It's beginning to look a lot like 2007

Consumer debt and consumer savings usually have an inverse relationship, while consumer debt and debt defaults have a parallel relationship. With that in mind, consider this news.

Not since the beginning of 2008 have Americans saved so little — and that’s before accounting for inflation. It could be a sign of trouble ahead.

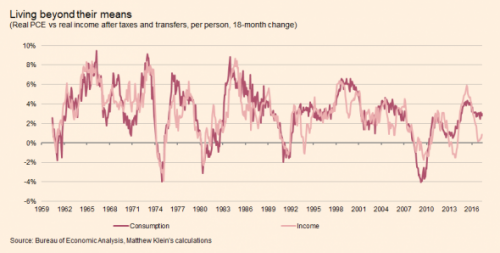

...By contrast, average real disposable income — income earned from work and asset ownership minus taxes plus transfers from government and businesses — has grown less than 1 per cent since the start of 2016. That’s the worst performance since the recovery began that can’t be explained by tax hikes

Americans have made up the difference between mediocre spending growth and abysmal income growth by sharply reducing how much they save. The current gap between growth in consumption and disposable income is among the widest since the data begin.

Today’s situation is one where consumption would have slowed into recessionary territory if not for the collapse in the savings rate. The one parallel is 2004-2007.

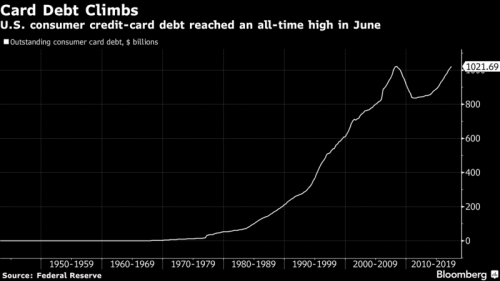

There is another debt record being set by American consumers right now - credit card debt.

Credit-card debt in the US rose in June, surpassing the peak set just before the 2008 financial crisis.

Outstanding revolving credit, which includes credit-card debt, rose to $1.02 trillion in June, according to a monthly report from the Federal Reserve released Monday.

But defaults are rising again for credit cards and auto loans. The New York Federal Reserve observed a 7.5% rise in the share of credit-card balances that were seriously delinquent, or at least 90 days past due, in the first quarter.

"We simply can't keep taking on credit card debt forever without it causing major problems," said Matt Schulz, the senior analyst at CreditCards.com. "This record probably won't be a major tipping point, but it likely isn't too far off."

"It's worrisome that we are starting to see delinquency rates now begin to rise even with the unemployment rate at a cycle low," David Rosenberg, the chief economist at Gluskin Sheff, said in a note on Tuesday.

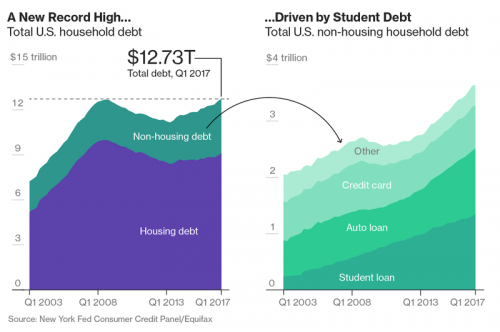

And finally there is the mountainous, total amount of consumer debt that must be considered.

Americans faced with lackluster income growth have been financing more of their spending with debt instead. There are early signs that loan burdens are growing unsustainably large for borrowers with lower incomes. Household borrowings have surged to a record $12.73 trillion, and the percentage of debt that is overdue has risen for two consecutive quarters. And with economic optimism having lifted borrowing rates since the election and the Federal Reserve expected to hike further, it’s getting more expensive for borrowers to refinance.

To be fair, a lot of consumer numbers don't look so bad historically.

But then history might not be the best measurement to how precarious the consumer's finances are.

About 46 percent of Americans surveyed by the Federal Reserve could not pay a hypothetical $400 emergency expense, or would have to borrow to do so, according to a 2016 report.

In 2007-2010 these was collateral for much of the debt - houses. However, this time, when the credit cycle ends, there will be few houses to seize, and thus, the debt will have to be written off.

Credit cycle: During an expansion of credit, asset prices are bid up by those with access to leveraged capital. This asset price inflation can then cause an unsustainable speculative price "bubble" to develop. The upswing in new money creation also increases the money supply for real goods and services, thereby stimulating economic activity and fostering growth in national income and employment.

When buyers' funds are exhausted, an asset price decline can occur in the markets which had benefited from the credit expansion. This can then cause insolvency, bankruptcy, and foreclosure for those borrowers who came late to that market. This, in turn, can threaten the solvency and profitability of the banking system itself, resulting in a general contraction of credit as lenders attempt to protect themselves from losses.

Comments

Well, there's indentured servitude I guess,

about the only way the banks would get paid off. Of course, the Treasury would help them absorb the loss, but ordinary people? When there's nothing left to take? They'll want something and hell, most people in this country will think they DESERVE it too. And these savages have trained people far too well to endlessly consume, and yes, take out debt to do it, no problem, you'll win lotto one day, just believe and all will be well!

Only a fool lets someone else tell him who his enemy is. Assata Shakur

capitalism and capitalization

Yeah, just beLIEve.

Non credo, amice.

If we had a society and an economy which worked for all, this wouldn't be happening. But, because we have a society and an economy which only works for the richest 0.1% of us, it is.

And I don't think "endless consumption" is what's driving this. Wage dilution of ordinary working folks' wages is. Basic daily bread and some occasional roses, for Cat's sake!

Speaking of Cat, I thank Cat that I have no children! The expenses of raising children are also much of what drives this, I suspect!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

non credevo mai

perche io penso.

Gëzuar!!

from a reasonably stable genius.

why I have no children

..... perche io penso!

I wouldn't wish the realities Millennials and younger must face on my worst enemy!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

I know it's not the endless consumption

but that's the current line we are also fed. It is our fault, not our owners fault. They know what's best for us but we simply will not cooperate with them.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

Business Insider = Chicken Little

When you look at the underlying NY Fed Reserve data, there's not much reason for concern. Credit card, mortgage, and home equity 90 day delinquencies are well below their 2008 peaks, having dropped by 2/3rds or more in each category. Credit card 90s are only 50% of their 2003 level while mortgages and home eq have dropped back to their 2003 levels.

I think a less "sky is falling" look at the numbers shows that debt is largely under control, that people have been getting their mortgages under control as they found employment, and that student loan debt is the area of greatest concern, having quintupled since 2003. (See Debt Composition chart below.)

As the following chart shows, credit card balances have been pretty close to a flat line the past 14 years (dark blue bars). There's been a slight trend upward since 2011 but nothing to be alarmed about yet, especially considering that utilization (balance divided by limit) is still quite low at 22.6% and much of the increase reflects purchases that were deferred due to the Bush Recession.

And looking at one final chart here, delinquency status, you'll see that delinquencies of all lengths are substantially down from their 2009 - 2011 peaks. Some of this is from charge offs by credit issuers while the rest is from consumer's paying off overdue balances.

I think it's sad that Business Insider and Bloomberg are playing games with the numbers. I suspect this is driven by bond hawks who want to see interest rates shoot sky high so they can suck more money out of our pockets. But all in all, there's not a lot to worry about on the debt front. People are being re-employed, debt is being paid down, and if we can keep the chicken littles from crashing the economy, things should keep slowly improving despite a 1 or 2 month blip in the statistics.

That's one way of looking at it

Yes, delinquencies are indeed well below a complete collapse of the global financial system.

I don't believe that anyone was saying otherwise.

The case being made here was to try a feel out the peak of the credit cycle - i.e. the moment before everything freezes up.

Also, I wasn't even looking at mortgages and home equity, because they aren't playing out in a subprime credit way at all.

I've had this debate before, back in 2005 when I said housing was unsustainable, and people pointed out the previous peak.

No, it's not. Not by any measure.

That's the right way of looking at it.

As the chart I posted shows, credit card debt has barely budged in the past 14 years. And that charts not even corrected for inflation. How can you claim otherwise when the data is right in front of you?

Ways of looking at it

Which means it went from all-time bubble highs, dropped a great deal, and now it's back to all-time bubble highs again.

Yeh, I get it.

Under the microscope

1. The Bloomberg chart is not adjusted for inflation. For example, one trillion dollars today equals 750 billion in 2003 dollars. IOW, the chart is a classic example of how to lie with statistics. It looks alarming because of the huge upward slope, but inflation isn't accounted for.

2. The Bloomberg chart is garbage. Even though titled credit card debt, it's not. The chart uses the value for revolving credit, which is credit cards plus other revolving credit. The credit card portion is about $775 billion, not $1.02 trillion.

