Energy bust is bigger than the 80's

Swift Energy went bankrupt this week. Swift wasn't a large energy producer, and is only notable because it was the 40th North American fracking company to go under in the past year.

Shale companies did an amazing job of cutting costs and improving efficiency in 2015, much better than most people expected, but they've run out of tricks.

Those efforts, to the surprise of many observers, largely succeeded. As of this month, U.S. oil output remained within 4 percent of a 43-year high.

The problem? Oil's no longer at $50. It now trades near $35.

For an industry that already was pushing its cost-cutting efforts to the limits, the new declines are a devastating blow. These drillers are “not set up to survive oil in the $30s,” said R.T. Dukes, a senior upstream analyst for Wood Mackenzie Ltd. in Houston.

There's a real chance that oil prices could fall into the 20's this year.

Other than obvious problem of looming bankruptcies, there is the other problem of about $180 billion high-yield energy bonds are trading at distressed prices, half of which will default.

Of course, it's not just oil companies under financial duress. S&P said a whopping 72% of the bonds in the metals, mining and steel industry are now distressed.

The commodity wipeout is nearly as bad in the mining industry, especially coal, where many mining companies are facing bankruptcy. Like the oil industry, miners have kept up production with the false hope that prices would bounce back.

Most of the hedged position for the frackers have rolled off, leaving them totally exposed to these low market prices. Productivity gains have mostly stalled out in recent months.

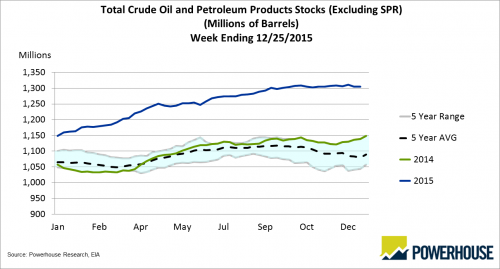

Oil inventories are at their highest levels in 80 years.

The cuts already made in the oil patches have been huge, but deeper ones are coming.

As crude prices languish below $40 a barrel, American drillers are retreating from domestic oil fields even faster than in the tumultuous 1980s oil bust.

U.S. oil companies are set to curb investments by 24 percent this year to $89.6 billion, meaning that from the beginning of last year to the end of this year, domestic drillers will have cut their annual capital budgets by 51 percent. That’s more than the industry’s 46 percent cut in the mid-1980s, according to Cowen & Co., which began its oil-company spending survey in 1982...

Deep budget cuts are expected to prompt another exodus of drilling rigs from Texas and North Dakota, with the average U.S. land rig count dropping by about 300 this year, Cowen says. Each rig is tied to dozens of oil field jobs, and the Federal Reserve estimates the nation has lost 70,000 U.S. oil and gas jobs already.

Those of us old enough will remember how the mid-80's oil bust wiped out the Texas economy and started the real estate bust that ended with the S&L crises.

But that's not the whole story.

To make matters worse for Houston’s oil equipment makers, Cowen’s estimate for the 2016 spending reduction may be too conservative because the survey went out in November, when oil was $48 a barrel. U.S. crude has tumbled to about $36 a barrel, and if prices stay that low for much longer, drillers will likely have to shed more capital dollars than they anticipated.

Evercore ISI’s survey indicated a 19 percent drop in spending this year, but with oil prices much lower than they were just two months ago, official budgets may come in 40 percent to 50 percent below initial projections, West said.

The domestic oil industry wasn’t designed to function with $36 oil.

80 percent of energy producers are planning to spend within their cash flow this year. Meaning an industry that has spent the past decade borrowing hand-over-fist at $100 oil, won't be taking on any new debt at $35 oil.

The wipe out in the energy sector this year could be epic.

Comments

Who's next to default

Bubble bubble, toil and trouble....

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

Crude prices just hit an 11-year low

below $35

Another bad day on Wall Street

Crude dumped by over5% just today and the S&P is down 1.7% as I type.

That's two really bad days out of the first three days of the new year.

Tuesday was the crucial day here...

After a big drop as was had on Monday, one would expect a rebound of similar proportions were it a normal reaction to some bit of bad news. But it wasn't; Tuesday merely had the markets basically hold steady with negligible gains and/or losses on the day. Did not bode well for Wednesday, or the rest of the week for that matter. Which may have some disturbing implications for the year.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

China stock market crashing again

link

china stock market halted again

Two 7% drops in three days.