The Commodity Market Wipeout

There is a systemic and fundamental change going on in the global economy and it's time to pay attention.

With our economy and financial media engineered toward consumption, falling commodity prices generally don't register for most Americans. However, there are significant shocks from a collapsing commodity market that need to be recognized as non-negligible.

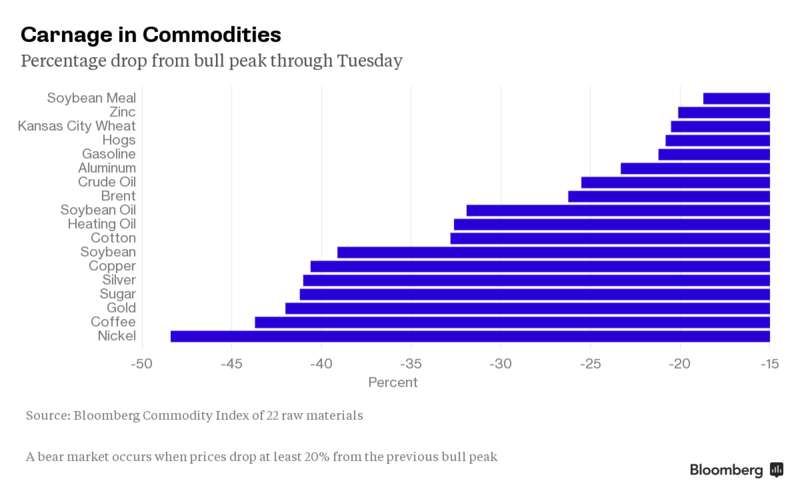

Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20 percent from recent highs, which means they are in a bear market. The last time this happened was October 2008.

People might have forgotten that the commodity market collapse in the summer of 2008, just months before the Lehman collapse almost took out the global financial system.

Of course, commodities also collapsed during the Asian currency crisis of 1997-98, which didn't threaten the global financial system.

So are commodities a leading economic indicator or not? The correct answer is: 'sometimes' and 'it depends'.

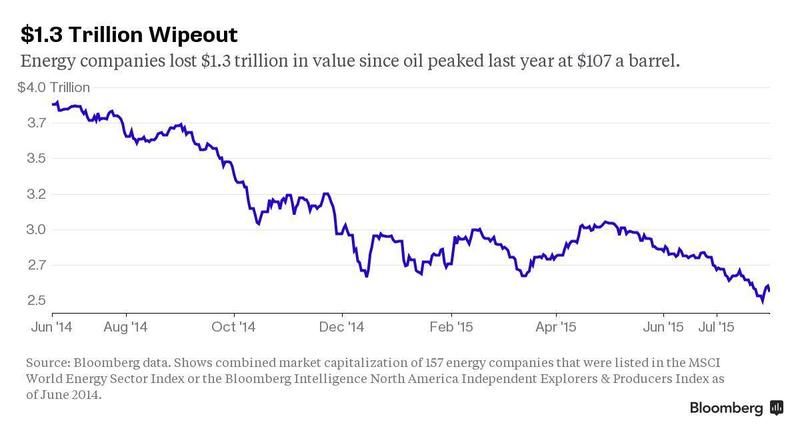

The center of this commodity collapse is the energy market.

Chevron's earnings were down a dramatic 90% from last year. Exxon's were down 51% y-o-y, the worst quarter since early 2009.

The collapse in energy shares alone adds up to $1.3 Trillion and is expected to create a $4.4 Trillion hole in energy company earnings over the next three years.

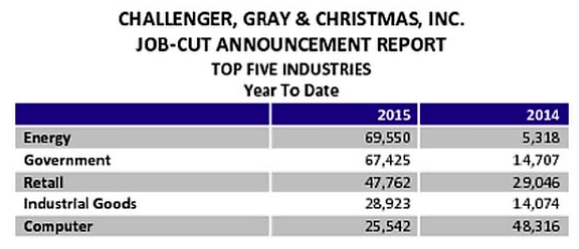

This has caused the energy sector to be the leading sector for layoffs in the entire economy.

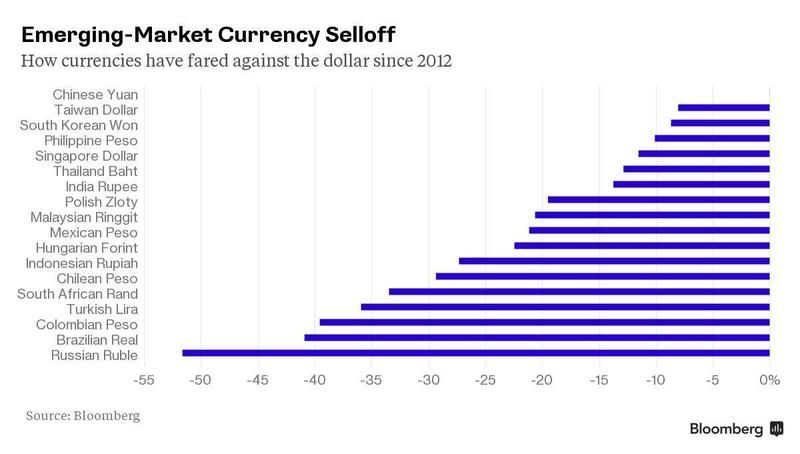

As is typical, the biggest impact of the commodity crash is overseas in the emerging markets.