Also not being considered is the effect of employment and economic recovery on credit card debt. When people go back to work, they buy clothes and purchase gas for their cars. When people have a job, they buy household items and catch up on deferred maintenance. I'd be far more alarmed if credit card debt wasn't rising as it would mean there is no recovery underway.

The Swiss national bank

owns 80 billion of US equities, that's 10,000 dollars for each of the 8 million Swiss citizens. The Swiss are making these purchases with newly printed Swiss Francs. The Euro zone bank and BOJ are buying more than 100 billion in stocks and bonds a month by way of QE. CEntral banks around the world have created 57 trillion dollars of credit since 2008. Japan recently created a quadrillion Yen. BOJ now owns a much as 10 percent of every major stock in Japan. The only explanation is that they are fighting a massive DEFLATIONARY monster. They are losing and in fact I believe they has lost control. We have moved into the kill box of endgame capitalism. Debt tsunami. Still the global economy is in fits and starts. What have we got about 1.5 percent GDP growth. They are pushing on a string. 3 dollars of debt for every dollar of GDP. This is absolutely unsustainable. It will not end well. The asset bubbles will burst.

GDP

You can't get rich taking in your neighbor's wash while he takes in yours. Services are a net zero. Only production is "product".

A country can't get rich shipping and selling goods made in Asia. Industrial production and engineering development have shifted to Asia. The 1% are rich because they suck more and more from the 99%. One day Indians will not come here to work for peanuts. Their own country will be developed. One day China will stop selling us goods in exchange for land because they will own all the land that's worthwhile. Americans will look up from their cell phones and find no food on the table because America will have become a Third World country, colonized by foreigners and ruled by the 1% who bow to their colonial masters.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

I never liked how the average American's low savings rate

is portrayed as our fault. The problem is we can't save. Stagnant wages, coupled with the ever rising cost of living are forcing us to not save then borrow just to keep our head's above water. We're slowly being turned into a nicer version of China.

The real SparkyGump has passed. It was an honor being your human.

Absolutely.

You can't save what you don't have. Most of us live paycheck-to-paycheck and fight a daily battle to keep the wolves from the door. And really, what's the point of saving when savings accounts pay a tiny fraction of a percent in interest?

Seriously?

You've had an emergency expense before, right?

He was pointing out the lack of a decent interest rate

on saving accounts. Many people I've spoke with over the years are simply holing on to their cash.

The real SparkyGump has passed. It was an honor being your human.

@gjohnsit

Emergency funds need not be parked in traditional savings vehicles which are currently paying abysmal rates of return.

What do you suggest?

I'm open to suggestions, as long as the vehicle is very, very liquid.

The evil of the ZIRP culture

…(Zero interest-rate policy) was designed to kick Americans in the gut while they were down and dazed, after the 2008 economic crisis. ZIRP refers to a monetary policy of very low nominal interest rates, such as those in the US from December 2008 through December 2015, and beyond.

Banks can borrow at near nothing, and then charge borrowers a lot. That and a vast number of extraordinary fees and penalties that customers are slapped with on a daily basis (for behaviors that cost the bank absolutely nothing to process — like a credit card rejection on a purchase that exceeds the credit limit) — have driven bank profits into the stratosphere and driven the stock markets beyond safe and natural valuations, while at the same time crushing further the poor and middle class, and impoverishing seniors trying to live on fixed incomes.

This is the cradle of income inequality.

Conversely, Islamic banking shares their profits with depositors, which is the way privatized banking should be run. All parts of society benefit from the growth of money. Otherwise banks should be nationalized. Humans have confused banks with temples, again.

As per the story, it's not clear whether "savings" refers only to deposit accounts. ZIRP policies would naturally kill the idea of saving money in banks, so that might cause a drop in the savings rate, as well. Not that the economy is not heading into a crisis. We are pouring every available cent we have down the black hole of war. Bad business, that.

credit unions and Islamic banking

Credit unions work in exactly that same way,

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Right you are.

Credit Unions work the same way.

If only they worked the same way when it came to borrowing. Then we would have true income-opportunity equality. (Profit sharing with the bank so ordinary folks can start or buy a good business to improve their lives, while not being crushed with debt in the early years.)

Interest is evil in many ways to both individuals and the state. That is why all of the religions that started in the ME forbade it. After they invented the zero and could see what's what.

