This never, EVER happens on Wall Street

It's one of the oldest rules in the book: The Public is always wrong.

I've only been watching the markets since the mid-90's, but I've never seen this rule broken...until last month.

The rule of Wall Street is the same as the rule of a Vegas casino: if you look around the table and you can't spot the mark, then you are the mark.

Basically the game works like this.

When a stock and/or sector has been on a long, winning run, Wall Street insiders sends their cheerleaders onto CNBC and yell, "Everyone is getting rich!"

The mom and pop retail investor who hasn't been paying attention says, "I wanna be rich too" and buys those expensive stocks.

Wall Street insiders sell those expensive stocks to mom and pop, booking their profits. Then the insiders turn around and 'short' those very same expensive stocks, thus putting downward pressure on the stocks.

Savvy investors realize the bull run is over, sell the stocks and the market drops.

Mom and pop are suddenly faced with having their nest-egg wiped out sell in a panic, just wanting to rescue something of their meager savings. The very same insiders then buy the no longer expensive stocks from mom and pop, and soon the stock starts moving up again.

It's a lot more complicated than this in reality, but basically this is how it works. Over and over again. It never fails.

Until this happened.

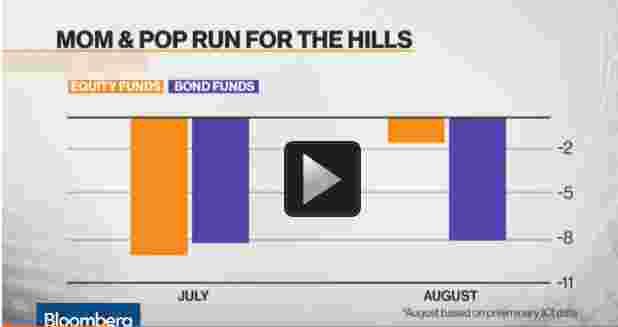

Mom and pop are running for the hills.

Since July, American households -- which account for almost all mutual fund investors -- have pulled money both from mutual funds that invest in stocks and those that invest in bonds. It’s the first time since 2008 that both asset classes have recorded back-to-back monthly withdrawals, according to a report by Credit Suisse.

Credit Suisse estimates $6.5 billion left equity funds in July as $8.4 billion was pulled from bond funds, citing weekly data from the Investment Company Institute as of Aug. 19. Those outflows were followed up in the first three weeks of August, when investors withdrew $1.6 billion from stocks and $8.1 billion from bonds, said economist Dana Saporta.

I don't want to speculate yet as to why this happened. I want to focus on when this happened.

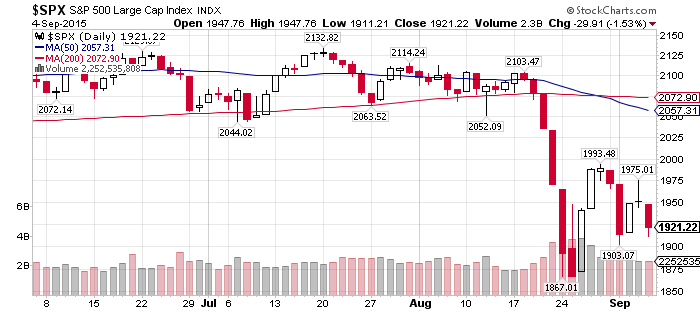

Take a look at the S&P 500 chart and you'll see why.

Mid-July is one of the highest peaks in the history of Wall Street. Everyone was getting rich. That's when mom and pop should have been buying with both hands, according to historical trends. Instead they sold billions.

It's the opposite of what is supposed to happen.

And the truly amazing thing is note the date on the article, August 19th. After mom and pop had already been selling, the market dropped 10%.

So if mom and pop weren't there to be "bag-holders" for Wall Street insiders, who took those losses?

Would you believe, hedge funds?

“August was a fair test, and many hedge funds had a tough time,” said Simon Lack, founder of the financial consultancy SL Advisors and author of “The Hedge Fund Mirage” and the forthcoming “Wall Street Potholes.”

That's right. Mom and Pop retails investors beat hedge fund managers last month.

That's like a high school football team beating the Seattle Seahawks. It simple doesn't happen. Ever.

Plus, some hedge funds took a brutal beating because there was no dumb money to sell to.

It wasn't just stocks. Notice how mom and pop retail investor was selling bonds too. Well, do you know who else was selling bonds? China

The PBOC has sold at least $106 billion of reserve assets in the last two weeks, including Treasuries, according to an estimate from Societe Generale SA.

China did this to prop up their suddenly shaky currency, a move that the hedge fund managers didn't see coming either. If China has to keep selling then bonds won't be a good place to be either.

That leaves us with the question of "why"? Why did this happen? Will it happen again?

I can only speculate as to why. Maybe it was just like a stopped clock.

Or maybe mom and pop retail investor is getting wise to the game. They are realizing that Wall Street and the financial media always lies to them. So they should do the opposite of what they are told. At least I'd like to think so.

Wall Street has thrown away the trust of the public, and that should have a monetary cost.

Will it happen again? I don't know. I hope so. I hope it happens a lot.

Comments

Great post, gjohnsit!

I think what we are seeing is a total lack of trust in the Wall Street institutions. At least that is what I am hoping.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Great post, also read it over at the GOS

Commenters there noted that another part of this may be that the boomer retirement tsunami is starting to hit as boomers reach age 59.5 years where they can safely remove $ from their 401k's and IRA's and other such "pension" devices and have begun doing so, with August being the first foam of the wavefront that's begun crashing into Wall Street's beaches. If so, I welcome it with open arms: We've been hearing how Social Security is some sort of Ponzi scheme, but the boomer retirement could show us where the real Ponzi scheme lies -- at the corner of Wall St. and Broadway.

I'll also note that between this post and your last on the housing crisis we see the emergence of the 800 lb. gorilla in the presidential election room; the economy, stupid.

Should a recession hit (and I think it will sometime in mid 2016) the prospects for any Democrat to be sworn in as president come January 2017 look dim, as the punditocracy weighs in with the inevitable question of whether said recession is "like '07-09" reminding voters of that fun time from which we have yet to fully recover. (Which is why I think Sanders is the Dems best prospect as any recession takes its greatest toll on working people and Bernie has a better grip on how to address the consequences better than anyone out there running. That said, I'm with Big Al in that Bernie needs to practically declare all out war on the MIC and a foreign policy based on fattening that bloated welfare queen to earn my full confidence that he would be able to address the fundamental forces that threaten the working masses.)

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

Boomers retiring

A few commenters on GOS suggest that last month was "only" Boomers retiring.

While that may be true, the implications of that being true are enormous because if that was true then there is no reason at all for it to stop for the next decade.

The markets simply can't function at anywhere close to these prices without a steady diet of dumb money. This is true for both stocks and bonds.

If we've hit an inflection point where Boomer retirement-inspired selling drowns out GenX/GenY 401k buying, then there is going to be downward pressure on stocks and bonds 24/7, year after year. Every market correctly will be oversold before a bounce finally happens. We will be looking at the 2000-2003 bear market, except it will last nearly a generation.

What's more, the "wealth effect" on the economy (where people spend more because they think they are wealthier due to asset prices) will also end. Consumer buying will take a long-term hit.

If, and it's a very big "if", this is true, then Wall Street will be a very different place in a generation.