Inequality in business

When the topic of inequality comes up you don't normally think about business inequality, but that has potentially as much impact as wealth inequality.

For instance, there hardly goes a day without the financial media mentioning the huge piles of cash that corporate America is sitting on. Why don't they spend it?

You might think big U.S. companies, if anything, have been too conservative with their finances. They've collectively hoarded hundreds of billions of dollars in cash, instead of spending it to hire workers or expand their operations.The reality is different, and more worrisome...

"There's a misconception that companies are swimming in cash," says Andrew Chang, a director at S&P Global Ratings. "They're actually drowning in debt."

It turns out there's a wealth gap among companies, just like among people. Of the $1.8 trillion in cash that's sitting in U.S. corporate accounts, half of it belongs to just 25 of the 2,000 companies tracked by S&P Global Ratings. Outside of Apple, Google and the rest of the corporate 1 percent, cash has been falling over the last two years even as debt has been rising. It now covers only $15 of every $100 they owe, less than it did even during the financial crisis in 2008 when finances were crumbling.

Much like the rest of society, the corporate 1 percent is getting richer while the corporate 99 percent is getting poorer.

The number of companies that have defaulted so far this year has already passed the total for all of last year, which itself had the most since the financial crisis. Even among companies considered high-quality, or investment grade, credit-rating agencies say a record number are so stretched financially that they're one bad quarter or so from being downgraded to "junk" status.Companies whose debt is already deemed "junk" are in the worst shape in years. To pay back all they owe, they would have to set aside every dollar of their operating earnings over the next eight and a half years, more than twice as long as it would have taken during the 2008 crisis, according to Bank of America Merrill Lynch.

That sounds familiar. Just replace "company" with "household" and you have a news article that you've read before..

Remember that the largest job creator in America is small businesses. So if small business is hurting, so is the labor market.

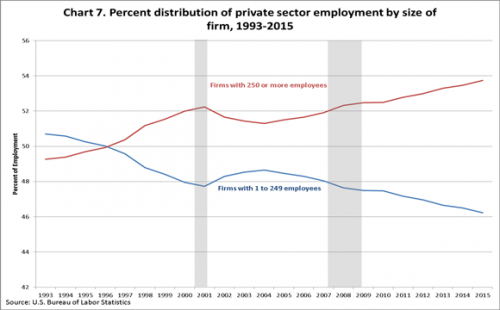

Jobs at small businesses fell 60 percent from the pre-crisis peak in December 2007 until the private sector started adding jobs again in February 2010. That is a staggering number, and represents a decline that is 40 percent larger than the fall in jobs among larger businesses. This is especially problematic because small businesses employ half of the private sector workforce, and since 1995 small businesses have created about two out of every three net new jobs—65 percent of total net job creation.

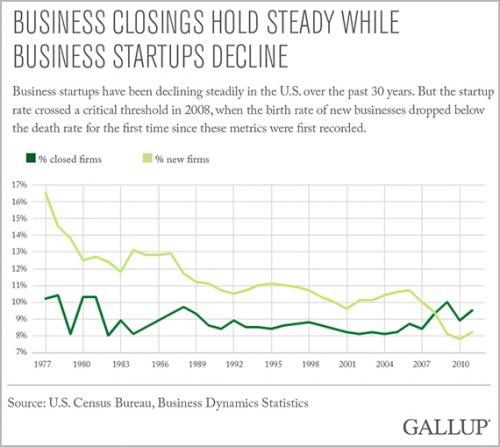

So with job creation dependent on small businesses, an unprecedented decline in small businesses is devastating to the labor market.

Comments

I'm trying to reconcile small the small business claim

with Chart 7. It looks to me like the total employment for small business dropped below large around 1996 or so? Or are there two different definitions of "small" here?

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

There are!

The Koch holdings and so many other companies are seen as S Corporations for tax purposes. The basic determinant is whether or not the company is privately-held no matter how much market value it has.

Vowing To Oppose Everything Trump Attempts.

To address the wealthy companies is to address those who, in

large part, make up the global monopoly capital system( in my view). They are not only able to administer prices rather than compete for sales, they are able to enlist governments to work on their behalf.

As has been known for decades, the capitalist system tends toward stagnation - slow growth in econ-academic speech - and we are seeing that. There are few areas where it's profitable to invest productively, so capital expenditures are low. This is also a reason why the world has seen the financialization of much of the global economy. Since profits are not readily available in a productive sector, profits can be had in finance, a more or less parasitical non-productive sector.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

"..the huge piles of cash that corporate America is sitting on."

"Why don't they spend it?"

Pretty much a rhetorical question, but I'll bite. The reason corporate America doesn't spend those "yuuuge piles of cash" is because THE CEOs WANT IT ALL FOR THEMSELVES!! (A revelation, no?) The way they do this is by using all of those YUUUGE piles of cash in stock-buyback schemes (which used to be illegal, BTW, until this became a legalized side-note to the repeal of Glass-Stegall, under none other than William ["Bill"] Jefferson ["BJ - Blow-Job"] Clinton).

Guess what happens when an American corporation buys back its own stock? Stock price goes up! and the CEOs cash-in their stock-option ransom notes at large profits! Such a deal!! and what a scam! and entirely legal!!!

When Cicero had finished speaking, the people said “How well he spoke”.

When Demosthenes had finished speaking, the people said “Let us march”.

There's a little more to it than that

Think of a corporation like a household.

A wealthy household saves a lot of their income, because they don't have to spend it.

A poor household has to spend nearly every dime to stay afloat.

Don't discount the "buyback as payback" aspect --

it happens A LOT.

When Cicero had finished speaking, the people said “How well he spoke”.

When Demosthenes had finished speaking, the people said “Let us march”.

It would

be interesting to see which businesses are thriving and which are failing. I'm still a firm believer that manufacturing is the backbone of an economy. I'd hate to think that the businesses that are struggling are manufacturing but that's probably the case. I look at google and facebook as window dressings. If they ceased to exist tomorrow this wouldn't be a burp for the average American trying to scrape by. Yet here these next to worthless companies are raking in more than most if not all of our top manufactures....

See?

The system works.

Anyone who can read should know by now we are in a Recession, and one where there established system can't cope with to boot. Negative interest, bail-ins, failure of QE, etc.

Of course the R/D parties and the 1%'s media are pretending this all ain't happening; at least until the election is over. The only thing I see blowing the whistle would be some Lehman-like failure leading to a market "correction" come the next few weeks. Then we'd have to discuss something more substantive than which candidate is more full of crap.

Orwell: Where's the omelette?

The sad thing is...

All of those failing small business owners are going to blame (for the most part) government over-regulation and over taxation as the reason why they failed. Very few will see the real reason - if you can buy it at Wal-Mart, then you can't sell it and make a profit.

Democrats, we tried to warn you. How is that guilt and shame working out?

There are a lot of reasons

Over-regulation and over-taxation is over-simplistic, but regulatory capture is a real thing. It's certainly not the only thing to blame, but it's a part of the overall business environment. What use does a mom and pop shop have for the TPP? Wal-Mart will certainly put it to use however. The regulatory environment designed by neocons and neoliberals is intended to benefit the largest corporations at the expense of every competitor.

There are 2 factos I see

The first is that taxes are too low on individuals and (relatively) too high on corporations. Think like a CEO. What makes more sense, spend your company's money on increasing business, when it's new profits will be taxed at (supposedly I admit) 35%, or inflate the company's stock price and have your personal income taxed at (if you pay taxes at all) 15%?

But I think that this is actually just a smallish issue. (by that I mean easily corrected) The real, fundamental issue, is that capitalism is counterintuitive and counterproductive to the overwhelming majority of people. To "work" capitalism requires that everyone work more than necessary - at mostly dehumanizing drudgery, but always for lesser and lesser pay - then consume more than necessary at ever increasing prices. In fact, thanks to automation, it is optimal for capitalism to not have any workers at all, but consumers must still consume. See the inconsistency? (rhetorical question)

A sane, free person would work only as much as necessary, save for retirement, and consume only what he truly wants. And that is what we are doing, more and more of us, willingly or forced.

That is what is killing the world economy - the inherent contradictions between capitalist imperatives and rational human responses.

On to Biden since 1973

Well, since monopoly

is the goal for many large companies, this plays nicely into that grow or die paradigm of capitalism. The big ones grow, the small ones die, and the big ones eat the small ones. And since the American consumer is tapped out, this is the only way they can continue to show a short term "profit" to get that big bonus and more stock. And that is ALL they care about. No matter that it isn't remotely sustainable, they're taking this baby right into the ground and as long as they get that bonus, they could care less about the consequences. With TPP I'm sure they think they can make up those sales that used to be American consumers, and they may just be correct there. But only for a while I think, it's only going to be so long before there are no more consumers to keep the whole rotten scheme afloat. Stupid? Why yes, yes it is, but only if you care about sustainability, and that's not what they get that bonus for.

Only a fool lets someone else tell him who his enemy is. Assata Shakur