I believe low interest rates on savings is by design forcing

small investors into the casino that is Wall Street making wealth extraction easy.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Good point.

The economy is rigged to promote wealth extraction from the 99%. It's all just a big casino game and we're the suckers born every minute.

Yayyy! Good charts and graphs for everyone!

My question for the researchers is this: how many layers of skin does the average American citizen have and how long does it take to grow back?

I'm a happy

little debt serf, playing whack-a-mole with various extraction schemes and financial repression. The really smart people are running up as much debt as possible to wait til the crash and declare bankruptcy or maybe just die. Too bad I'm and relatively honest person cause I could borrow a lot of moola. My depression era parents taught me to pay my debts. Alas.

Probably a good policy.

Before long, your debts will be legally passed on to your children, forming a new slave class if stripping their inheritance doesn't fill the bill.

That may be the one thing that would mobilize the 99%.

No one wants that for their children or grandchildren.

Right now Boomers are being sold death benefits to be

paid to their heirs, so we're already being groomed to accept the lot they are forcing on us. They make the unfair rules and then tell us how we have to play by them.

"The object of persecution is persecution. The object of torture is torture. The object of power is power. Now do you begin to understand me?" ~Orwell, "1984"

Maybe they'll force us to have kids next.

It must really tick off banks when someone with no heirs dies owing them money.

The only missing variable in a

comparison is that the price of oil is less than half of what it was in 2007. This is extremely important point. Still we might get there to over 100 dollars a barrel if Qatar, KSA, and Iran get into it and close the straights of Hormuz, or take out Saudi super giant oil fields Ghawar, and Abiqua. The price of oil would double overnight. Whatever happens it will be extremely fast with the markets, rolling and squealing like a greased pig, or five year olds mutton busting at the county fair.

The price of oil does not reflect its true cost.

How much do we spend on all the military interventionism designed to provide the US with control over the oil and gas resources of other nations? Like the goverment subsidies that keep consumer prices of food staples much lower than their true cost, the US market price of oil is not reflective of its true cost in dollars or in blood and lives.

It is an illusion, a manipulation maintained by government ultimately intended for the benefit of the oligarchs who's fortunes grow with each bomb dropped, each foreign intervention: a house of cards.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

Sort of ..most of our imported Oil

comes from Mexico, Canada and Nigeria none of which we are at war with. Yes subsidies do affect price but government doesn't really control the most fungible commodity around. It's more like good old boy scratch my back thing. We support KSA royals the market stays calm. Like that. the petrodollar we create ex nihilo and we get the most magic stuff on the planet. oil! Good deal for us.

Debtors Prison and Time Crimes...

Here we go.

Debtors prisons are coming. And they're going to stop critical thinking and access to information by monitoring people's time and information consumption.

Super scary, right?

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

And the Oligarchy cheered.

The only way the news could be any better is if forclosures are up.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

For whatever it means, more homes seem to be going on the

market in California, including a sprinkling of short sales. This is relayed to me by a Californian who plays poker every week with a real estate agent.

My memory could be off, but I remember California of 2008 as having been the canary in the coal mine of real estate foreclosures and people just walking away from homes (including, of course, condos) whose mortgages they could no longer afford.

I don't think I have whatever it takes to witness another 2008 so soon. I also remember a number of suicides of couples where the reason seemed to be their finances. Too awful.

Kamala Harris failure to prosecute Mnunchin

This comment is in the general theme of this article about economics and finance.

David Dayen is an important journalist who writes a lot about finance. His excellent book "Chain of Title" follows three citizens in their fight against a corrupt system surrounding housing. He now writes for The Intercept and is often linked by Naked Capitalism.

On the other hand, I have been following what I hope are the death throws of the democratic establishment which is addicted to money and power.

Along comes Kamela Harris and lots of controversy. Is the the establishment savior? Is she the diversion to maintain neo liberal economics and the military state like Obama?

The position of many is that her failure to prosecute Munchin's banks in CA proves that she is a sell out

This article by David Dayen says that EVERYONE HAS BLOOD ON THEIR HANDS. And what she did is no worse than any other player.

The Left’s Misguided Debate Over Kamala Harris My article about a bank's law-breaking during the housing crisis became a political football, obscuring the real issue at hand

Wow DM, had no idea that

many foreclosures still happening based on false documents. Thanks for the link.

A truth of the nuclear age/climate change: we can no longer have endless war and survive on this planet. Oh sh*t.