How Trickle Down Killed Trickle Down

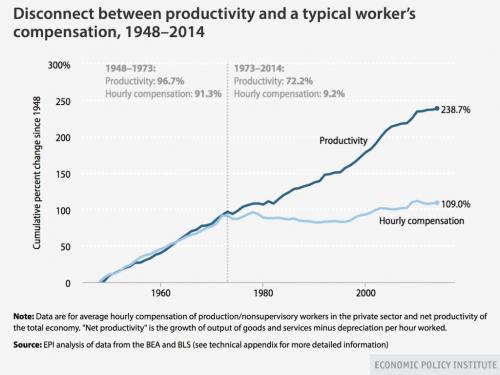

Trickle down does work. It worked for large parts of the last century. Then the Trickle Down theory was used to kill it. Take a look at this chart.

Do you see what I see?

I see wealth trickling down to workers as productivity goes up from 1948 to 1973. We had trickle down economics! That Trickle Down effect was the result of government regulation of business, progressive taxation, and executive compensation based on salary and bonuses.

Then came the Big Lie

The seventies were a time of economic uncertainty (as I suppose they all are...). Japan was out competing the USA, taxes weren't enough to cover government spending and corporate executives were earning a shocking 30x the average worker's pay. Enter the Laffer Curve and Trickle Down economics to save the day! The theory was that if we reduced taxes and regulations and tied executive compensation to stock performance, it would unleash growth and a new cycle of investment that would create additional wealth that would trickle down to the average worker. It didn't happen. Worker pay stagnated. The execs wanted to increase their own pay and overemphasized short term gains--any productivity increase went to the bottom line to increase their pay, not the workers.

The same dynamic led executives to reduce R&D spending, offshore jobs to cut costs, and grow businesses by acquisition rather than organic growth. The result is executive pay that's 10x higher than it was when we set out to fix the problem, and the elites getting a larger share of an expanding pie.

So the Big Lie is that you encourage Trickle Down by reducing taxes & regulation and tying exec pay to stock performance when in truth those actions killed Trickle Down. You encourage Trickle Down by regulating businesses to be community members, not stock price optimizing algorithms; by taxing income progressively; and by connecting executive compensation to value creation, not price appreciation.

Cheers y'all

Comments

The other, companion Big Lie...

...was to kill the traditional defined-benefit pension plan and replace it with a defined contribution plan that invested in the stock market so as to make everybody and "owner". This was key to convincing people that what was good for the stock market was also good for them, via their retirement accounts, even if what was good for the stock market was for those rubes to lose their jobs to children living in squalor on the other side of the planet who will work for pennies a day...

I want my two dollars!

and new investments in the

and new investments in the stock market raised the value of stocks which is really nice for the major stockholders. Who by the way were probably the same people who were telling people that 401ks were better than pensions.

It's true right now like it was back then. The old devils are at it again. When I say devil you know who I mean these animals in the dark malicious politicians with nefarious schemes charlatans and crooked cops. - 'Old Devils' William Elliot Whitmore