The $48 Trillion Bank Bailout that you had no idea had happened

Let's clear up a bit of confusion:

#1) I am NOT referring to the post-2008 bank bailout. This bank bailout had nothing to do with Lehman Brother and Bear Stearns.

#2) I am not making this up. Nor am I not exaggerating. $48 TRILLION, more than twice the size of the GDP of the United States, was created out of thin air by the Federal Reserve, and shoved into the banking system, without a vote by Congress, or even an article about it in the NY Times. A large part of this bank bailout wasn't even to banks in the United States. Yet you, the American taxpayer, are still back-stopping all of those loans.

One of my favorite sites, Wall Street on Parade, sifted through all of the boring, Federal Reserve financial reports and pulled out a gem like this.

As thousands of businesses were forced to close in the U.S. as a result of the coronavirus outbreak in March of 2020, and millions of Americans were financially struggling, the Federal Reserve was pumping what would become a cumulative $3.84 trillion in secret repo loans into the U.S. trading unit of the giant French global bank, BNP Paribas, in the first quarter of 2020.

The repo loan market is where banks, brokerage firms, mutual funds and others make loans to each other against safe collateral, typically Treasury securities. Repo stands for “repurchase agreement.” The Fed only comes to the rescue of this market when there is a liquidity crisis and Wall Street firms are backing away from lending to each other. September 17, 2019 was the first time the Fed had to intervene in the repo market since the financial crisis of 2008 and it was months before the first case of COVID-19 was discovered anywhere in the world.

BNP Paribas is not just any ole global bank. It’s the bank that the U.S. Department of Justice fined $8.8 billion in 2015 for flouting U.S. sanctions, covering its tracks, and pleading guilty to a criminal charge.

What may have led to the scramble for money by BNP Paribas Securities is – wait for it – risky derivatives, the same financial weapons of mass destruction that blew up the U.S. financial system and economy in 2008 and led to the biggest bailout of Wall Street in history by the Fed.

The BNP Paribas information comes from a repo loan data dump by the New York Fed this morning – the regional Fed bank that handled all of these secret repo loans from their inception on September 17, 2019 to July 2, 2020.

The Fed has withheld the release of the names of the banks that got these massive loans for two years but is now forced to release them under the provisions of the Dodd-Frank financial reform legislation of 2010.

The raw Fed data can be seen here.

The Fed has no business buying $2.7+ TRILLION RESIDENTIAL Mortgage-Backed Securities (RMBS). The Fed recklessly pumped the housing bubble for Wall St's benefit. Result?

Out-of-control housing inflation - for both home prices AND rent. It's like they WANT a homelessness crisis! pic.twitter.com/dNiVfP6dAn

— Occupy The Fed Movement (@OccupytheFeds) March 25, 2022

We shouldn't overlook the fact that the largest bank in America, and five-time criminal felon, JBMorgan Chase, took an oversized amount of that bailout money.

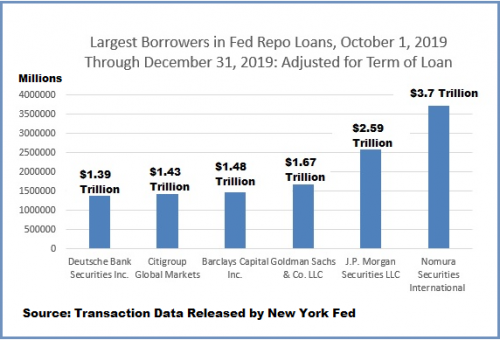

According to the quarterly data releases by the Fed for its repo loans, the trading unit of JPMorgan (J.P. Morgan Securities) borrowed $2.59 trillion in term-adjusted cumulative repo loans in the fourth quarter of 2019 and another $3.6 trillion in the first quarter of 2020.

Noone seems to understand just how illicit JPow's trading has been while having access to the most inside financial info imaginable.

He failed to file 278-Ts for anything but muni bonds. He hid all his personal trade dates behind 'Multiple' on his annual forms.

C.f. even JYell pic.twitter.com/HU7VDplpc3

— Occupy The Fed Movement (@OccupytheFeds) March 29, 2022

Wall Street on Parade has also noted the total news media blackout on this enormous bailout.

Those Fed revelations, that had been withheld from the American people for two years, should have made front page headlines in newspapers and on the digital front pages of every major business news outlet. Instead, there was a universal news blackout of the story at the largest business news outlets, including: Bloomberg News, the Wall Street Journal, the business section of the New York Times, the Financial Times, Dow Jones’ MarketWatch, and Reuters...

The most puzzling part of this news blackout is that the majority of the reporters who covered this Fed story at the time it was happening in 2019, are still employed at the same news outlets. We emailed a number of them and asked why they were not covering this important story. Silence prevailed. We then emailed the media relations contacts for the Wall Street Journal, the New York Times, the Financial Times and the Washington Post, inquiring as to why there was a news blackout on this story. Again, silence.

Gosh. You don't think that there's a connection between major corporations getting an obscene bailout, and the lack of news coverage from news media groups owned by those very same major corporations, do ya?

Occupy The Fed noticed this story by WSOP and asked a very good question: Was this bailout even legal?

How are the Fed’s actions legal? This is a great question and one without a satisfactory answer. Experts have opined that the Fed “broke the law” with their repo program. Indeed, the Dodd Frank Act, enacted in response to the Global Financial Crisis, was supposed to prevent exactly these kinds of massive, selective bailouts of “failing” financial institutions. The Fed and their cronies on Wall Street will argue that the megabanks were all well capitalized and were not at risk of failing. If that was true, why did the Fed drop reserve requirements to zero in March 2020? And why has the Fed failed to reverse the supposed “emergency” action for more than 2 years?!

The one thing I've learned during my time on this planet is that the more important the event is, the less the news media will talk about it. So if NO ONE in the news media is talking about an event, then this is what you should be demanding answers for.

Comments

I posted this in several reddit subs

I'm curious if anyone will notice/care.

It's just $48 Trillion after all.

Hmmm. Now that I think about it, isn't it curious that price inflation happened shortly after this massive bailout? A galactic-sized amount of money is created, and then prices go up? Hmmm.

Oh well, it's not like being able to afford a roof over your head and food in your stomach is important to people.

Do you want to know why you can't afford a house? Do you want to know why you can't afford rent? Do you want to know why gas and food are so expensive? Do you want to know why the political system is so corrupt and why society is so unequal?

Many of the answers are in this news story. That's what you get when you print more than twice the GDP of the United States and then give it the oligarch-controlled banks.

Yet this story will get ignored.

[update:] Posted it about an hour ago and not a single comment or rec'. Plenty of activity for bullsh*t though. I wish I was surprised.

You haven’t heard?

Inflation was caused because congress sent us $1,400. That’s what red maga thinks. Well that and people flipping burgers are being paid too much. It’s weird how they want to make a living wage, but people who aren’t as smart as they are shouldn’t expect to be paid even a fair one.

Congress rolled back most of Dodd-Frank while Obama was still acting like he was in charge, but even more was rolled back during Trump.

Even before we saw prices going skyward companies were doing shrink inflation by putting less product in the same box. But boy my last roll of TP has really tiny rolls in it.

The message echoes from Gaza back to the US. “Starving people is fine.”

Thinking required

for comprehension of your article.

Your article is excellent and very important but requires critical thinking. It is far removed from typical “propaganda/news”,which only requires swallowing whole and repeating.

Anyway, thank you for your essay.

I'm going to dumb-down and redo this post at some point

It's important that everyone understands what is going on here.

All you accomplish

by dumbing it down is make people more dumb.

I'd call that a lost cause at improvement of the human mind.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I agree in principal,

but since I am one of those who requires this kind of information to be made more ‘accessible’ due to the numbness/dumbness in my brain I wouldn’t mind some cliff notes. I’d like to understand more about why it becomes increasingly impossible for so many to afford a roof over their head, and why so many are denied that simple human right.

I do at least understand this … "if NO ONE in the news media is talking about an event, then this is what you should be demanding answers for."

Ditto, Janis

Numbers actually make my brain fuzzy. And poems. It’s uncomfortable. I’m trying to understand the difference between inflation and stagnation and other 'tions. But I got the gist of this essay. Mostly.

But boy that $48 trillion really puts paid to the idea that we can’t afford to help people with unimaginable student debt from their loans. When people owe more money after paying on their loans for 10-20 years it shows that the system is really out of wack. It’s predatory. Also trillions were transferred upwards during the epidemic and the poverty rate has skyrocketed. Congress did it deliberately. It’s debt slavery. Banks get zero interest loans, but credit card interests are still very high for the poverty class. It’s a rigged system.

The message echoes from Gaza back to the US. “Starving people is fine.”

Not dumb-down

but maybe begin by mapping the roads into basic facts and comparisons for people like me for whom there was never any training on using numbers to think with or about. Probably an impossible task as the figures are so immense. But that might take a lifetime.

I once told a neighbor that I was a book editor. They shook their head -- the meanings of words were always changing, so words were not helpful. But numbers were always the same!

"One, two, three ... many"

I'm starting to do that right now

I'm drawing out how A turns into B which becomes C.

Very helpful, thank you

Without any theatrics I have a sense of an imminent, tremendously dark time. I hope we can describe that here.

Need to get legal papers drawn up.

Around me, at a nearby market, most move about vaguely, as if at a mall; others looking comfortable and at peace walk infants by my place in strollers - though more walk dogs.

The fed exists to enrich the 1%.

Bankers, Wall Street speculators and investment firms relish in the monetary policies.

It would seem congress and regulators are in on this scam as well. So, when will this

bubble pop? Transparency is the enemy of crooks.

Zionism is a social disease

It’s not the

48T but the 128-139T that they’ve blown through, wish I could remember where I saw that-tae maybe?

Dr.D comment? Not sure. Just the last day or so, kicckin’ the jams on mmt

You Rock on economic shenanigans!

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

I'm pretty sure the Fed hasn't loaned out $120+ Trillion

Maybe you are thinking about the size of the derivatives market.

In the 2008 bailout they loaned out $25-$30 Trillion if I remember correctly.

Either way, it looks like my posts for this on reddit have gotten ZERO traction. However, people are sure to complain about inflation.

This is what it feels like to me (outside of C99P, of course):

[group of random people] "Have you seen the price of gas? Rent? Homes? Food? Who's responsible for this?"

[me] "I just posted this article all over the place showing that the Federal Reserve had a huge hand in all of this price inflation."

[random people] (silence) "I bet it was the Democrats fault! No, it was the Republicans! No, it was Putin!"

[me] "But I just showed you it was the Fed!"

[randos] "God darn Biden! He's the reason why"

Ron Paul said ”End the Fed” … Ross Perot said “NAFTA = bad idea”

Outsiders often do see what’s what and try to tell us. People are so psychologically conditioned, they have this emotion-driven tribal loyalty thing going on — they just don’t want to hear it.

tribal loyalty - the number one tool in causing wars, imo /nt

https://www.euronews.com/live

New World Order

same as old world order except wealthier and more powerful. Still, they're hiding this from us, so on some level they must be wary of us. I wish I knew why because I'd do whatever it is a whole lot more.

That’s become my logic too.

In Germany now, everyone’s in cahoots putting their thumb on the scale “against the Right,” right?

Looking at the diagram of all the various state-level coalitions and noticing that all the parties except the AfD are working together like one big corporate meta-party…

Composition of the German Bundesrat as a pie chart

So I go through the various causes, ideas, and things “on the Right” being unfairly discriminated against, identify those that I can live with, and then support those, just to put some sand in the gears of the (now allegedly center-left, progressive, and Green) war-for-profit machine.

For me, it’s those right-wing populists — for example, Jürgen Elsässer’s Compact magazine — who oppose getting on the World War III, anti-Russia, anti-China, U.S.-EU-NATO-driven train to the death camps. Support them, just to mess with the uniparty corporate censorship, global militarist state.

I’d rather get on a “One Belt, One Road” peaceful trade and development train connecting Europe, overland all the way, to the Far East.

If this got 1/10th of the coverage of the SLAP at the Academy

Awards heads would be rolling.

It should not come as a surprise that Biden did this.

https://www.federalreserve.gov/newsevents/pressreleases/other20220204a.htm

Obama liked him

Trump liked him, now Biden likes him! What a guy! True bipartisanship. Wall Street sure got it's moneys worth.

Blind

random people] (silence) "I bet it was the Democrats fault! No, it was the Republicans! No, it was Putin!"

[me] "But I just showed you it was the Fed!"

[randos] "God darn Biden! He's the reason why"

And stupid

It’s reddit but I repeat myself

Ya got to be a Spirit, cain't be no Ghost. . .

Explain Bldg #7. . . still waiting. . .

If you’ve ever wondered whether you would have complied in 1930’s Germany,

Now you know. . .

sign at protest march

Confederate Money

Thanks to the Federal Reserve, our greenback is turning into a grayback. I don't see a painless way out of this financial mess for the "little guy". I do wonder how today's world events will further affect the dollar, if there is a challenge to its place as the world's reserve currency.

No matter the outcome

The wealthy, big corporations and the politicians will do fine. Us, not so much.

So...proof of MMT?

I do not use the word "proof" lightly.

Some of you may recall my reaction to an earlier post on here from which I first learned about MMT - my reaction was something along the lines of, 'if this is true, then there is no longer ANY justification, not even the most backward of priorities, for the disparity we are witnessing; if MMT is not only correct in theory [another word I know better than to use lightly], but ALREADY being practiced by those in the know, then there is hardly any other explanation for what we are now seeing than authentic, Kantian Evil'.

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

Human exceptionalism is expressed in both monetary and

environmental policies. When we step outside of the natural world’s reciprocal order and balance we find an unsustainable future. When we detach the medium of exchange from actual value of something tangible we get an unsustainable financial system.

The common root causation lies in humanity’s refusal to live as a harmonic part of a much larger, thoroughly interconnected, collective organism. Our human dysfunction and extreme hubris have caused the predicaments we now face. The solution is obvious, but currently has no meaningful impetus. We’ve been well trained by our masters to ignore the obvious.

“The story around the world gives a silent testimony:

— The Beresovka mammoth, frozen in mud, with buttercups in his mouth…..”

The Adam and Eve Story, Chan Thomas 1963

This isn't MMT

MMT, as I understand it, comes when you print money to fund your fiscal budget. Sort of like when the Union printed Greenbacks during the Civil War.

Note that it worked.

What we've got here is a central bank printing a mountain of money, loaning it at 0% interest to major banks, many of them not even in the U.S., and them turning around and using it to drive up asset prices.

In a certain way this is trickle-down economics on steroids.

Leaving blankets contaminated with smallpos

where they'd be found comes to mind.

One of "our" earliest motifs.