Actually it's a lot like 2008

Wall Street wants us to think that “it feels more like a 9/11 - not 2008.”

They have two selfish reasons for this.

Firstly, it's all about "don't blame us." Because if we blame Wall Street then they won't get their taxpayer bailouts.

Secondly, the economy bounced back from 9/11, so you should buy those Wall Street products now while they are still cheap.

Both of these reasons are complete bullsh*t, and the proof can be seen in the actions of the Federal Reserve.

Everyone remembers the collapse of Lehman Brothers in September 2008.

But the beginning of the crash began in the summer of 2007 with Bear Stearns.

If you only focus on the Lehman event you might believe that the lesson to be learned was the government should have bailed out Lehman. It distracts from the fact that every major bank was already insolvent by the time of the Lehman event.

It's easy to blame the collapse of the markets entirely on the coronavirus, but it doesn't explain the fact that the Fed was bailing out Wall Street for months before the coronavirus even existed.

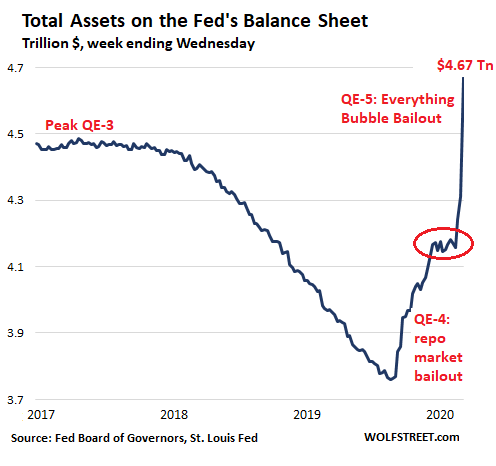

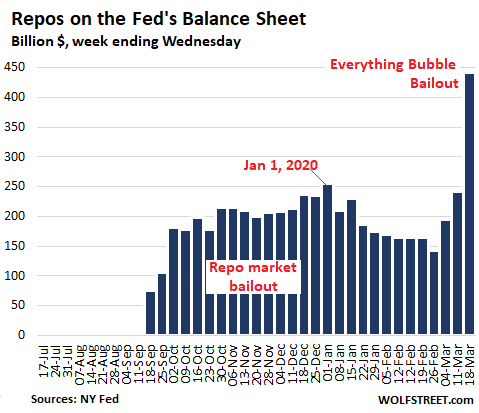

in terms of Wall Street privatizing profits and socializing losses, this is exactly like the last financial crisis.Wall Street’s crisis has a specific launch date: September 17, 2019. That’s when the Fed, for the first time since the last financial crisis, began dumping hundreds of billions of dollars a week into Wall Street’s trading houses. That program, called “repo loans,” now tallies up to more than $9 trillion in cumulative loans made to Wall Street at super-cheap borrowing rates. The first article we wrote on that Fed program was dated September 18, 2019 and titled: The Fed Intervened in Overnight Lending for First Time Since the Crash. Why It Matters to You.

September 17 was almost four months before the first death from coronavirus was reported in China on January 11, 2020 and five months before the first death was reported on February 28, 2020 in the U.S.

Yes, the coronavirus was an event that was outside of the control, or blame, of Wall Street. That much is true.

But what was also true was that the markets were already in trouble and ready to crash four months before the first person got sick, based on the actions of the guys who do the bailouts.

"History never repeats itself, but it rhymes."

- Mark Twain

"History repeats itself, first as tragedy, then as farce."

- Karl Marx

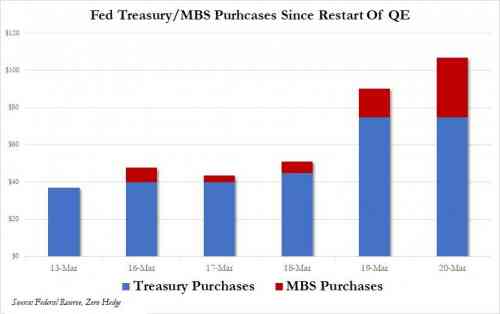

On the surface the markets are somewhat more stable this week, but behind the scenes the Fed is throwing everything but the kitchen sink at the markets. Consider just the Fed's money printing from just this week.

After buying $40 billion in Treasuries on Monday and again on Tuesday, the Federal Reserve upped the ante to $45 billion on Wednesday — to no avail. The Fed announced late Wednesday that it planned to buy $50 billion in Treasuries on Thursday and again on Friday.By Thursday morning, it had upped the plan to $75 billion on each day and added $10 billion in mortgage securities. By Friday morning, the Fed had decided to buy $107 billion worth of Treasuries and mortgage-backed securities.

This week's Fed quantitiative easing purchases will amount to $317 billion, which is slightly faster than the Fed balance sheet grew at the height of the financial crisis.

That's an enormous, unprecedented amount of money.

And despite throwing hundreds of billions in QE at the markets, the S&P 500 is down nearly 4% today as I write this.

QE money printing is the least of what the Fed is doing.

One half hour before midnight yesterday, the Federal Reserve Board of Governors quietly rolled out one more in a string of bailout measures it has been announcing since Sunday night to deal with Wall Street’s decade long gorging on speculative debt, derivatives, stock buybacks, obscene pay, and its serial crime spree. Each one of these Fed programs is identical, or almost identical, to the programs the Fed operated during the 2007-2010 financial crisis. If this were truly “nothing like” the last financial crisis, why would the Fed be using the identical measures to try to stem the crisis?

The Federal Reserve Board of Governors announced this past week that it “has reduced reserve requirement ratios to zero percent effective on March 26, the beginning of the next reserve maintenance period. This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.”

In other words banks aren't required to hold ANY money in their vaults. Nothing at all.

Isn't that a bit alarming?

Then a few days ago the Fed decided to swap cash-for-trash.

The Federal Reserve Board of Governors announced at 6 P.M. last evening that it is following the direction of Steve Mnuchin, the former foreclosure king who now serves as U.S. Treasury Secretary, and authorizing the reinstatement of a hideously operated, multi-trillion dollar bailout program for Wall Street’s trading houses known as the Primary Dealer Credit Facility (PDCF). Veterans on Wall Street think of it as the cash-for-trash facility, where Wall Street’s toxic waste from a decade of irresponsible trading and lending, will be purged from the balance sheets of the Wall Street firms and handed over to the balance sheet of the Federal Reserve – just as it was during the last financial crisis on Wall Street...

Just as is happening this time around, the Fed spun the story that the program would help American workers and businesses. It did no such thing. It went to bail out the trading and derivative operations of sinking ships on Wall Street as those same firms paid out millions of dollars in bonuses to their derelict executives and traders. Of the $8.95 trillion in loans issued by the PDCF, $5.7 trillion, or 64 percent, went to Citigroup, Morgan Stanley and Merrill Lynch according to the GAO audit.

This needs to be put into perspective.

Normally to get cash from the Fed, a bank must provide quality collateral.

Collateral that is eligible for pledge under the Facility must be one of the following types:

1) U.S. Treasuries & Fully Guaranteed Agencies;

2) Securities issued by U.S. Government Sponsored Entities;

In normal times eligible collateral is limited to the first two items.

After all, you want your central bank to be financially solid, otherwise your currency turns to sh*t.

But these aren't normal times.

3) Asset-backed commercial paper that is issued by a U.S. issuer

4) Unsecured commercial paper that is issued by a U.S. issuer

This is not good. Commercial paper is solid assets in normal times, but not in a crisis of this magnitude.

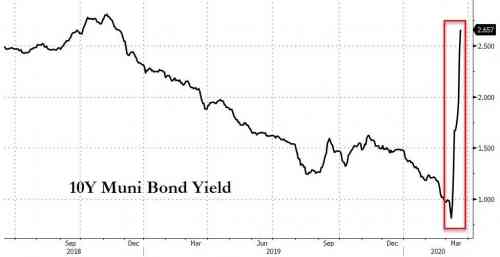

5) U.S. municipal short-term debt that: i. Has a maturity that does not exceed 12 months

This is a step that Fed didn't do even in 2009.

Why are they doing this now? Because of this.

Next on the list will be corporate bonds.

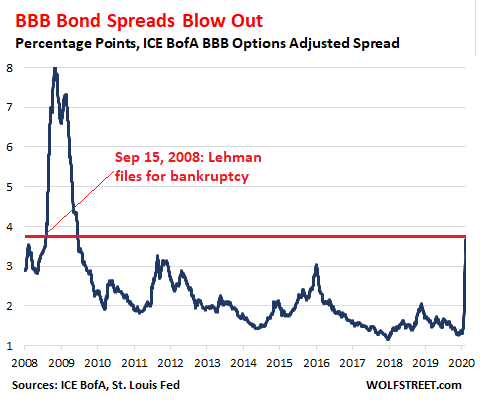

Why? Because of this.