The hit is especially significant in the currencies and bonds of emerging market countries.

All told, developing-nation currencies have fallen to their lowest levels since 1999, and bonds denominated in those currencies have wiped out five years’ worth of gains.

What's more, the collapse is expected to continue.

Leading this meltdown is Brazil, who's economic indicators are at a 2009 low, and its scandal-plagued government is in crisis.

Brazil may be the worst off, but all of the BRICS countries except for India are having trouble. Russia is in a recession.

China's stock market bubble continues to struggle, despite the government spending an unprecedented $1 Trillion in an attempt to keep the bubble inflated. China's debt problems are becoming more apparent.

South Africa's economy has also nearly stalled.

Combining the BRIC problems with Europe's economic stagnation we get the sharpest decline in global trade since 2009.

So what does it all mean? It's hard to say right now, but it is something worth keeping an eye on.

Comments

By coincidence I spotted the very same graphs on Automatic Earth

By coincidence, I had just been looking at those very same Bloomberg graphs earlier today. A writer named Raúl Ilargi Meijer used them to illustrate a blog post on the website The Automatic Earth.

http://www.theautomaticearth.com/2015/08/debt-rattle-august-6-2015/

It's hard to understand

…the impact of commodity deflation on global economics. It's counter-intuitive.

Of course the currencies of commodity export-based nations — such as Australia, Russia, Brazil, etc — will drop relative to the Dollar. But that is neither the disease nor the cause of it. Holding to the metaphor of "disease", these currency trends are a symptom much like "fatigue", which is a symptom of almost all systemic diseases. It's probably a lagging indicator that comes once the disease has taken firm hold.

It's counter-intuitive to people because they see falling commodity prices as a good thing. I remember trying to explain to problem of falling home prices (and trillions of dollars vanishing from earth, overnight). But the response was: "Home prices need to fall, otherwise I will never be able to afford a home. So, it's a very good thing!" Yet, it's unlikely these people own a home, now, because credit tightened severely and fewer people own homes now than did in the 1970s. Fewer people are in the job force now than 1989. The people are still being crushed by the collapse of 2006-2008 — in the US, at least.

But between then and 2014, commodity prices remained robust and stable. Commodity profits made oligarchs fabulously wealthy in the Robber Baron West — and in the emerging world, where the people own their own natural resources (China, Russia, Brazil, Norway, etc.), it pulled vast swaths of people into a much higher standard of living. A spiraling deflation in commodity prices will bring pain to everyone, on a global level, with fewer jobs and less production, sales, and investment.

What I can't understand is how and why it started. It seemed timed exactly to the moment when the US collapsed the elected Ukraine government and began a proxy war with Russia. Then the Arabs jumped in with oil over-production and collapsed the value of oil to a point where it is sold at a loss. The global economy reeled. Now it's spinning out of control and money and purchasing power are vanishing into the ether by the trillions, slamming everyone in the world.

(If oil price manipulation began as an attempt to cripple Russia and China and the rise of the BRICS and Eurasia — it failed catastrophically. It not only killed the Petrodollar, but it resulted in an out-of-control contagion across the entire global commodity market.)

What's your take?

i wonder if the base cause isn't the problem of value...

there are so many things in flux now that there is no true standard of value.

for instance, the value of oil, gas and other staples of the commodities markets are dependent on the stability of climate. it is understood by anyone in the market not totally in denial that once society (sorry, for them there is no such thing as society), er, the market can no longer keep up the illusion that use of their product is destroying the planet and there is no choice but to organize the world on some other basis than cheap energy, oil will be of no value at all and trillions of dollars of "value" will evaporate. since much of western civilization is organized around cheap energy, all values are questionable once the organizing principle is removed.

to add to this problem - there's the incredible, epic mismanagement of the money creation process (debt) by central banks, (de)regulators, legal authorities and political institutions who have allowed banksters, hedge funds and speculators to debase their currencies and the entire assets of nations through fraud which has created an enormous value problem for currencies. there is no longer a rational basis for valuing currencies, since all of the banks are really insolvent and the assets that allegedly back up debt are fraudulently valued.

so there's no organizing basis for industrial society and no valid means of exchange for a market to operate.

what do you think, am i barking up the right tree?

Makes sense to me, & I think Automatic Earth writers would agree

Your take makes sense to me, and I think the writers for "economics truther" sites like Automatic Earth and Zero Hedge would agree.

I have always thought that American "left" / "liberal" / "progressive" support for the Federal Reserve model of money supply management, giving unlimited economic powers to unelected secret cabals of banking insiders, stood in huge contradiction to their stated values and to democratic governance in general.

My take can be summed up this way

With this quote:

And this chart.

The commodity deflation troubles

….me far more than the Forex, a market I have traded for a decade.

Commodity pricing is wacky and irrational. Both markets can be gamed geopolitically, fundamentals be damned. It's all spend and pretend.

I think we are living through the end of money right now. And, it is my intention to stay ahead of the game.

I'm moving into cryptocurrencies. As an early adopter, I see some lucrative advantages to holding my money that way, both inside and out of investment strategies.

I'm reading The Bitcoin Tutor, which is a simple yet empowering overview of global money that is under the control of the people. Heck, Lots of people carry bitcoin on their smartphones. It could easily end up becoming the reserve currency of the world.