Would you like to get paid to buy your house?

There's a new career option in Denmark. It's one that sounds too good to be true: getting paid to borrow money to buy homes.

As mortgage-bond refinancing auctions came to a close in Denmark, it was clear that homeowners in the country were about to get negative interest rates on their loans for all maturities through to five years, representing multiple all-time lows for borrowing costs.

For one-year adjustable-rate mortgage bonds, Nykredit’s refinancing auctions resulted in a negative rate of 0.23%. The three-year rate was minus 0.28%, while the five-year rate was minus 0.04%.

...

In AAA-rated Denmark’s government bond market, yields are negative right through to the 10-year segment.

The negative rates have so far done little to revive inflation in Denmark, which has hovered around 1% for well over a year.

Until now negative yield bonds have been limited to the safest types of bonds, like governments and major corporations.

Denmark is hardly alone. They have just had NIRP the longest and deepest.

The German 10-year Bund yields touched a record low of -0.219%.

Imagine willingly loaning someone a lot of money, and after 10 years getting only 98% of it back (minus inflation).

Or how about this, investing in risky, nearly insolvent companies and getting practically no yield.

Japan’s negative interest rates have upended many conventions in the local credit market and another was broken on Friday when the nation’s first publicly offered junk bond priced -- at the super-low interest rate of 0.99%.

Aiful Corp., a consumer lender that teetered on the edge of bankruptcy a decade ago, sold 15 billion yen ($138 million) of speculative-grade notes due in 1.5 years.

How did this happen?

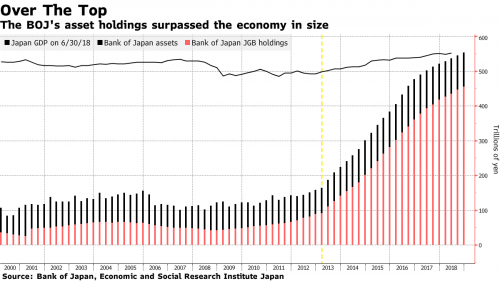

Look no further than the central banks.

The BOJ has likely also become the top shareholder in 23 companies, including Nidec, Fanuc and Omron, through its ETF holdings. It was among the top 10 for 49.7% of all Tokyo-listed enterprises at the end of March.

At this point you've probably figured out that this is insane, and you are wondering what they hope to accomplish. Bloomberg has mostly accurate explanation, even if it describes a batshit crazy solution in ho-hum terms.

Growth and inflation are weak. Devaluation is difficult if every nation tries to reduce the value of its currency at the same time. Debt defaults on the scale required would destroy a large portion of the world’s savings, not to mention affect the solvency of the financial system, triggering a collapse of economic activity. That’s why policymakers resist write-downs of trillions of dollars’ worth of debt that cannot be paid back.So, central banks must instead covertly use negative rates to reduce excessive debt levels by transferring wealth from savers to borrowers through the slow confiscation of capital.

What negative rates are telling us is that the global economic system cannot generate sufficient income to service, let alone repay, current debt levels. The latter are so high that even current, artificially depressed rates only allow them to be barely managed.

The fact remains that someone has to pay the price of the financial excesses of the last few decades. With low and negative rates, that “someone” will be savers.

It's as if this is the right thing to do and that there won't be serious consequences.

We'll just steal from savers. No biggie.

Comments

I can hear the pigs screaming now.

"That's communism!" "We can't afford it!" "It'll make you lazy!"

If they can't afford it, then we can't afford them.

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

OT interesting

seeking answers outside the bubble

Been stealing from savers for years haven't they?

they want investors, not savers.

The insanity of fiat currency based on nothing, corporations plowing their profit into their own stocks, and a US economy pegged to fossil fuels and warfare spells economic disaster ....the only question is when. Ponzi schemes eventually collapse.

I recommend planting a garden (and you might want to bury your treasure of gold). Aaaarrr...

“Until justice rolls down like water and righteousness like a mighty stream.”

Large hoard of Roman coins found in a French field last year

Sorry I don't have the link. One of the largest finds IIRC.

