The Fracking Bubble enters terminal decline

The worst oil price rout since 1986 is beginning to claim victims in the shale oil patch, and now its every man for himself.

Investors in $158.2 million of Goodrich Petroleum Corp.’s debt agreed to take 47 cents on the dollar in exchange for stock warrants for some note holders and a lien on Goodrich’s oil acreage, according to a company statement today...

"In the industry it’s called ‘getting primed,’" said Spencer Cutter, a credit analyst with Bloomberg Intelligence. "It’s every man for himself. They’re trying to get in and get exchanged, and if you can’t you’re getting left out in the cold."

Investors in shale oil frackers like Goodrich aren't the only ones writing off huge losses.

Earlier this month, Halcon paid about 65 cents on the dollar to investors in $1.57 billion of the company’s debt, in exchange for being third in line to get paid if the company fails...

"The bubble is bursting," Cutter said. "And if oil stays where it is, the worst is yet to come."

With creditors of fracking companies taking huge losses on their investments, and with more losses coming, it isn't surprising that frackers have been basically locked out of the bond market, and regulators are worried that banks are overexposed.

On one side are the bankers who have been grappling with the plunge in oil prices and the need to shore up billions of dollars in credit extended to the energy industry. On the other are regulators eager to prevent another financial crisis while not knowing what it might be. Caught in the middle are the small- and medium-size exploration and production companies that rely on credit lines that use their energy reserves as collateral.

Regulators are right to be worried. Bankers may only be worried about having to admit losses right now, but they should be more worried about how they are going to cover those losses, because there is no coming back from this.

According to energy analysts at Well Fargo, more than 50 percent of the U.S. fracking capability is just sitting there, too unprofitable to keep working the land.

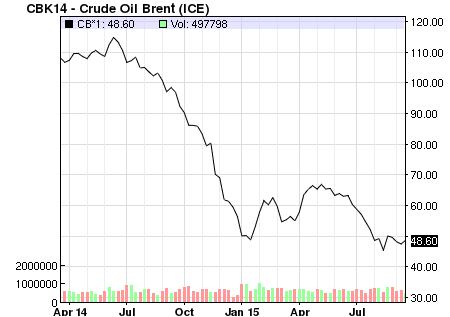

I started writing about the insanity of Frackonomics when the price of oil was more than $110. I called the fracking industry a bubble when the price of oil was still over $100.

Did I have insider information? Did I spend hours reading quarterly reports from energy companies? No. The main sources of my information were mostly Bloomberg and the WSJ.

Much like the housing bubble a decade ago, the signs were all there for anyone to see. For instance, this chart.

And like every other bubble, there will be lots of fraud exposed when companies go bankrupt and investors start scrambling.

For instance, consider this chart I posted last year.

Frackers have been able to survive this long because investor over-confidence and forward price hedging, but those hedges are rapidly expiring, thus leaving the frackers totally exposed to lower oil prices.

Half of the frackers will go bankrupt before the year is over.

83% of frackers spent most of their cash paying interest on debts.

What this means is over 140,000 job losses. It also means over $240 Billion in junk bonds are at risk, which will shake the financial industry.

Comments

Good news gjohnsit! thank you, n/t

To thine own self be true.

My question

I wonder if this fracking bust is really that or is it a way for someone (ie, Koch brothers) to eventually make more money in the long term by covering the fracking market? I have no idea if this is even possible.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Read this over at the GOS, and once again was dismayed

over the number of petro-Dems that post over there.

Really, this fracking thing can't come to an end soon enough. Haven't we f*d this planet over too many times already?

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon