The $29 Trillion Problem

Traditionally, one of the most reliable ways of predicting future economic performance is to look at corporate earnings. More earnings means more sales, means more profits, means more investment, means more hiring, means more economic growth. Rinse and repeat. Simple.

What if it wasn't so simple? What if the earnings indicators were fouled for unusual conditions? What if corporations were buying their own stock hand-over-fist?

Corporations report profits as earnings per share (EPS). By reducing the number of shares outstanding, buybacks help increase a company’s EPS.

Companies do buybacks all the time, ever since Reagan loosened the rules on it in the 1980s. That's not unusual. What is unusual is the amount of buybacks.

Almost 60 percent of the 3,297 publicly traded non-financial U.S. companies Reuters examined have bought back their shares since 2010. In fiscal 2014, spending on buybacks and dividends surpassed the companies’ combined net income for the first time outside of a recessionary period, and continued to climb for the 613 companies that have already reported for fiscal 2015.

In the most recent reporting year, share purchases reached a record $520 billion. Throw in the most recent year’s $365 billion in dividends, and the total amount returned to shareholders reaches $885 billion, more than the companies’ combined net income of $847 billion.

The analysis shows that spending on buybacks and dividends has surged relative to investment in the business. Among the 1,900 companies that have repurchased their shares since 2010, buybacks and dividends amounted to 113 percent of their capital spending, compared with 60 percent in 2000 and 38 percent in 1990.

This math is real simple. If you are sending more money to shareholders than you are taking in, then you don't have money left over to spend on investment, development, or hiring and raises. In fact, you have to borrow money just to send it to shareholders. Corporations are borrowing money, but not to make their companies more efficient and competitive.

And among the approximately 1,000 firms that buy back shares and report R&D spending, the proportion of net income spent on innovation has averaged less than 50 percent since 2009, increasing to 56 percent only in the most recent year as net income fell. It had been over 60 percent during the 1990s.

IBM, Pfizer, 3M, they are all spending more money on buybacks and dividends than on R&D. In 2015, stock buybacks and dividends exceeded $1 Trillion for the first time, up 84% in a decade. What's more, by pushing those share prices up, they generate increasingly less bang for the buck with those buybacks.

Corporate America is doing a huge fail.

If U.S. companies continue to dole out their cash to investors, he said, economic investment “will go where it can be used well. If a company in Germany, India or Brazil has something to do with the money, it will flow there, as it should, and create growth and activity there, not in the United States. It’s a scary scenario.”

Let's get back to that missing gap of several billion dollars that had to come from borrowing. That debt means future revenue going to pay for something that doesn't help the company. Just how much is it?

Underpinning much of the angst is an unprecedented $29 trillion corporate bond binge that has left many companies more indebted than ever...

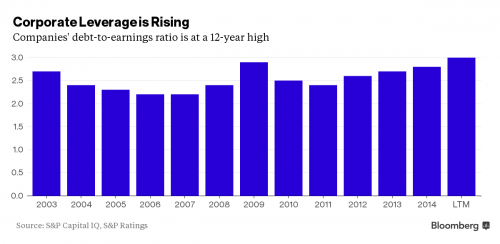

Strains are emerging in just about every corner of the global credit market. Credit-rating downgrades account for the biggest chunk of ratings actions since 2009; corporate leverage is at a 12-year high; and perhaps most worrisome, growing numbers of companies -- one third globally -- are failing to generate high enough returns on investments to cover their cost of funding. Pooled together into a single snapshot, the data points show how the seven-year-old global growth model based on cheap credit from central banks is running out of steam.

“We’ve never been in a cycle quite like this,” said Bonnie Baha, a money manager at DoubleLine Capital in Los Angeles, which oversees $80 billion. “It’s setting up for an unhappy turn.”

The $9 Trillion is globally, not just the United States, but domestic corporations are following the same pattern.

Lately the bond market has begun to roll over. Corporate junk bond losses are starting to leak over to investment grade corporate debt, which raises interest rates and the burden of that mountain of debt.

Worsening debt profiles contributed to S&P downgrading 863 corporate issuers last year, the most since 2009. More than a third of commodity and energy companies have ratings with negative outlooks or are on credit watch with negative implications, S&P said. Almost 6 percent of U.S. corporate bonds were downgraded through the third quarter, the largest proportion since 2009, according to Fitch Ratings. American, speculative-grade companies experienced downgrades totaling $94 billion compared to upgrades of $89 billion in the first nine months of 2015, Fitch said in a November report.

Much of the cheap credit accumulated by companies was spent on a $3.8 trillion M&A binge, and to fund share buybacks and dividend payments.

So far this isn't a crisis, but corporations have painted themselves into a corner that will be very hard to get out of.

Comments

Ha! Nice, gjohnsit.

Mike Whitney (Mr. wd's favorite op-ed writer) had a hella lot of fun with it in his: 'Stock Buybacks and the Wall Street Sharktank: “A Whole Lotta Stealin’ Goin’ On”. He goes back to 2012, iirc, and uses the old 'add up the billions and billions, and soon yer talkin' about some real money' framing.

What a fucking casino con job it all is; too bad the average person on the street dunno, eh?

But let's hear some Jerry Lee for now; I gotta go heat some leftovers for dinner: caviar on top of osso bucco in champagne, with a side of poached nightingale tongues.

Ladies and gen'men, thank you very much!

my god, another game - how long until it all comes down?

and we have Condi Rice for the words of wisdom

"no one could have seen it coming"

I worked at Lucent, the spin off from ATT that had Bell Labs and Western Electric. There was a quarter where they cooked the books to make the quarterly stock look good. I didn't trust them and sold all my stock. I didn't have much, but I dumped it all. I forget what it was - maybe $50/share. It later went up to $80 per share and then it went down to the range of a few dollars. The Market Cap of the whole company was less than one internet product that they bought as things were going up

ATT is now a marketing company

Back in the day, there was R&D and manufacturing and a lot of talent in the business. We have now had maybe 20 years where the engineering has become financial engineering. All those PhD in physics who could not get jobs went into finance and came up with the wild ass derivatives and all those gambling devices that I think are going to sink the economy.

I have known for years that companies were buying back way too much stock, but I NEVER THOUGHT THAT IT WOULD BE IN THE SCALE THAT YOU DESCRIBED here

So, thanks for more bad news

Thom Hartmann's book "The Crash of 2016" was written a couple of years ago and .......

A bad time to be deep in debt

Another milestone

This was certainly easy to predict

Whoculdaknown?