Oil bust about to get serious

Oil prices dropping to six-year lows is already serious, but doing it in the middle of the peak season for oil should get everyone's attention.

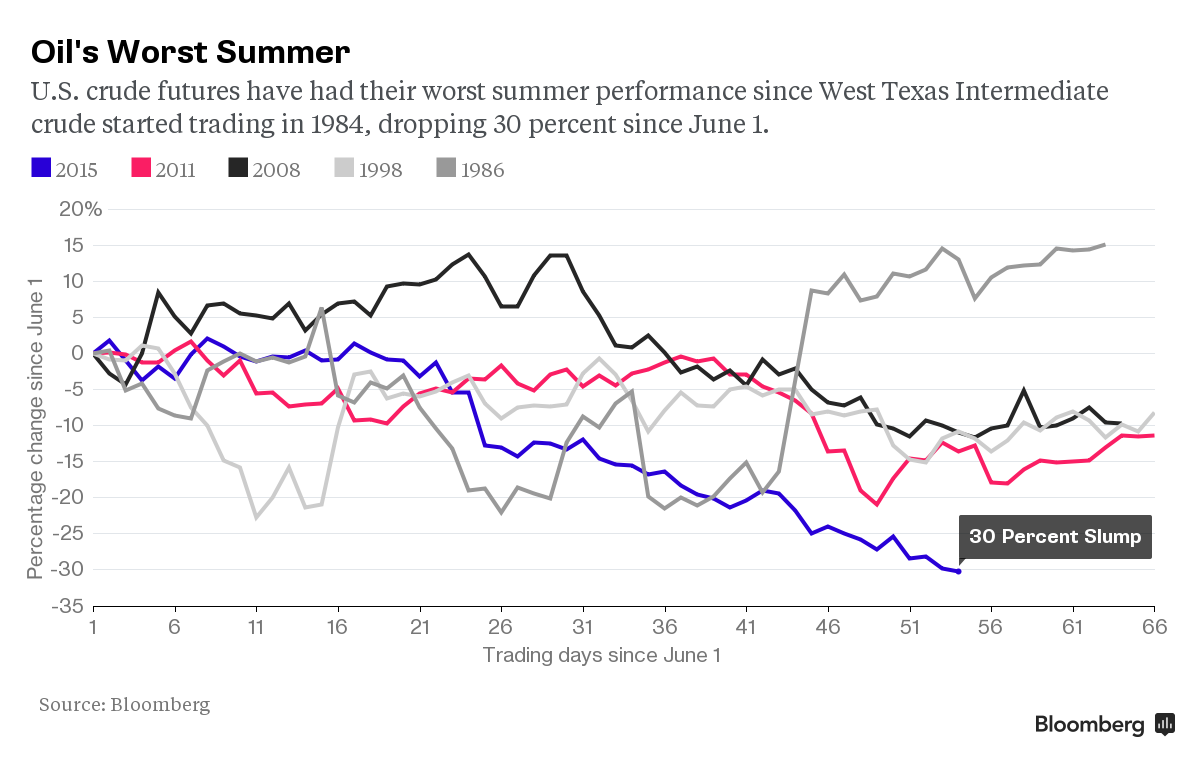

U.S. crude futures have lost 30 percent since the start of June, set for the biggest drop since the West Texas Intermediate crude contract started trading in 1983. That beats the summer plunges during the global financial crisis of 2008, the Asian economic slump in 1998 and the global supply glut of 1986...

"OPEC is basically saying we're not going to cut production, we're going to see who can stand lower prices longest,'' Shilling said. "Oil is headed for $10 to $20 a barrel.''

Oil was already having a very bad year, but then China did something that took the markets by surprise - they devalued their currency this week. That suddenly made everything very real.

For oil, the move has raised concerns that oil demand will take a hit. China is the world’s largest importer of crude, and a devalued currency will make oil more expensive. On August 11, oil prices dropped to fresh six-year lows, surpassing oil’s low point from earlier this year. But with China’s economy – once the engine of global growth – suddenly looking fragile, it would be difficult to argue with any certainty that oil has hit a bottom.

Our domestic energy market appears to have been taken off-guard by this devaluation, because they've been betting that the bottom was in.

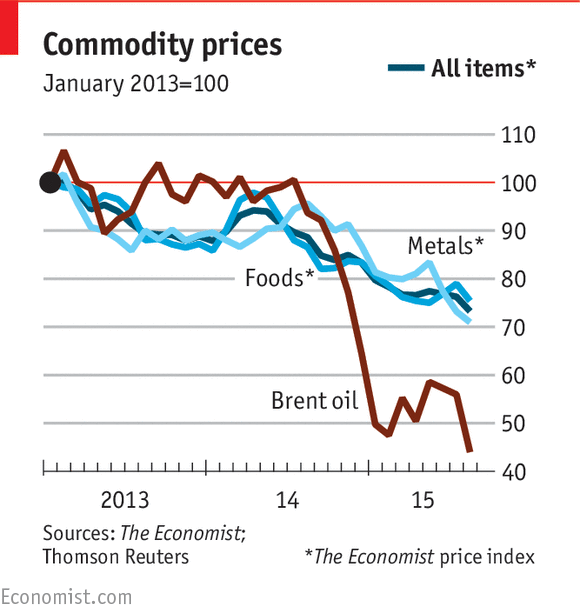

Of course the Yuan devaluation goes far beyond just oil, and is expected to crush the commodity market in general.

