The markets are still collapsing

That's an ADDITIONAL. $1 Trillion. Daily.

The New York Federal Reserve Bank said it will offer $1 trillion of overnight loans a day through the end of this month to large banks. That is in addition to $1 trillion in 14-day loans it is offering every week... Wall Street analysts say the huge number is intended to calm markets by demonstrating that the Fed’s ability to lend short-term is nearly unlimited.

The Fed is also buying Treasury bonds at a furious pace, and will soon run through the $500 billion in purchases it announced on Sunday. It is also accelerating its purchases of mortgage-backed securities. Most analysts expect they will buy more.

To be fair, the banks haven't borrowed nearly as much as the Fed is offering, and none of the funding is directly from the taxpayer.

But as for calming the markets...

The 30-year fixed-rate mortgage averaged 3.65% during the week ending March 19, an increase of 29 basis points from the previous week, Freddie Mac reported Thursday. This was the largest weekly increase in the average 30-year mortgage rate since November 2016, and it’s the highest mortgage rates have been since mid-January.

The Federal Reserve slashed rates to zero and launched a new bond purchase program that included $200 billion in mortgage-backed bonds, and interest rates still went up.

And there is corporate debt, where the real economic bombs rest.

Consider these two headlines.

the benchmark that tracks the most creditworthy part of the $9 trillion U.S. corporate bond market, the ICE Bank of America U.S. IG Corporate index, is having its worst month yet...

What can the selloff slamming bonds tell us in terms of expected defaults? In the near $1.5 trillion high-yield sector, 32.6% of its outstanding bonds were trading at distressed levels, as of Wednesday’s close, according to Fidson, which implies a 8.35% default rate over the next 12 months.

And then there is the foreign exchange markets.

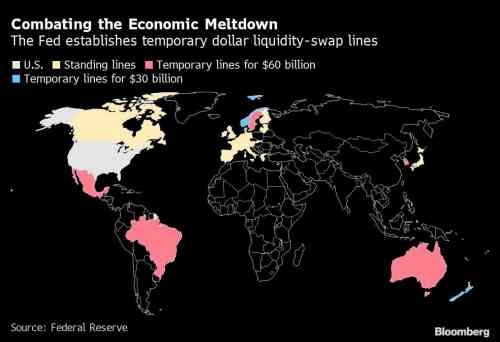

The global rush for dollars that’s been roiling the $6.6 trillion a day foreign-exchange market has showcased a missing piece of financial-safety architecture that world policy makers never addressed in the aftermath of the 2008 crisis...

Some moves have hinted at markets veering toward dysfunction:At one point Thursday, Britain’s pound registered its deepest eight-day slide since 1992, when it was infamously ejected from the European exchange rate mechanism.Australia’s dollar hit its weakest since 2002, suffering its biggest two-week decline since the aftermath of Lehman.The Japanese yen, Swiss franc and gold, which usually gain when fear grips markets -- and did so until recently -- have been sliding the past two weeks as the dollar stood alone as a haven.Mexico’s peso and India’s rupee hit record lows. The Korean won slid the most in a decade on Thursday.

“The dollar’s surge will renew calls for a shift from a dollar-centric global financial system,” said Eswar Prasad, who once led the International Monetary Fund’s China team, and is now at Cornell University.

Prasad is totally correct.

Russia and China will soon have something important to say about Dollar Hegemony.

Meanwhile, the U.S. economy is about to take a body blow.

Upcoming weekly jobless claims will shatter the standards set even during the worst points of the financial crisis and the early-1980s recession, with Bank of America forecasting a total of 3 million when the number is released Thursday. Those figures are expected to be so bad, in fact, that the Trump administration, according to several media reports, has asked state officials to delay releasing precise counts.

...

The worst month for job losses during the financial crisis was 800,00 in March 2009.Some forecasts see April quintupling that or worse. Forecasts for that month range from 500,000 to 5 million.

Comments

"But how are you going to pay for it?"

There is no justice. There can be no peace.

The old fashioned way

For Wall Street, anything

For actual human beings, nada. Let them eat cake!

"Don't go back to sleep ... Don't go back to sleep ... Don't go back to sleep."

~Rumi

"If you want revolution, be it."

~Caitlin Johnstone

That unemployment forecast

is incredible.

Just no good news, no positive trends at all.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

The damage that is about to be inflicted

upon working families will be unprecedented.

And both parties are uniquely unqualified to respond.

It's worse in Europe

link

Well, one positive trend...

...if society collapses, that should mean Big Brother finally runs out of gas and we suddenly get our civil liberties back.

One needs only skim the fucking Declaration of Independence to realize that the system lost its legitimacy years ago; without the rule of law and the consent of the governed, the police are nothing but gangsters. Why should we comply? When all they've got is threats on our lives, they've lost. All it's going to take is someone calling them on it in the right place, at the right time, in the right way....

In the Land of the Blind, the One-Eyed Man is declared mentally ill for describing colors.

Yes Virginia, there is a Global Banking Conspiracy!

My dream is that society reforms itself

while I am alive to see it.

I feel I am both blessed and cursed by not having family. I have no children or grandchildren to worry about, but I have none of them to help me out when I reach the almost-end of the line.

I have no clientele if nobody is working.

Period.

While I do have a couple of alternatives, I am reluctant to even fool with them. They involve 3 and 4 hours a day of driving. Those are hours I would not be getting paid.

I will not be on the streets, I will be ok.

I do not want to give the impression that I am not getting plenty worried about all the poor people in my community, and in the country.

Their best chance is to see the end of our empire, perhaps the end of capitalism.

I want to see it.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

A worthy dream.....

They keep trying to throw more debt at the problem...

when the problem is too much debt to begin with.

No bank wants to lend in this ridiculously overleveraged environment. Regardless of how badly the Fed may want them to.

Mitch McConnel's small business low-(not 0)-interest-loan scheme suffers from the same problem.

Still, when all you have is a debt hammer...

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

What is the end game?

The pathology of COVID-19 suggests this is going to last for months. Can anyone even imagine how this plays out with all these concurrent collapsing systems? I can't. Too many variables.

“Until justice rolls down like water and righteousness like a mighty stream.”

I don't know either.

But a lot of innocent people are going to get hurt, badly.

US confirmed cases exploded today. The Trump administration has proved itself to be clueless in controlling it. Maybe Trump should get on his knees and plead for help from Xi?

Coronavirus Dashboard

Maybe he'll announce

a National Day of Prayer and that'll fix it right up, after all, God is surely in the USA's corner as His exceptional nation.

Only a fool lets someone else tell him who his enemy is. Assata Shakur

Done did that...

https://www.presidentialprayerteam.org/2020/03/15/prayer-alert-sunday-ma...

Congresswoman Rashida Tlaib: F*** Trump’s national day of prayer

https://www.3ccorp.net/2020/03/16/congresswoman-rashida-tlaib-f-trumps-n...

Pretty effective too. Well, may be not so much.

“Until justice rolls down like water and righteousness like a mighty stream.”

Praise the Lord and Pass the Ammunition

It worked 75 years ago. When do we invade Chi-na?

[video:https://www.youtube.com/watch?v=uV9s1a6AZT0]

That would go down well with most Americans

It's the American way to run to church and pray after every disaster. As if the disaster was the result of not having prayed enough to prevent it.

Actually this is about

insuring local transactions remain processable …

That is scary

I don't think most people are grasping the potential implications of the situation.

"Don't go back to sleep ... Don't go back to sleep ... Don't go back to sleep."

~Rumi

"If you want revolution, be it."

~Caitlin Johnstone

Overall You are Spot On

My frustration is the lack of focus. If every emerging detail sparks outrage, angst, and an adrenalin dump we will not react in a constructive manner.

Think of it this way: If the Nuclear Reactor next door starts to experience an unexpected excursion, which reactor operator would you prefer be on the job?:

RIP

Criminal simply criminal

Nothing to prove it's right out in the open.

These are the bonds that corporations sold to buyback stock with in record volume. Every/anyone that knows this field knew should anything go wrong even something as little as picking your nose would make them not worthy the paper they are written on. WS profits on everything.

In the meantime tptb(our fucking clowngressshits) are fucking arguing about what crumbs to give the people and how long before they do that

https://www.zerohedge.com/political/after-bernanke-yellen-demand-monetiz...

After Bernanke & Yellen Demand 'Monetize Everything', Congress Considers Set To Allow Fed To Buy Corporate Bonds

“It will be done jointly with the Treasury and the Fed.”

88

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

Dow Stock Futures

Here's the latest regarding the stock market:

This unwinding has been in the making for years.

The failure of financialized capitalism

is getting ready to make itself apparent.

A pandemic is a destructive thing to begin with, but the human race could hunker down and weather it.

Problem is, everything human beings do impacts Wall Street. Wall Street operates on fear and greed.

I keep hearing Nancy Pelosi warbling, "We are capitalists and that's just how it is."

"Don't go back to sleep ... Don't go back to sleep ... Don't go back to sleep."

~Rumi

"If you want revolution, be it."

~Caitlin Johnstone

This is a failure of all capitalism.

Predicating its existence upon the dominant positions of capitalists, the representatives of capital, will prove its undoing.

The big question at this point is one of what sort of social contract will replace the capitalist one. Here in the US I'm expecting feudalism. If people in the US were smarter, there would be your basic revolution.

"It hasn't been okay to be smart in the United States for centuries" -- Frank Zappa

Financialized capitalism results in

industries and workers losing the skills to make things:

The vultures are busy:

The markets? Saturday's farmers' market was pretty well

attended on both sides. The local grocery stores are busy enough that they are nearly devoid of most things one wishes to obtain, the supply chain can't keep up with panic driven demand, but, like the kids, the markets are all right.

The great Ponzi scheme financialization casinos? They're sinking, but not enough for my liking, there is no substance there, and nothng we need to survive or even to live well.

That, in its essence, is fascism--ownership of government by an individual, by a group, or by any other controlling private power. -- Franklin D. Roosevelt --