News Dump OT: Monday Wall Street Edition

The one question we all want answered: Why was no one prosecuted for contributing to the financial crisis?

A little background: The FCIC was set up to investigate the causes of the financial crisis. The commission didn’t have either the authority or the resources to do a criminal investigation. But as the documents show, a number of matters—involving Goldman Sachs, AIG, Merrill Lynch, Citigroup and Fannie Mae—were referred to the Attorney General. No criminal prosecutions arose from any of those. (In Citigroup’s case, the SEC settled with the company and two executives in the fall of 2010 for a paltry sum. The Commission drily noted, “The SEC’s civil settlement ignores the executives running the company and Board members responsible for overseeing it. Indeed, by naming only the CFO and the head of investor relations, the SEC appears to pin blame on those who speak a company’s line, rather than those responsible for writing it.”)

Why? Well, really, we have no idea...

The FCIC went on to note that while the banks did disclose that they might include loans that didn’t meet the stated criteria, they didn’t disclose just how many loans that was. And if a loan didn’t meet the stated criteria, there were supposed to be “compensating factors.” If there weren’t compensating factors—or if the banks hadn’t even bothered to look to know if there were compensating factors—well, then this was a false statement. And if the statement was material, “there could be a violation of the federal securities laws.” Or as the FCIC put it, there were “two possible areas of misrepresentation…failure to disclose the gross numbers [of] waivers of underwriting standards, and inaccuracy in disclosing that not all waived loans had confirmed compensating factors.”

People have been sent to jail for less. See Enron.

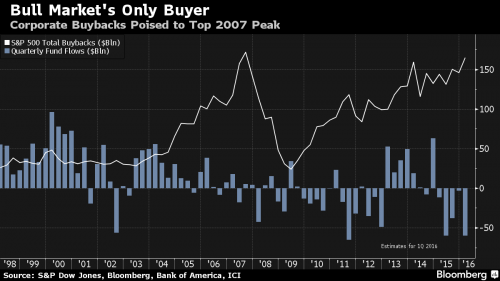

Bloomberg finally catches on: There's Only One Buyer Keeping S&P 500's Bull Market Alive

Standard & Poor’s 500 Index constituents are poised to repurchase as much as $165 billion of stock this quarter, approaching a record reached in 2007. The buying contrasts with rampant selling by clients of mutual and exchange-traded funds, who after pulling $40 billion since January are on pace for one of the biggest quarterly withdrawals ever.

“Anytime when you’re relying solely on one thing to happen to keep the market going is a dangerous situation,” said Andrew Hopkins, director of equity research at Wilmington Trust Co., which oversees about $70 billion. “Over time, you come to the realization, ‘Look, these companies can’t grow. Borrowing money to buy back stocks is going to come to an end.”’

Assuming Bank of America maintains a roughly 8 percent share in the total buyback pool since 2009 and the pace of transactions lasts through the end of March, corporate repurchases may reach $165 billion this quarter, data compiled by Bloomberg show. That would bring the 12-month total above $590 billion, an amount that’s higher than the record $589 billion in 2007.

“Corporate buybacks are the sole demand for corporate equities in this market,” David Kostin, the chief U.S. equity strategist at Goldman Sachs Group Inc., said in a Feb. 23 Bloomberg Television interview. ..

Should the current pace of withdrawals from mutual funds and ETFs last through the rest of March, outflows would hit $60 billion. That implies a gap with corporate buybacks of $225 billion, the widest in data going back to 1998...

“It’s definitely not sustainable that the only buyer is companies themselves,” said Vikas Gupta, Mumbai-based chief investment officer who helps oversee more than $8 billion at Arthveda Capital.

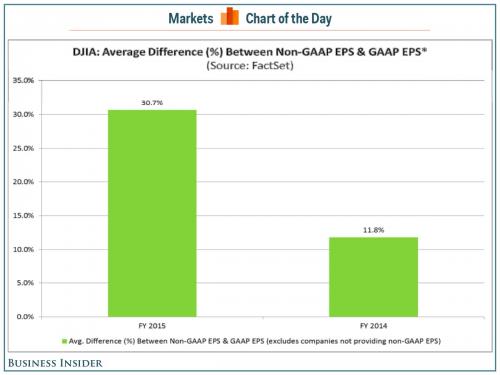

When companies report earnings they give investors a series of numbers. The most basic measure of earnings per share is profit divided by diluted shares. This figure is most often referred to as GAAP — or Generally Accepted Accounting Principles — earnings.

But a growing trend has been reporting an "adjusted," or non-GAAP figure, which includes the company's best estimate of things that came up during a quarter or year that, in the company's judgment, were charges outside the normal course of business.

As a result, non-GAAP earnings tend to be higher.

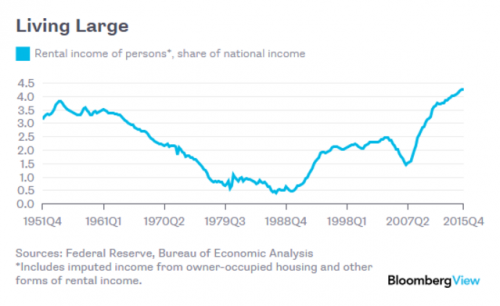

It's a great time to stick it to renters

According to the latest data from the Federal Reserve, property owners' rental income -- a number that includes the estimated benefit they gain from homes they occupy -- added up to $168 billion in the last three months of 2015, or about 4.3 percent of U.S. national income. That's up from just 1.5 percent at the beginning of 2007, and the highest level going back to 1946.

Great as this may be for landlords, it presents a problem for social cohesion and the broader economy by contributing to wealth inequality. The higher rental income goes, the more money gets transferred from poorer people, who typically rent, to wealthier people, who tend to own. Indeed, as the Massachusetts Institute of Technology doctoral candidate Matthew Rognlie has noted, housing wealth has driven the increase in the capital share of income that the French economist Thomas Piketty made famous in his book "Capital in the Twenty-First Century."

What happens when they own ALL of the markets?

According to data from the U.S. National Inflation Association (NIA), the balance sheet assets of the world's six major central banks - the Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), the Swiss National Bank (SNB), the Bank of England (BOE) and the People's Bank of China (PBOC) - hit $16.9 trillion in May 2015, a 239 percent increase from $4.9 trillion in balance sheet assets in May 2006. While the total assets of the aforementioned central banks reached nearly 36 percent of the combined gross domestic products (GDP) of the countries whose monetary policies they lead, this proportion was 14.3 percent in 2006.

Global markets have observed The People's Bank of China (PBOC) with caution due to concerns regarding its growth, but it has the largest balance sheet with total assets of $5.497 trillion, 52.92 percent of China's combined GDP in 2015 in comparison to 56.31 percent of China's GDP 10 years ago.

The balance sheet asset of the Fed, which has been leading the monetary policies of America, the world's largest economy, reached $4.495 trillion, equal to 25.41 percent of the country's combined GDP. This proportion was 6.17 percent in 2006.

The total assets of the Bank of Japan (BOJ) reached 70 percent of the country's GDP in 2015 with $2.834 trillion, compared to 24.27 percent in 2006.

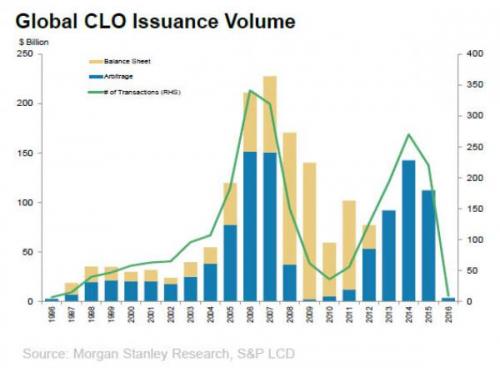

But collateralized loan obligations, or CLOs, remain frozen after the void of volatility. Should CLO issuance remain scarce in 2016, it could reverberate across lending markets as loans will become more difficult to place and liquidity will tighten elsewhere on Wall Street.

Banks are slashing expectations for issuance and tightening in the market is reminiscent of the plummet in CLO deals that coincided with the onset of the global financial crisis.

Morgan Stanley has hiked the probability of a recession hitting the global economy within the next year to 30 percent from 20 percent.

Comments

Oh they were...

But apparently owning the people who investigate and prosecute counts as a "Get out of jail free" card.

Sorry, my cynicism on this issue makes me believe that the only time an aristocrat will ever face justice, pitchforks and torches will be involved.

I do not pretend I know what I do not know.

gjohnsit,

I really like these news OT's. One suggestion would be to include the word NEWS in the title. I think otherwise people might confuse them with the morning OT. But I hope you will continue to post these. It is a great idea.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

I was confused, but hey, what's new. :D eom

"Religion is what keeps the poor from murdering the rich."--Napoleon

banksters and wall st.

I just watched the movie The Big Short and although it is best to keep in mind it is a movie,it was very good and has a lot of truths and realities and while it doesn't explain all it gives a great insight into what went on before during and after the collapse.Defineatly worth a watch but expect to be more pissed (if there is such a thing) after watching.

Oh, by the way

Oh, by the way, we're overdue for a recession. They happen every five years on average. Bush's Great Recession ended in June 2009, according to the NBER. (I always call it Bush's Great Recession because President George W. Bush presided over two recessions)

"We've done the impossible, and that makes us mighty."

Hi g...

I renamed this essay to News Dump OT so folks wont get confused with the morning OT.