BBB is rated just one step above junk.

It turns out that during the past decade, our corporate masters (not satisfied with over-sized profits gained by not paying their workers) borrowed heavily in order to purchase their own stocks. All of this debt on company books forced down their credit ratings.

The average spread of bonds rated BBB widened to 3.68 percentage points as of last night (ICE BofA US BBB Effective Yield Index). BBB is the enormous and ballooning $3.3-trillion category of “investment-grade” bonds just above “junk” that everyone is fretting about. And this spread of 3.68 percentage points is the magic number that the index blew through on September 15, 2008, the day Lehman Brothers filed for bankruptcy.

Everyone is fretting about the BBB category of bonds because it’s so huge – it accounted for about half of all investment grade bonds – and because many of these bonds are going to be downgraded to junk during a downturn.

A lot of pension funds are forbidden from owning junk bonds. So any credit ratings cut in this huge pool of corporate bonds (which often happens in a financial crisis) will force pensions to sell their holdings.

Another thing like 2008 is the panic flight to cash. Total assets in government money-market funds rose by $249 billion to an all-time high of $3.09 trillion in the week ended March 18. The previous weekly inflow record? $176 billion set in September 2008 just after Lehman Brothers filed.

Comments

And the prize for the biggest suckers are...

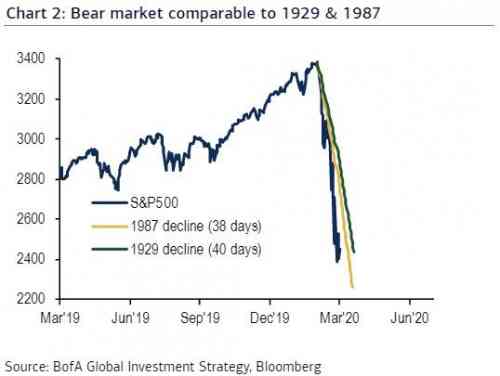

This was the worst week for stocks since Lehman (and worst 4 weeks since Nov 1929) for The Dow.(Dow was down 18% during the Lehman week and 17.35% this week)

Despite The Fed injecting $307 billion into the markets - almost double its previous biggest liquidity injection (in March 2009)

My Kroger stock made my old 401k look good

Due to the ridiculous toilet paper hoarders, KR stock shot up during one of the sell-offs. I don't expect it to hold long term, but it was hilarious to watch.

Also, it proves that the population would be worthless in a zombie apocalypse. "I've got my AR-15 and 60,000 rolls of Charmin!"

no shite

we lost $30K overnight in the the Bush era lie circa 2008

retirement savings - just gone

never forget him blinking like a cheating card shark

Zionism is a social disease

I remember the headlines in 2008

"Wall Street Lays an Egg."

Now we get daily propaganda reports where the inner circle takes turns praising Trump while secretly wondering how he manages to squeeze a coherent sentence out.

Here's another version of Bush's speech

It's gonna be worse.

Much worse.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

You could be right

1) the fiscal situation is much worse in 2020 than it was in 2008

2) the Fed never used all of its ammo in 2009. It already has in 2020 and we're still at the beginning.

this time it is different

Past 10 years, BRICS have been buying Gold

Past 10 years WS/DC have been buying (paper)Stocks

You make the call....

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

If they break the dollar

They might. Russia and China have alternative systems to the dollar that didn't exist in 2009. And we've pissed off a lot of people since then.

But at the same time, a financial crisis means a margin call, which means a rush to the dollar.

What's more likely is that this crisis won't kill the dollar, but will finally convince the rest of the world that dollar hegemony must end.

Thus this crisis is the beginning of the end of the dollar. That's my prediction.

think the dollar is already broke

not sure why the international money changers

encouraged this, except, perhaps

a move toward global currency

satisfies their ambitions

Zionism is a social disease

Jimmy lays into the Dems again

Renters are gonna get fucked

both tRump and SIL are ghetto landlords

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

It's good to avoid being a renter.

