The real unemployment rate

Chairman Powell of the Federal Reserve this week said something amazing. He said that the official unemployment rate, of 6.3%, wasn't real. And thus the official number was nothing but propaganda.

Now it's not a big surprise that the official unemployment rate is dramatically understated. But what is surprising is that they actually admitted it.

Reviewing the change in the labor market over the last year, Powell noted that there are problems with the way unemployment is measured. “After rising to 14.8 percent in April of last year, the published unemployment rate has fallen relatively swiftly, reaching 6.3 percent in January,” he said. “But published unemployment rates during COVID have dramatically understated the deterioration in the labor market. Most importantly, the pandemic has led to the largest 12-month decline in labor force participation since at least 1948.”Additionally, errors seem to be distorting the picture. “[T]the Bureau of Labor Statistics reports that many unemployed individuals have been misclassified as employed. Correcting this misclassification and counting those who have left the labor force since last February as unemployed would boost the unemployment rate to close to 10 percent in January,” Powell said.

10% is nearly double the official unemployment rate that's not a statistical problem. That's a structural, fundamental problem with measuring. It makes one wonder what other numbers are useless, and only meant to misinform.

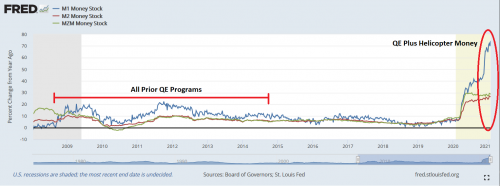

The most obvious example would be the inflation rate. People have been doubting the official inflation rate for decades, but it's low level has been used to justify the Federal Reserve pumping an enormous amounts of money into the financial markets. When I say enormous, I mean mountain of money.

M1 money supply growth just keeps surging. It has now hit roughly 75% year-over-year, more than triple the previous all-time high from 2011.

let's take a moment to appreciate the fact that we are nearly doubling the amount of cash in the economy while at the same time the economy is shrinking by 3.5%

that constitutes a failed policy.

If the Treasury printed $10 trillion and nobody used it, it wouldn’t cause inflation.

However, there is an important caveat. We cannot directly measure money velocity. People may imagine that the Fed is tracking how many times a dollar gets spent in a year, but they are not. The current velocity figures are inferred by dividing GDP by the money supply.

The result is a very imperfect measure of velocity, especially when one recalls that imports are subtracted from GDP and government transfer payments are not counted.

so both inflation and money velocity are calculated in highly questionable ways.

However there is one way of measuring all the Fed's money printing in a accurate way - by looking at the valuation of the stock market compared to the GDP.

The stock market is now worth twice the economy of the country. Mission accomplished

Comments

Interesting admission, but headlines I see implying otherwise

I don't have links but I look at a number of websites just to read the headlines about developing narratives. Seems that some headlines are touting a growing economy, huge drops in covid numbers. Sorta the narrative is good times are almost back. I do believe the facts in your essay, but I wonder if there is a developing narrative about good times that is more fantasy than real. And maybe reaching, no stimulus/survival checks as things are getting better. We will see how it plays out. Just speculating.

Going back to brunch

There is plenty of incentive.

The good news is

only 9000 deaths from the flu for an entire year.

Usually this number is up to 10 times higher.

"Those people just don't want jobs"

That's the message I hear when reading the BLS monthly figures. If one is unemployed for more than, I think the figure is, six months, then one is not in the workforce. Unemployment rate is per cent of those in the workforce that are unemployed. see the catch-22?

IOW, the "unemployment" rate is just the percentage of the employed that are currently between jobs.

Re inflation. IIRC my SS went up about $15 a month and my pension went up $20 a month. I do know, being shocked by my credit card bills, that December's and January's grocery bills are up ~$200 a month over the December 2019-January 2020 bills. Beef is something only the rich can afford and fish too.

Oh, and Biden thinks SS increases are "too generous". Who was the lesser evil, again?

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

I thought it

was...if your unemployment runs out and you fall off the rolls, you are then considered employed and don't count anymore.

No, "Not in the workforce"

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Yes

Trump has been The Excuse for four years. The preposterous attempt to Impeach and Convict a guy who isn't President produced a deliciously ambiguous result -- a MAJORITY voted to convict Trump for attempting to overthrow the government, but an insufficient MAJORITY to convict.

So after litigating with this man who resides in the World Wrestling Federation Hall of Fame for four straight years, the Dems continue to litigate with him in the media. This will keep all consideration of public policy on the back burner, where the powers that be want them to be.

Accident? I don't think so.

I cried when I wrote this song. Sue me if I play too long.

Jimmy Carter knew how to end inflation

but at the cost of unemployment. Reagan proved him right, but he escaped the consequences by simply lying about the unemployment rate. Then he replaced inflation with tax cuts. Then he saved the corporations money on regulations by repealing or just ignoring the regulations.

This couldn't work forever, the government ran out of taxes and regulations to cut, so it just started printing money. The rich are only a few thousand out of 330 million people, they couldn't spend enough to trigger inflation - except in the stock market, and you could lie about how that is a good thing. Today everything is a trick or a lie. They've run out of tricks and nobody believes the lies.

On to Biden since 1973