

Taking out the war sector is an obvious no-brainer. The very idea that our nation would seek to enrich itself upon war ought to be repugnant. That idea leads inevitably to us promoting war and going to war ourselves because hey, it raises the GDP! It turns the nation into nothing but thugs. So any "GDP" that I cared about would not count war profits as a good thing.

Taking out the financial sector also seems obvious since it does nothing useful. It is the casino for the wealthy. I cannot see how it in any way materially reflects on the health of our economy.

It'd be fascinating to see a 60 year graph of GDP using that version of GDP.

That's GREAT news on the middle class though. I'm actually surprised it can sustain 59%. But hey, the next crash ought to lop that neatly below 50% and maybe we can get some changes going.

A lot of wanderers in the U.S. political desert recognize that all the duopoly has to offer is a choice of mirages. Come, let us trudge towards empty expanse of sand #1, littered with the bleached bones of Deaniacs and Hope and Changers.

-- lotlizard

Very interesting...

Thanks and Happy New Year to all

"Religion is what keeps the poor from murdering the rich."--Napoleon

Do you recall what was going

on in the 90s that increased the velocity of money to 2.2?

dfarrah

Friedman's Monetarism

M * V = P * Q is not the GDP formula, it's the Equation of Exchange used in Monetarism theory. The standard GDP formula is GDP = C + I + G + (X – M).

YES!

Now if you would be kind enough to identify the elements of the

GDP formula, it will save me the trouble. I was going to look it up to make the point you made, but fortunately read all the way through first. Otherwise, I'll read your link, but I'm lazy today and the rain is beating on my house. It's a better night for a novel.

GDP formula

"C is equal to all private consumption, or consumer spending, in a nation's economy, G is the sum of government spending, I is the sum of all the country's investment, including businesses capital expenditures and NX is the nation's total net exports, calculated as total exports minus total imports (NX = Exports - Imports)."

The NX component is often overlooked or minimized by globalists, but the fact is that GDP would be about 2% higher if we weren't running the huge trade deficits that funnel money and jobs out of the country.

Thank you.

You are right

That was a stupid mistake of mine.

I'll need to rewrite the lead-in.

TY