I've spent much of a lifetime trying to avoid being a renter, because renters have almost always been screwed. Websites such as https://freecampsites.net/ are often not great, but a lot of them can proliferate and so if you can't stay with your parents (if you have them), maybe one of such websites can direct you to a place where you can camp for free. There are also places the Internet won't tell you about, where you can camp for free but since it's illegal in those places you have to do it really discreetly to avoid getting caught. I really don't know what camping is like, though, in the era of the Coronavirus.

Also I guess California is going to try to house its enormous houseless populations for the duration of the coronavirus spread, so if that's true you might be one of those.

"You exclude the poor, not necessarily by disenfranchising them, but by giving them nothing to vote for. By giving them two candidates who are both members of the oligarchy." -- Michael Parenti

Yep

She wants means testing. More complicated paperwork, delays and quibbling over brackets. Having established that, the next step is to negotiate with the republicans. Graham in the senate doesn't want anything. Settle somewhere between the center and the far right. It sounds like another 20% of Americans will get help...maybe, for big biz bailouts.

Jimmy's losing it.

Starting to sound like Dennis Hopper in Apocalypse now.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

horror is your friend

[video:https://youtu.be/mPPGMNOLaMw]

Zionism is a social disease

Well, this time

maybe their right in that it's kind of like 9/11, except this time we know who the hijackers are, fucking wall street! That $9 trillion was their "plane" ramming through the Federal Reserve! All that corporate paper is like pouring gasoline on a fire.

I think there's a lot to be learned from the French Revolution! (dark snark) There is like $24-$36 trillion sitting in offshore tax havens, just waiting to get clipped, if any one is wondering how to "finance the revolution"... (and get gas masks and protective clothing too, it would seem!)

I have a very bad feeling about all this... 2008 is gonna look like child's play

C99, my refuge from an insane world. #ForceTheVote

A quote from my financial adviser

It's a pay service so I'm not going to quote much.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

So --

there's a ton of surplus money out there. How can there not be? The US government is, what, $23.5 trillion in debt, and it doesn't collect enough in taxes to pay off that debt, so it has to keep issuing dollars just to pay the interest on that debt, and the banks have to keep absorbing the dollars otherwise the existing dollars lose their value, and nobody can afford for that to happen. So it doesn't happen voluntarily. That's why I've been saying "there has to be a run on the dollar for the whole thing to blow up." If it happens it will happen involuntarily -- the country will crash anyway, and banks will sell dollars because they can't buy anything anymore.

Even if you account for the huge reserves the banks have squirreled away, a lot of that surplus money has accumulated in rich people, so yes, there are a lot of inflated assets out there, like stocks, real estate, T-bills and so on. Since the prices of those things are likely to be reflections of the amount of surplus money that's out there, price is not going to be a reflection of value, but rather of what are the investors' other options. Where ELSE can they go with them money?

"You exclude the poor, not necessarily by disenfranchising them, but by giving them nothing to vote for. By giving them two candidates who are both members of the oligarchy." -- Michael Parenti

We are going to have to choose - Communism or Fascism

If we don't discuss this then the decision will be made with no input from the people, as it usually is. In order to survive the pandemic the government will have to take responsibility for health care, payroll, rent, mortgages, education, jobs, manufacturing, etc. What is initially perceived as an emergency policy will soon become a permanent policy. We are staring down 18 to 24 months of pandemic. We have only begun to sink into this crisis. It looks like most small businesses will be bankrupt in three months. Infections will be in the 10s of millions by Summer and deaths will be millions. We are kidding ourselves if we believe anything else. The speed of this thing is staggering. The Fed has blown up its powder propping up the banks and the stock market, essentially trying to preserve capitalism. Well, it failed. Now it's going to have to take direct control of the economy to preserve this country. The alternative is unthinkable. The question will be - what kind of a country do you want the US to be? Better think about it and start forming an opinion.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

formulating a reasonable response

requires more involvement

start locally

our communities

respond well to focused

support

think co-ops and

turn off the tee vees

Zionism is a social disease

Does anyone know the lyrics to Le Internationale?

On the other hand, does The New York Stock Exchange even have a fight song? Used to work there, and I don't remember there being one.

Probably couldn't even round up a full-size orchestra today in Manhattan, anyway.

All the orchestras have been furloughed

most if not all of them without pay. Live music has become too expensive a luxury, and too obvious a possible source of contagion.

There is no justice. There can be no peace.

You can't analyze fake by history

I don't think a fully fake economy can be analyzed by historical reference.