The Criminal Semi-Legal Stuff That Wall Street Does

If you want to open an investment account with any of the major Wall Street firms, you have to sign away your right to the nation’s courts and agree to accept mandatory arbitration with the Financial Industry Regulatory Authority, Inc. (FINRA).

What is FINRA? FINRA is a private corporation that acts as a self-regulatory organization for member brokerage firms and exchange markets. So you, the small investor, doesn't have access to public courts, or have the right of appeal.

Did you know that? Would it surprise you to know that Wall Street almost always wins in this private court?

Would it surprise you that Wall Street wins in FINRA because they rig the court?

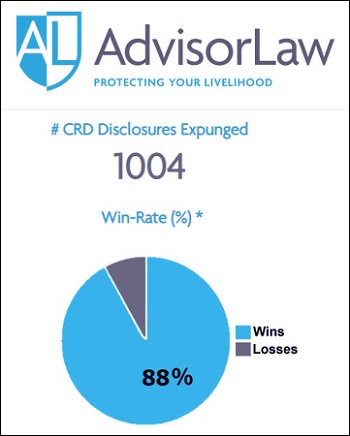

This time around, brokerage units of big Wall Street banks like UBS and Citigroup are gaming the system by getting legitimate customer claims against their brokers purged from the public record known as BrokerCheck, a website where customers go to determine if they can trust a potential broker by looking at past charges against him or her.

Both UBS and Citigroup have not yet been able to purge their own criminal history. Both Wall Street firms were charged with one felony count each by the U.S. Department of Justice in 2015, to which they both pled guilty...

The PIABA Foundation’s research report characterizes what has happened to BrokerCheck as follows: “It is being systematically gamed, exploited and abused with one-sided hearings, manipulation of arbitrator selection, deletion of significant customer complaints, and abusive (and possibly fraudulent) conduct to such an extent that it must be frozen immediately until the system can be fully vetted and repaired. Until such a time, BrokerCheck cannot be considered a reliable tool for investors to use when researching the background of brokers.”

Wait a second, you say. What about the SEC? Doesn't that have oversite of stuff like this?

To which I reply, "You are correct...but..."

Unfortunately for the public, the man currently at the helm of the SEC, Jay Clayton, had represented 8 out of 10 of the largest Wall Street banks in the three years prior to coming to the SEC. Clayton came from the Wall Street go-to law firm, Sullivan & Cromwell.

What other industry conducts their business in this way? None that I know of, outside of a government's security services.

Does that piss you off just a bit?

It should but maybe you don't have any investments on Wall Street, nor a pension.

All you have is a simple savings account with a major bank.

Well, I've got news for you.

According to its SEC filings, JPMorgan Chase is partly using Federally insured deposits made by moms and pops across the country in its more than 5,000 branches to prop up its share price with buybacks. The wording in the filing is as follows:“In 2019, cash provided resulted from higher deposits and securities loaned or sold under repurchase agreements, partially offset by net payments on long-term borrowing…cash was used for repurchases of common stock and cash dividends on common and preferred stock.”

Had JPMorgan Chase not spent $77 billion propping up its share price with stock buybacks, it would have $77 billion more in cash to loan to businesses and consumers – the actual job of its commercial bank. Add in the tens of billions of dollars that other mega banks on Wall Street have used to buy back their own stock and it’s clear why there is a liquidity crisis on Wall Street that is forcing the Federal Reserve to hurl hundreds of billions of dollars a week at the problem.

Isn't that why you put money into your savings account? So someone that you don't know can play the markets with your money without asking you?

Before Glass-Steagel's repeal this would have been illegal.

JPM used so much depositor's money buying it's own stocks that Reuters said that JPMorgan’s use of cash “accounted for about a third of the drop in all banking reserves at the Fed during the period.”

This drop in bank reserves have forced the Fed to create a mini-QE in order to keep the global financial system stable. How big is this mini-QE? An astounding $690 billion and counting.

This has gotten so big that Senator Elizabeth Warren has demanded that the Fed provide answers.

One surprising, and disturbing, sentence in Warren’s letter is this: “I do not question the actions of the New York Fed, but I write to seek clarity on why they were necessary….”

If ever there was an institution that deserved intense scrutiny, it’s the New York Fed. (See related articles below.)

I would like to remind the jury of the defendant's history of criminal conduct and general disregard for the rule of law.

life is good at JPM. Raking in huge profits, doing god's work, and - oh yeah - getting prosecuted for racketeering, while under probation after pleading guilty for multiple felonies.

JPM, HSBC and Deutsche Bank may be the most corrupt banks, but they aren't alone.

In its latest global banking review, McKinsey & Company said that nearly 60% of the world's banks need to make changes or they'll probably go under during the next downturn.

Even right now, the total bank exposure within money market funds increased to $934 billion.

Remember it was the money markets breaking that kicked Lehman in bankruptcy in 2008.

Comments

Watch Netflix new show The Laundromat

You want to see how thieves have legalized the kleptocracy.

Best movie you'll watch all year.

Banker Suicides

Someone has kept a list of just the high-profile banker 'suicides', including one banker shooting himself 8 times with a nail gun.

Another banker was shot 6 times at a busy traffic intersection in his Mercedes Benz

Official sources at the scene could not ‘confirm it was a ‘hit”.

Another was discovered lying on his back in bed with a wet towel stuffed in his mouth and a pillow over his face inside the apartment.

Those are supposed to be suicides???!!!

I don't think so.

A new Bernie scandal

Thanks, I laughed out loud at this.

Sounds like it's from the Onion, but I didn't think they had writers that good.

It was The Onion

Bernie’s response was hilarious!

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

I thought it was a government agency.

All the financial sites give that impression.

So it's another toothless watchdog? Or should it be called a lapdog?

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

I recently logged on, not to my bank, but my credit union.

I was presented with a document, which I had to mark that I'd read it and agreed to it before I could do anything at all. I downloaded it; it was 44 pages. Only a corporate lawyer would think that’s sane.