Tell me apocalypse is not coming.

Was at Wal-Mart and Kohl's today looking for socks today for my wife's brother. Couldn't find his size. Many brands, all Made in China. Looked at shirts out of curiosity. All Made in China. Not even Bangladesh anymore. China. Looked at the goods at Menard's last Saturday, particularly smoke detectors that I need. China. China. China.

If China withholds shipments in the Trade War - massive unemployment and businesses folding. Used to be able to buy socks at Sears, Carson's, KMart, Montgomery Ward's - all gone. Cotton socks used to be made in textile mills in the American South. No more.

Last month I bought two Western Digital hard drives - both made in Thailand. Yay! I think. Twenty years ago they were made in Seattle. Quality motherboards were made there too. CPU's made in Idaho and Washington. Now - Thailand (drives) China and China. Cheaper brand hard drives are made in China too. My damn Buick was made in China! Dealer lied and said it was one of the South Korean Envisions. Should have read the Monroney Sticker before buying. Should have bought a Honda made in Ohio. Buick's engine was made in Mexico, anyway. That's close. I'd say it saved some workers from running Trump's gauntlet, but I recall GM has a giant engine plant down there that has only 20 employees. Why relocate to save the wages on only 20 employees? It's not wages. It's that Mexico has very lax pollution standards. Cutting oils and other toxic waste goes straight out a pipe in the back.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

Fort Payne, AL

...where I spent most of my teaching career was the sock capital of the world. Almost every mill has now off shored, and abandoned mills and warehouse abound.

Seems all we make in the US these days are bombs, drones, and drilling rigs.

“Until justice rolls down like water and righteousness like a mighty stream.”

Found it on the map and wikipedia

From wikipedia:

Bill Clinton again. Millions of southerners voted for him because he was a Southerner, showing the hollowness of Idpol.

I remember my father warning me. "Never trust anyone just because they are Italian. No one will screw you worse than your fellow Dago." Note: Use of the D-word is like using the N-word. Don't do it unless you are a member of the group.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The banks are getting paid to lend, not home buyers to borrow

Negative real interest rates have been a recurrent feature of crisis capitalism since the early 1990s, when the Nikkei took a dive after the Japanese real estate bubble blew out. But, the title of the article is a bit misleading. Big banks use assets, such as mortgages, to borrow funds from central banks at obscenely low rates (negative real interest rates - many percent lower than the interest rates they charge to their customers, far less than the rate of inflation). That's how banks continue to pay pornographically huge bonuses and dividends every year to their executives and preferred stockholders, even when their accounts sheets show flat or declining net profits.

Who pays for this? Every few years, a speculative bubble bursts, and for every fictional dollar of asset value lost is a speculative dollar gained by financial institutions that own and underwrite hedges, called Credit Default Swaps (CDS). Even the Fed owns trillions in CDS to balance out the risks in its own enormous holdings of Mortgage-Backed Securities. But, sometimes, when the lenders panic and call in their markers, as in early 2008, the losses far exceed the ability of the underwriters to pay off hedges, and you get bankruptcies which result in cascading failures of overleveraged institutions that maintain cash reserves equal to only a tiny fraction of their commitments.

When that happens, as it did later in 2008, the entire banking system can become insolvent, the repo markets fail, and the lender of last resort -- the Federal Reserve and U.S. Treasury -- must borrow externally (as it did, borrowing more than a trillion dollars from China, and another Tril from Japan, to recapitalize the Fed's reserves). In the absence of an external lender, the markets freeze up solid, and the banking system collapses.

That raises the obvious question, what happens when the external lender with real hard cash reserves won't lend, again?

Not really, but

if you have any openings for a position where I get paid for screwing young women, drop me a line.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Albert Bartlett

"A species that is hurtling toward extinction has no business promoting slow incremental change." -- Caitlin Johnstone

You're particular.

I would settle for any woman that remembers how to. (yeah. Men are dogs.)

I've seen lots of changes. What doesn't change is people. Same old hairless apes.