Another milestone on the road of Late-Stage Capitalism

A few days ago the European Central Bank suggested that it was about to cut interest rates.

This planned cut is happening at a time when Denmark is offering to lend money at MINUS 0.12% for a ten-year mortgage.

In other words, the bank would PAY YOU to take out a loan.

Switzerland is even deeper into negative interest rates (NIRP) and has promised to cut rates further if the ECB cuts again.

NIRP turns all of the rules of capitalism on its head.

People aren't supposed to get paid to borrow money. At some point you could simply stop working for a living and just borrow money for a living instead.

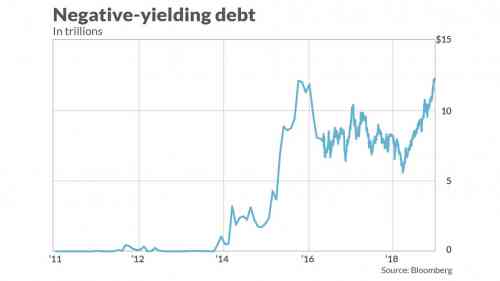

Some civilizations, like the early Roman Catholic Church and Islam, were opposed to charging interest, but negative rates just didn’t happen, as far as Sylla knows, until the modern era. Now 14 European countries, including France, Germany, the Netherlands, and Spain, have negative interest rates on their two-year bonds.And the negative interest rate virus is spreading to emerging European markets such as Poland, Hungary and the Czech Republic.

Amazingly even junk bonds are going negative. Junk bonds! They are called junk because they are expected to default. They're often called "high yield" bonds, but that no longer applies.

There are about 14 companies with junk bonds worth more than €3 billion ($3.38 billion) that are trading with negative yields, according to Bank of America Merrill Lynch. They include telecom giant Altice Europe NV and tech-equipment company Nokia Corp.

Believe it or not, NIRP is not a net good thing for banks because it means that banks are charged a fee for parking their reserves with the central bank.

So why is this happening?

It's a direct side-effect of central bank QE following the 2008 crash. They printed money out of thin air and bought financial instruments.

The thing is, they've bought so much that they are running out of quality financial products to buy.

Because of specific bond issue limits, Jefferies International estimates the ECB may have as little as three months’ worth of German bonds to buy for QE at the current monthly rate of 19.6 billion euros.

The Bank of Japan is in even bigger trouble.

The BoJ is a top 10 shareholder in 90% of Nikkei 225 companies, and owns between 70% and 80% of the ETF bond market in Japan. There simply isn't much left to buy.

That's the immediate reason for why we are here.

However, if you step back, there is a Big Picture explanation for how we got here and what it means.

For that I leave it to economist Michael Hudson.

Debts that can’t be paid, won’t be. That point inevitably arrives on the liabilities side of the economy’s balance sheet.But what of the asset side? One person’s debt is a creditor’s claim for payment. This is defined as “savings,”...

The new fallback position to keep the increasingly zombified U.S. and Eurozone financial markets afloat is to experiment with negative interest rates.Writing down savings by a few percentage points helps bring the glut of creditor claims marginally back towards balancing bank deposits with the ability of debtors to pay. But such marginal moves are rarely sufficient.

At some point there will be mass defaults on this debt, and that is the Achilles heel. Our currency is debt-based. If the debt can't be paid then the currency is flawed.

“The best way to destroy the capitalist system [is] to debauch the currency.”

- Vladimir Lenin

Many Americans, especially those on the left, have an irrational aversion to owning gold. So here is an extremely easy way to understand the counter argument.

The plunge in interest rates across the developed world is giving gold a fair tailwind as well. Who cares if it doesn’t pay interest? Trillions of dollars of bonds in Europe now actually have negative interest rates. By that measure, a cynic might say, gold’s 0% coupon looks like a bargain.

It doesn't require being cynical. It only requires being able to do basic math:

0 > negative.

Gold has now risen 11% in the past two months, and 15% over the past year.

That’s more than the S&P 500, +0.03% or the Nasdaq, -0.44%.

Comments

So QE has run it's course

Of course IF one believes the government, we are at full employment. There should be NO reason to cut rates, except the stock market needs to be juiced up still farther to benefit the 1%.

Yes, I know many working people are heavily into the stock market via their 401K's. In gambling parlance, these people are known as "suckers" or "pigeons". The 1% will unload as the market crashes and the 99% will suffer the consequences. Obama bailed out the banks and gave the back of his hand to the homeowners. Do you expect any better from Trump? From Biden? (Hahahahahahahaha) Sorry couldn't stop laughing at the thought of the Senator from Citibank siding with little people against the banks. Harris? What his face from Montana?

I'm not even sure about Sanders or Gabbard, but maybe. I'm pretty sure about Warren, solely because she seems to have a personal bone to pick with the banks.

Japan tried negative interest rates. didn't help solve their structural problems. Increased immigration would have solved lots of problems but Japanese racism was aghast, although they did try to lure Nisei back from the USA, but non-Japanese "animals" never!

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

It's Not Just 401K Suckers In There... It's All the Insurance

companies and insurance vehicles that need to be grown or they shall perish. And if insurance companies and insurance vehicles perish, then banks will get stressed, and we all know what happens when banks get stressed...

How do you spell Greeced again?

Food shortages, money so tight it cost money to save it, global war threatens - man it's starting to look a little gloomy out there.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

Such a Weird Idea. So Many Ways This Is Wrong. You'd Think

some of those money men would realize that when holding wealth becomes a draw on your net wealth in systemic fashion that something ain't right in your market. Right? Like this should be a flashing light and siren type event and existential threat to their way of life - nope.

It also seems like an extortion/protection racket at this time too. Like just a fact of life - gots to pay GS their cut... I mean, it costs a lot to fence all this cash. And moving numbers around all day ain't free either, Right?

Kind of crazy.

Also, I read "tombstone" on the road of late stage capitalism in your title. Guess that's a bit of a tell, ain't it?

Thanks for sharing, man.

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

It almost séms like they are stalling

until a big change comes. They've consolidated all the resources. Now they just need to get rid of us.

The real question is who is buying this shit

I thought negative rates is you giving the bank money

to park your money?

These negative rates instruments are supposedly being

bought up by pension funds the world over most likely

w/ameriKans leading the way. This guarantees a blowup.

The next depression will likely be the last one and even

if it happens before the election I can picture tRumpolini

declaring martial law rather than him being tossed out.

Nothing in ameriKa is working, corruption everywhere, racism

everywhere, lawlessness everywhere, stolen elections everywhere.

Of, by, for the people is long gone, it's of,by, for the corp's.

End of rant

EDIT: added words here and there

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

@ggersh great rant

great rant

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

The social security Trust Fund!

And the CSRS and FERS trust funds, all the better to cut benefits because "the trust fund is depleted".

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The Non-Profitable Insurance Vehicles? Easily Spun Off and

wound down. They will probably even be able to be written off in taxes as a business expense.

I hope I got the terminology right. heh...

“Tactics without strategy is the noise before defeat.” ~ Sun Tzu

I've been watching a Spanish series on Netflix called,

Money Heist. Well, not really -- it's actually called, House of Paper (Casa de Papel) but in one of those really bizarre translation moments that I was ranting about not long ago, they've decided to completely change the title -- which is really a pity, because:

A. No native English speaker would ever produce the phrase "Money Heist" in any context whatsoever, period, do NOT argue with me about this.

B. The series has an overt political/economic viewpoint that is highlighted by the title House of Paper.

It's quite lefty. I can't imagine anything like it being produced in the US. The robbers are (mostly) the good guys. The cops, with all their SWAT gear and swagger and casual use of the word "terrorists", are conspicuously a bunch of obnoxious fascists, completely morally compromised by certain political realities, which the robbers exploit sans merci.

And the women have big noses, which I mention ironically, because there is also a lot of explicit gender politics involved, with irksomely paternalistic men repeatedly getting well-earned comeuppances that do not seem contrived or overdone, as they often do these days in US productions.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

LMAO

Somebody's Spanish-English dictionary was a bit

weak. Over and over throughout the series, the word "heist" appears -- including, for example, words overlaid on the screen, "12:15 Friday ... Hour 37 of the Heist". Whoever translated it completely failed to understand the subtle peculiarity of the word "heist", that it is used only in very occasional and/or formulaic contexts -- that, for example, it's a word that nobody would ever apply to an ongoing event, or at least, not more than once in the course of a conversation: "Didja hear there's some kinda heist goin' on down at the Mint?"; versus the comical idea, for example, that TV journalists would refer to an ongoing robbery as a heist.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Negative interest is a natural balance

...for parasitic interest-based banking, where the profits of economic expansion tend to flow to the hoarders of the greatest wealth. This top-heavy accumulation of idle wealth unfairly starves sectors of economic potential and distorts rational economic growth.

Negative interest sounds strange because we are simply unfamiliar with an economic rebalance achieved through the mathematical elegance of a "bail-in." The world seems far more familiar when economic imbalances are corrected by seizing the earnings-potential and unsustained-assets of the middle class — after they are thrown into soul-destroying economic depressions. This is all we have ever known.

Charging interest is the original sin. Look no further. Arabic mathematicians saw the evil of interest as a profit stream thousands of years ago and they placed an interest-prohibition at the root of all Abrahamic religions, including Christianity. The Islamicists are the only ones to keep the rule, which is how they developed the world's safest banking system.

If you haven’t already

Go get a copy of Debt: The First 5000 Years. It does the original sin bit in spades!

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Thanks for the book referral, Hawkfish

I dwell on those angles and connections a lot. Sounds like a book I would enjoy. There are so many eccentric correlations to explore. So many secret passages that lead to truth.

I do not understand how this works

How can banks stay in business if they are paying people to take out loans?

There is no reason why Wells Fargo shouldn't be shuttered and it's CEOs in prison. Except that Obama's protecting the banks and keeping the pitchforks at bay. 9 million people lost their homes during his presidency because that was why he was selected to be president. Think that Hillary or McCain would haven't gotten lots of shit for protecting them like Obama did? But the first black American president was charming and baffled people with his bullsh*t and to this day people say that they think he was the best president since FDR. I think he was as bad as Hoover and we can see all of the Obama-villes dotting American cities.

I posted this in another essay here, but if you missed it I hope you'll watch it.

Welcome to America's S***hole: Orange County California Edition Santa Ana River Trail

This is a really good article that even I can understand. America has been stripped of its factories and jobs and they are not coming back. The corporations are only concerned about making as much money as they can and to hell with us.

De-Dollarizing the American Financial Empire

Would like to hear what others think about this.

Edit to fix this word salad...

Man these drugs..lmao

The message echoes from Gaza back to the US. “Starving people is fine.”

They are being paid to BORROW money from the central bank.

They don't LEND it at that rate.

Example: Right now they borrow money at 2% from the Fed and lend it at 4% on mortgages and 30% on credit cards.

With negative Central Bank rates, they will be paid say 2% to lend the money in turn on 2% mortgages and 30% credit cards (credit card rates never change it seems, except upward).

This will fuel a second housing bubble by speculators that will, again, be blamed on the poor.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

This is an important essay

While I do not completely understand how money and the markets work, it is essays like this one and the great comments in it that help neophytes like me to better understand what is happening in the world as it pertains to money and finance. It is my personal belief that the ultimate demise of the United States will be financial and we may be closer than most of us think. I hope you will write more on this subject.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy