News Dump Thursday: Chamber of Commerce Extremists Edition

Guess which group less represents its own members in America today?

While organized labor has languished, the Chamber has become the single largest lobbying organization in the country. According to Open Secrets, a site that tracks political lobbying and spending, during the past 18 years the Chamber has spent three times more than any other organization on behalf of industry ($1.2 billion versus $351 million by the No. 2 lobbying group, the National Association of Realtors).

This is of great interest in the context of the Chamber's opposition to the new fiduciary rules for retirement accounts, requiring brokers to put savers' interests ahead of their own. Opposing the fiduciary standard may be pro-Wall Street, but it's anti-small business...

On one side is the financial industry, which manages about $14 trillion in various retirement plans. The president’s Council of Economic Advisers estimated that more than 10 percent of the advice given is conflicted in some way. That bad advice causes a performance lag of about 1 percent, costing investors an estimated $17 billion a year. This is money that otherwise would go into retirement-saving accounts. Wall Street, of course, isn't happy about the change and the vehemence of the opposition to the new rules make me suspect the losses for investors -- and the profits for the financial industry -- are much bigger.

On the other side are the millions of small businesses that have potential liability as 401(k)-plan sponsors. The natural outcome of this change is that once the new rules take effect, businesses will be in a position to shift that liability to the fiduciary advisers. This is something they should welcome -- especially since 96 percent of the Chamber's member businesses that have fewer than 100 employees. These are precisely the companies that will benefit from the change.

All of which makes the Chamber’s opposition -- based on arguments that have already been debunked -- so surprising. The new fiduciary rule doesn't harm business; it's a benefit. The Chamber had said it may sue over the fiduciary adviser rules, although for the time being it's taking a wait-and-see approach.

Examination of other positions leads to the conclusion that the Chamber isn't so much an advocate for industry as much as it is a conservative think tank.

U.S. corporate profits are expected to drop the most in 6 1/2 years in the first quarter, led by a wipeout in the embattled energy sector. Earnings for companies in the Standard & Poor’s 500 Index will fall 9.8 percent year-over-year, which would be the sharpest decline since the third quarter of 2009 and a fourth consecutive quarter of contraction, according to Bloomberg data. Results will be insufficient to justify current stock valuations, says Alex Bellefleur, head of global macro strategy and research at Pavilion Global Markets.

However, it's always a good time to buy stocks!

Just two days after Iceland's PM resigned, this happened

Three bankers from the defunct Iceland bank Kaupþing are to be released from jail today – after serving just one year of their 4/5-year sentences.

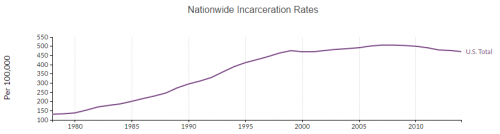

Prison population starting to slowly drop, but not because we are throwing fewer people in jail.

Nationwide, incarceration rates of sentenced prisoners peaked in 2007 and have been tapering off in the years since, Bureau of Justice Statistics data show. Between 2009 and 2014, state prison populations fell 8 percent and federal prison rates declined 2 percent.

More flexible sentencing, more post-release support to avoid recidivism, and alternatives to incarceration are among the drivers of the decline, according to a study by the Urban Institute...Even with the drop in incarcerations, the U.S. still has the second most prisoners per capita in the world. It is surpassed by only Seychelles, an East African archipelago of 115 islands. Among OECD countries, the U.S. puts the most citizens behind bars by far.

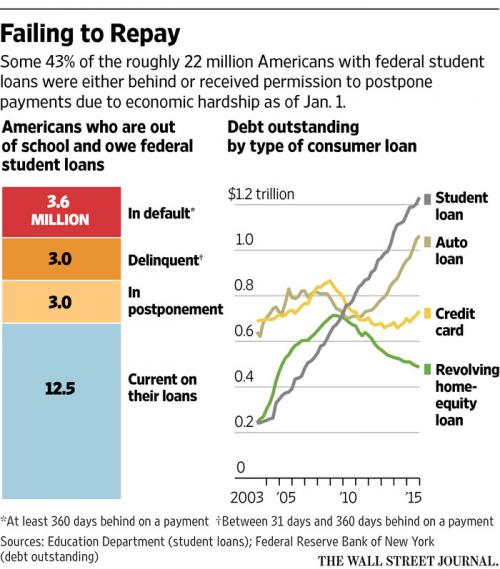

More than 40% of Americans who borrowed from the government’s main student-loan program aren’t making payments or are behind on more than $200 billion owed, raising worries that millions of them may never repay.

While most have since left school and joined the workforce, 43% of the roughly 22 million Americans with federal student loans weren’t making payments as of Jan. 1, according to a quarterly snapshot of the Education Department’s $1.2 trillion student-loan portfolio.

About 1 in 6 borrowers, or 3.6 million, were in default on $56 billion in student debt, meaning they had gone at least a year without making a payment. Three million more owing roughly $66 billion were at least a month behind.

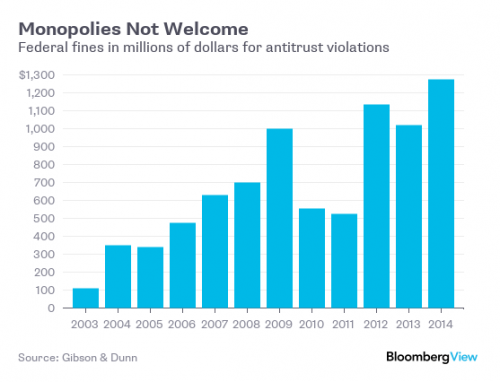

It’s therefore natural to ask whether the U.S.'s subpar economic growth is caused by a decrease in competition, and in fact, a bunch of people have been suggesting this explanation lately. In an article entitled “Too much of a good thing?," the Economist cites high rates of profit, record levels of merger activity and increasing industrial concentration as evidence of reduced competition.

Larry Summers, however, raises an interesting point when he contrasts the recent rise in profit with the decline in corporate investment:

If monopoly power increased one would expect to see higher profits, lower investment as firms restricted output, and lower interest rates as the demand for capital was reduced. This is exactly what we have seen in recent years!...[O]nly the monopoly power story can convincingly account for the divergence between the profit rate and the behavior of real interest rates and investment.

Comments

Fracking debt too

I read somewhere that these fracking loans have been bundled into derivative swaps...a toxic pill to appear later. Also I think the non-gov't student loans have been bundled into derivatives. When will we ever learn?

“Until justice rolls down like water and righteousness like a mighty stream.”

David Cameron admits he invested in tax avoidance scheme.

Drip, drip, drip...

Would that be

Larry Summers, chief architect of the "recovery" that made the rich get richer? Who could have known that corporations would try to become monopolies!?/s