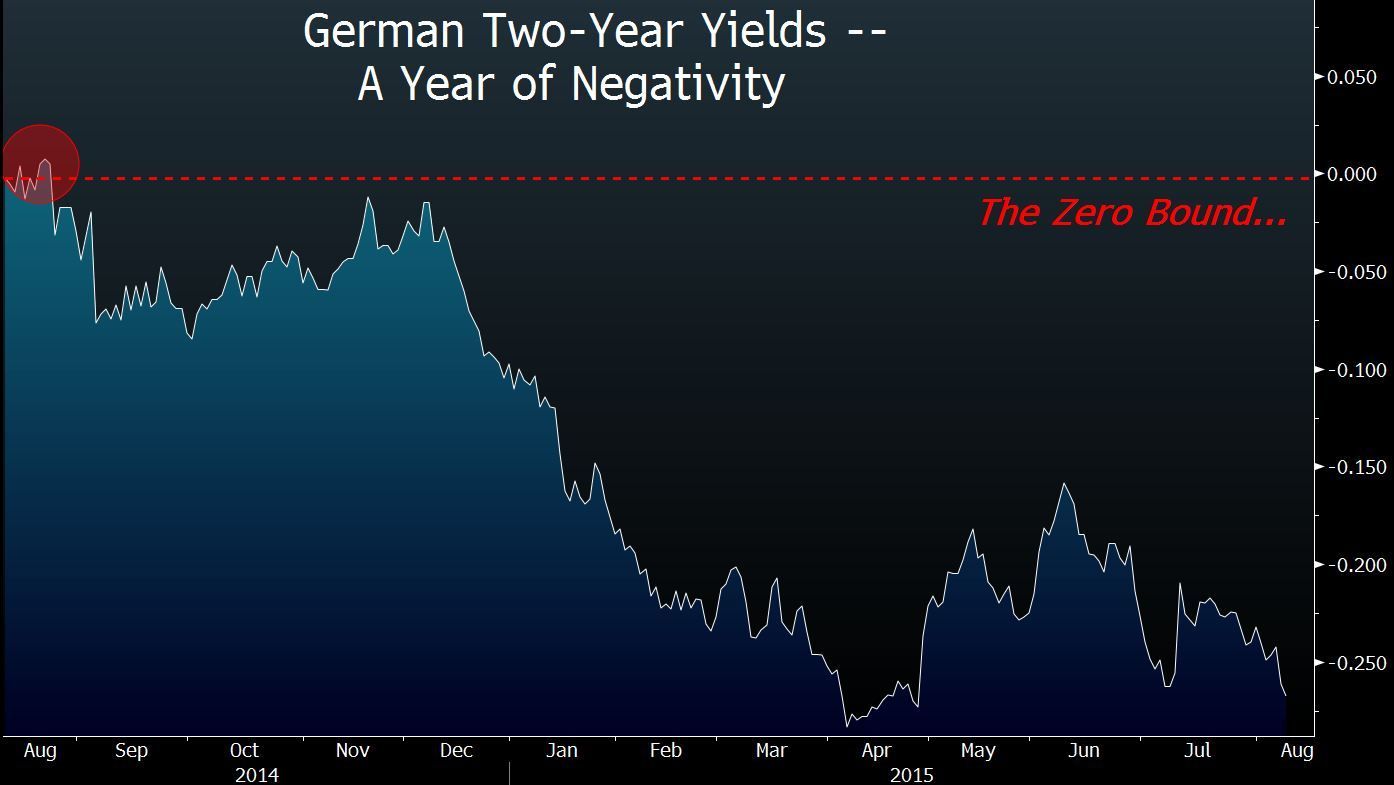

There is another factor that needs to be addressed: deflation.

“Make no mistake, this is the start of something big, something ugly,” Edwards wrote in a report on Wednesday.

“We expect the acceleration of emerging market devaluations to send waves of deflation to the west to overwhelm already struggling corporate profitability and take us back into outright recession,” he wrote.

With interest rates already near or at zero around the world, and deflation stalking the Eurozone, the Yuan devaluation was not what the world economy needed.

Both China's import and export prices were already in the deflationary red before the devaluation.

