Just how crazy have the bond markets gotten?

What is a negative interest rate bond?

It is by definition a default.

Just because it is an agreed upon default doesn't change that fact.

And that's at nominal rates. If there is any price inflation at all (and there is), that just adds to the losses.

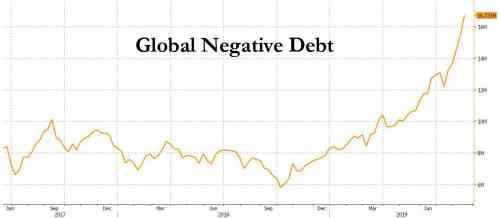

Right now more than 25% of all the bonds in the world have a built-in default.

There are ways that bond traders can still make a profit, but they require a lot of risk for very little profit.

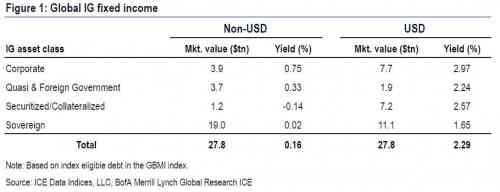

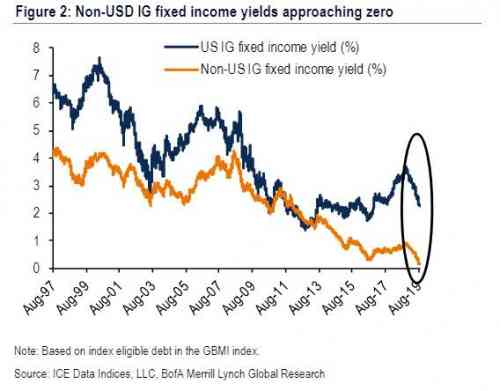

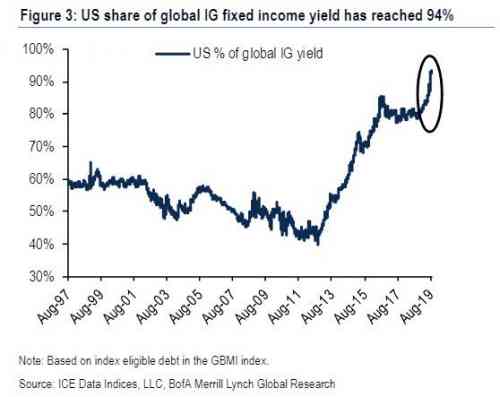

Extremely low interest rates in the U.S. are nothing compared to Europe and Japan, where most interest rates are negative.

Essentially if you want some yield and you don't want to buy junk bonds, you have to buy American.

The only way that this can be true is if a) the rest of the world's central banks are engaging in massive QE programs on a level that qualifies at an untested monetary experiment, and b) the U.S. is issuing new debt of its own by the boatload.

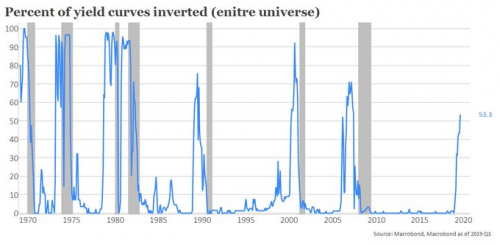

More than half of all the bond yield curves in the world have inverted.

Meaning that short-term debt pays better than long-term debt.

This indicated a global recession is coming.

Which means that global central banks will be cutting already historically low rates.

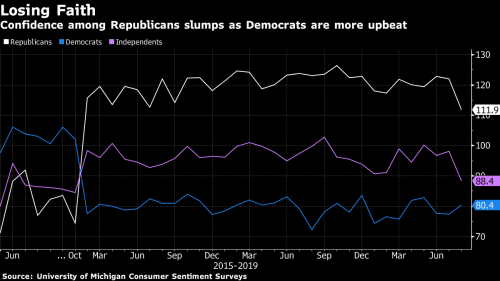

Meanwhile, Trump is hyper-focused on the markets.

When the stock market tumbled on Wednesday President Trump panicked and held a conference call with the chief executives of JPMorgan, Bank of America and Citigroup.

Stocks are only 5% off of all-time highs. What happens when there is a bear market?

At the same time, Trump is putting immense pressure on the Federal Reserve to cut already low rates.

Jay Powell, the Federal Reserve Chairman, has banned any public appearances by any member of the Fed, Cockburn hears. Appearances at conferences have been canceled, all scheduled interviews have been abandoned and any comments on or off the record are outlawed.This unprecedented action is a reflection of two pressures. First, there are growing economic indicators that suggest the US is heading into a recession with the Dow plunging 800 points on Wednesday. Second, relations with the White House have reached a new low. President Trump has pinned the success of his presidency upon a strong economy and his qualifications as a businessman who understands the economy. If a recession takes hold, Trump believes his reputation will be destroyed and his chances of reelection dimmed.

This week President Trump lashed out at Powell and the Fed claiming they are responsible for the slide in the stock market.

...

For his part, Powell believes that the Fed, which cut interest rates by a quarter point at the end of last month, has very little left in its armory and that even a cut in interest rates would do nothing to combat growing international economic pressures. Powell has become increasingly concerned at Trump’s criticisms, which he believes shows he has little understanding of the economy or the Fed’s role.

Powell is right. Trump doesn't understand sh*t. Only Trump voters are fooled.

But Trump can influence the Fed and interest rates, especially when the inevitable recession hits.

Comments

Beats me.

I didn't know about global bond markets going negative, but it does explain how the U.S. is able to keep jacking up its debt. Which brings up the question, what happens if the U.S. goes negative? Would anyone buy up U.S. debt? Would that crash the dollar?

What happens when oil is no longer sold in dollars? Would that crash the dollar?

What happens as China shifts from a cheap labor market to a capital-focused one? Would that crash Walmart?

What happens when the Fed decides to start fountaining hundreds of billions to the banks again? Will that save the stock market?

When I look at "the economy", I feel like I'm in the training room in The Edge of Tomorrow. For the first time.

My guesses

US going negative on yields would reduce the value of the dollar a bit but not crash it. If oil were purchased in currencies other than the dollar would crash the dollar (my guess 30%). As China goes away from cheap labor to high value, Walmart will move procurement to other low wage countries. The FED has been adjusting policy to support the stock market for years. They appear to be running out of tools to inflate bubbles and artificially support stock prices, but they are pretty ingenious.

I really wish I understood this

better than I do. What I suspect is that the bond markets are the predictors of what is coming down the line for all of us.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

I just read on several other blogs

That Trump wants to push the fed to zero or even lower. If he does, then he (or any other president doing the same thing) will be able to control the economy rather than the fed.

My thought is that pushing rates negative may be analogous to bills of credit.

Any thoughts about this?

One minor quibble.

A default is created when a borrower fails to meet an obligation. If the agreement is to pay less than the amount loaned, the agreed payment isn't a default. The investor has made an investment with a guaranteed loss.

Unfortunately, most savers have little choice. Rates on savings and checking accounts have been below the rate of inflation for years. The money you take out has less purchasing power than the money you put in. If you buy a bond and the interest rate goes down further, the bond will increase in value. But people who don't have $400 set aside for an emergency can't buy bonds.

Negative interest rates are just one more step in the carefully crafted plan to transfer wealth from the "takers" to the "job creators".