Crypto millionaires buying lawmakers in an effort to tap taxpayer bailouts

Rarely has an "industry" witnessed such a sudden and overwhelming increase in political campaign donations.

At the end of March the crypto sector had given $26 million in campaign donations. That was a 5,200% surge over last year.

Six weeks later the number was "over $30 million".

By the start of the fourth week in June, total donations by the crypto sector had jumped to "over $52 million."

If you count PACs, crypto has spent well over $100 million. As is normally the case, only a very tiny number of crypto wealthy are playing this game.

The crypto sector doesn't discriminate by party, it gives to both Democrats and Republicans, although it does discriminate against progressives. What do they want?

They are pouring millions of dollars into primary elections as they try to gain influence over members of Congress, Republican and Democrat, who will write laws governing their industry, as well as other government officials who are crafting regulations...

Officials are considering what consumer protections and financial reporting requirements to put in place and how to crack down on criminals who take advantage of the anonymity offered by cryptocurrency to evade taxes, launder money and commit fraud."What do they want? They want no regulation, or they want to help write the regulation. What else is new?” asked Sen. Sherrod Brown, D-Ohio, an industry critic...

In Washington, Democrats have been far more hawkish than Republicans. “They had me at ‘Hello,’ so they don’t need to lobby me," said Lummis, a Republican. "Democrats are another story.”

To give you an idea, the leading pro-regulation Senators are Elizabeth Warren and Sherrod Brown. While famously corrupt democratic Senator Kirsten Gillibrand has teamed up with Senator Cynthia Lummis, the Wyoming Republican, to push pro-crypto legislation.

All of that money being thrown around is having an impact. Up until now there's been a limited number of ways for people to turn crypto paper profits into real profits, but that has begun to change.

Fidelity Investments, one of the nation’s largest providers of retirement accounts, announced earlier this month it will start allowing investors to put bitcoin in their 401(k) accounts.

Everything was coming up roses for crypto, until the crash hit.

It hit just as crypto was about to get the ultimate stamp of credibility - the ability to pay taxes with it.

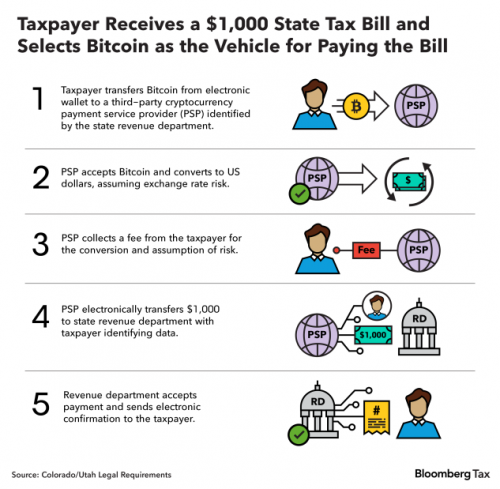

Two US states are steaming ahead with programs that will permit taxes to be paid in cryptocurrency, but the idea has been shelved almost everywhere else in the wake of the crash that has erased hundreds of billions of dollars worth of digital assets.Revenue departments in Colorado and Utah are implementing programs to enable businesses and individuals to pay their tax bills with virtual currencies such as Bitcoin, Ethereum, and Dogecoin, targeting implementation within a few months. The two Western states look to be outliers, however, and still face some logistical hurdles before their programs launch.

... While a half-dozen states have considered following the lead of Colorado and Utah, a chorus of fiscal watchdogs, academics and crypto skeptics is now warning lawmakers against initiatives that might put state treasuries and taxpayers at risk.“Anything involving crypto is less appealing in the wake of the massive volatility we’ve seen over the last month, and frankly the last six months,” said Lee Reiners, executive director of Duke University’s Global Financial Markets Center. “I don’t know if that slows momentum at the state level for payment of taxes, but it doesn’t help. And there is no financial benefit to the states to permit it.”

Betty Yee, California’s state controller, called a crypto-payment bill (S.B. 1275) currently before the California Legislature “fiscally irresponsible,” pointing to price volatility for cryptocurrencies and lack of a robust federal regulatory framework for digital assets.

...

Thirty-seven states considered bills affecting some aspect of cryptocurrency during the 2022 legislative session, according to Heather Morton, a policy analyst at the National Conference of State Legislatures. Within that group, she said Arizona, California, Hawaii, Illinois, Louisiana, New York and Oklahoma all considered bills that would authorize the authorities to accept crypto.

37 states! Think about that. Cryptocurrencies were that close to becoming what is historically the ultimate stamp of approval for currency legitimacy.

It was also that close for crypto millionaires to socializing the cost of any losses (aka put the losses on the taxpayer) from a very speculative asset.

Comments

Meanwhile, leftists continue to undermine 'Murica

But is this really "bad news"? Could it instead be good news?

May as well throw these in.

Don't worry-

they'll get bailed out on our dwindling dimes. It's The Law, which is to say that the Golden Rule will prevail here as it does everywhere else.

Twice bitten, permanently shy.