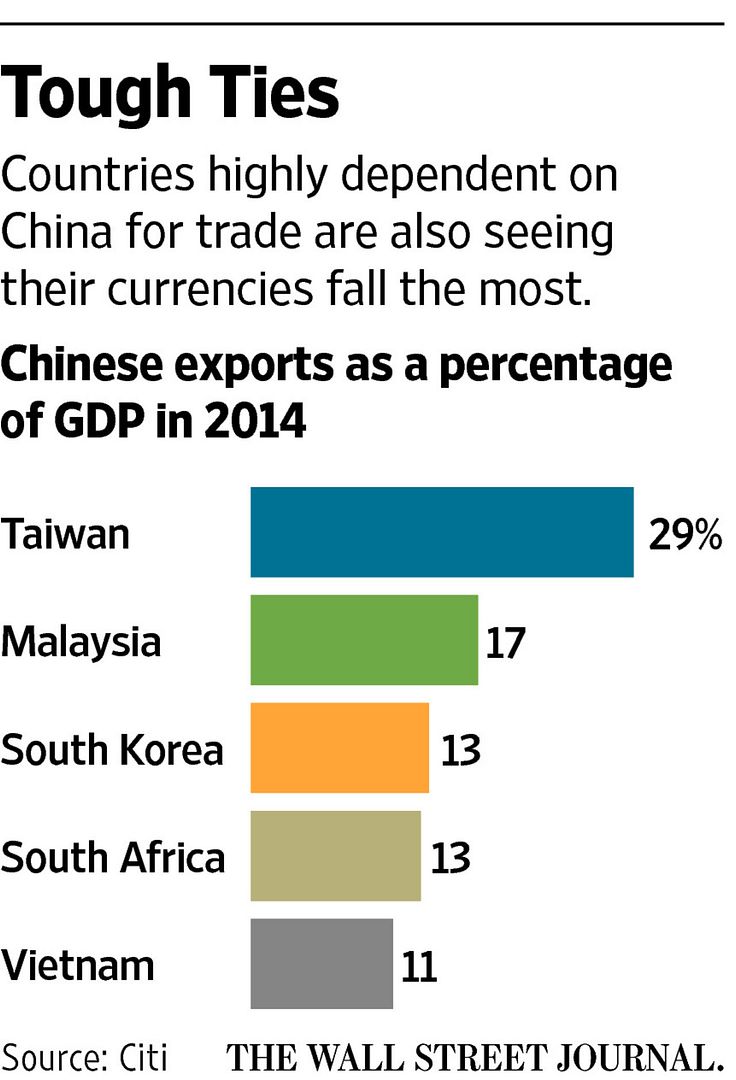

What China has done is set off a begger-thy-neighbor currency war with countries that export commodities such as Brazil, Indonesia and Malaysia.

The competitive currency devaluations is also causing a route in stocks for emerging market nations. This usually happens in these situations, but its only when commodities are already under heavy pressure that could turn this into a global crisis.

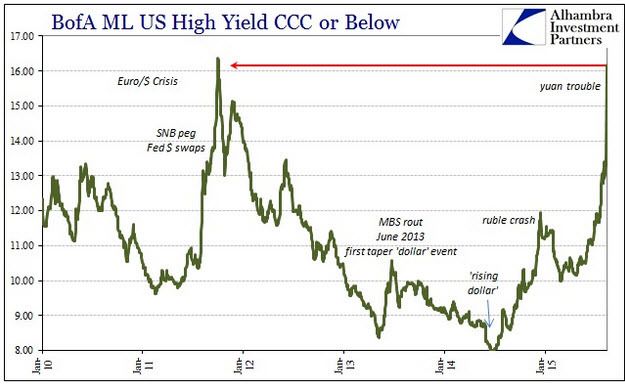

As for how this might wash up on American shores, look to the junk bond market.

High-yield bonds, specifically, often are seen as an effective proxy for movements in the equity market. If that's the case, trends in junk are pointing to a rocky road ahead.

Average yields for low-rated companies have jumped to 7.3 percent and spreads between such debt and comparable duration Treasurys have widened dramatically, according to David Rosenberg, chief economist and strategist at Gluskin Sheff.

History suggests that fallout in stocks is not far behind.

"If you think the equity market is heading for a spot of trouble here, the high-yield bond market is having a coronary," Rosenberg said in his daily market analysis Thursday.

How this plays out in the long run is anyone's guess. But in the short-term this is nothing but ugly.

Comments

I am trying to understand

why the Saudis are keeping the price of oil crude so low. I know that they can afford to do it, but I am not sure why.

It would be great for someone here who might have an idea to explain what the motivation behind this is. Are they dumping their reserves now because they are worried about whether there will be a demand in the future. Or they trying to put everyone else out of business to corner the market? Or is it something to do with trying to crash the financial markets?

I would love to better understand what is going on in the background or what could be going on behind this.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy