The art of the spin

Submitted by gjohnsit on Fri, 02/09/2018 - 1:08pm

Stocks are dumping again today, and are headed for their worst week since 2008.

However, the financial media always knows how every down day is just another reason to buy. Every up day is also a reason to buy.

I just wanted to give a sampling of this spin.

Another problem for stocks: Earnings may be getting too strong for the market's own good

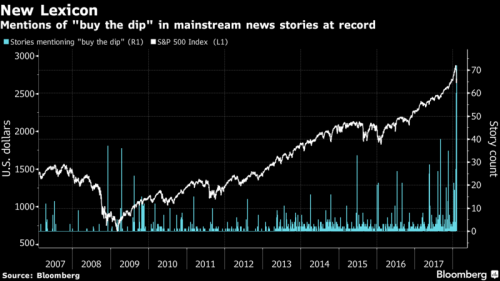

Here’s a frivolous way to gauge the frenzied trawl for marginal buyers amid this week’s equity rout: news stories that feature the phrase ‘buy the dip’ surged to a record, according to a Bloomberg analysis.

This stock-market shakeout looks a lot like 1996-97

In a Friday note, he said the closest match, or analog, is the March 1996 to March 1997 period, which had a .94 correlation (a reading of 1.0 would be perfect correlation).

“Today’s price action is weaker over a shorter period of time than that of ‘96, and then, as we suspect happens today, the market needed a few weeks to convalesce before resuming its uptrend. When we aggregate the price paths of the top 25 correlations with today, the picture suggests a pause of a few weeks and resumption of trend,” deGraaf wrote

This Stock Market Drop Is Good

You never know. Maybe stocks are just taking a breather before returning to another decade of gains.

And maybe trees grow to the sky.

Comments

Foxes running the henhouse

link

Reducing Complexity

Now that's entertainment! Wall Street is a perpetual motion frictionless top that defies the law of entropy.

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

The Vampire Market

Good advice for the small investor from Counterpunch. The conclusion:

https://www.counterpunch.org/2018/02/09/a-vampire-market-the-next-coming...

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

no place in the stock market

As I stated before, the only stake we 99%ers have in the stock market is the one we're impaled on!

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

But, but, but Cisco!

If you had invested $1,000 in Cisco in 1990 you would have over $400,000 now! Well until last week anyway.

Buy! Buy! Buy!

Oh yeah, some Thursday closing news:

https://ca.finance.yahoo.com/news/stock-market-officially-correction-apo...

Buy! Buy! Buy!

"They'll say we're disturbing the peace, but there is no peace. What really bothers them is that we are disturbing the war." Howard Zinn

C(r)isco

What about Crisco?

source

(Sorry, I couldn't resist!)

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

But Cisco!

After last week, you could sell your Cisco stock and invest in some Crisco.

Not Crisco stock; but actual Crisco. (See also my previous Comment).

[video:https://youtu.be/iu_YVswb3p4]

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

Party like it's 1999

1999, Just before the Internet Stawks Bubble burst. Where is Abby Joeseph Cohen to tell us all "Sell the farm and get it now. Don't be a fool and Don't miss out."?

This bubble has been ripe to burst for a couple years at least. I'm surprised it took this long.

We need Obama back to prop it up with more Free Cash For Clunkers. It's all Free. FreeFreeFreeFreeFree! Keep printing. Hahahaha.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

I pulled most of my 401k

money from stocks in Feb 16, so I did miss the run up but I don't care. I could not afford to see half that go like last time, I'm 56 and need to hang on to what I do have. I have not looked at my account this go around, I didn't look in 2008 until the bleeding was over, I did not want to know how much I really did lose then. And I did the thing that ALL the money guys tell you to do - stay the course. Not again.

Only a fool lets someone else tell him who his enemy is. Assata Shakur