Slowly spreading acceptance that U.S. dollar hegemony is ending

Just a decade the idea of an end of the global dollar standard was nothing more than a theoretical concept. Just two years ago it wasn't anything to worry about.

But today you see Bloomberg articles like this featured prominently.

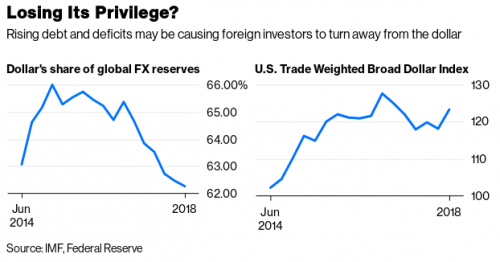

The International Monetary Fund released its quarterly report on global foreign-exchange reserves on Friday, and for dollar watchers, it sent some worrisome signals.The report revealed that the dollar's share of global reserves fell for the sixth straight quarter to the lowest since 2013, dropping to 62.3 percent in the three months ended June 30 from 62.5 percent in the prior period. It was 65.4 percent when President Donald Trump took office in January 2017.

The fact that the dollar's share of global reserves edged lower in the face of a big rally may be a clear sign that foreign central banks, sovereign wealth funds and institutional investors see increased risks from holding dollars as the U.S. government rams up its borrowing to unprecedented levels to pay for what is soon to be a $1 trillion budget deficit.

JPMorgan Chase & Co. strategist Marko Kolanovic raised the question in a report this week, arguing that Trump’s isolationist foreign policy is a “catalyst for long-term de-dollarization.”

Put another way, the dollar is in jeopardy of no longer being the world's primary reserve currency and enjoying the “exorbitant privilege” that goes along with that, such as interest rates that are lower than they might otherwise be and the government being able to fund budget deficits in perpetuity. “With the current U.S. administration policies of unilateralism, trade wars, and sanctions increasingly affecting both friends and foes, the question arises whether the rest of the world should diversify away from the risks of the U.S. dollar and dollar-centric finance,” Kolanovic and his team of quantitative and derivatives strategists wrote in a research note.

JPMorgan's Kolanovic isn't alone. Larry Fink, CEO of Blackrock, says the world could de-dollarize in less than a decade.

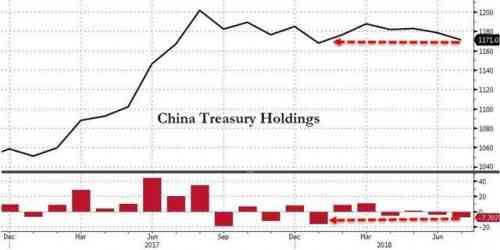

Countries like Russia have already sold virtually all of their dollar assets.

Until this past week only obscure writers on alternative blogs, like me, were sounding the alarm to this trend. But that has now changed.

We can assume that transactions done through this system will use the euro or pounds sterling in order to completely avoid the watchful eye of U.S. authorities. While the current intent of this new system is to allow trade with Iran in direct defiance of U.S. sanctions, there is no reason why it could not grow and allow greater amounts of international trade to be conducted without the use of U.S. dollars. This scenario would certainly reduce the dollar's dominance in international reserves.Thus far, most of the narrative about the weakening global dominance of the U.S. dollar has been confined to alternative financial blogs and hardcore gold bulls. However, some mainstream analysts on Wall Street have begun to take notice.

Meanwhile, the Trump Administration is pushing ahead with sanctions seemingly designed to make this a reality. Rumor is that Washington will sanction European companies for working on the Nord Stream 2 pipeline.

But that may be nothing compared to what Washington has planned.

Comments

Makes sense. We’ve been nobody’s ‘friend’

with our “my way or the highway” economic and foreign policy.

EDIT TO ADD: in many cases the “highway” would have been a blessing. Like for Iran and Iraq and Central America. We didn’t just diddle their economy when they decided to go against our dominance, we totally destroyed their countries.

Paybacks are rarely fun. Revenge always hurts. Bullies sometimes get both.

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

over and over again at dPOS, i found myself

in arguments with people who just couldn't believe that the rest of the world would ever stop buying our dollars, no matter how irresponsibly we wielded the financial and diplomatic power we derived from being the reserve currency.

it was weird American Exceptionalist magical thinking from people who ought to have known better.

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Seat belts:

Check.

Safety bar:

Check.

It's going to be a wild and dangerous ride. Hang on.

Regardless of the path in life I chose, I realize it's always forward, never straight.

I would rather the world dressed us down over dollars

than teach us the lesson of empire's end with bombs.

"We'll know our disinformation program is complete when everything the American public believes is false." ---- William Casey, CIA Director, 1981

I'm not seeing a problem. In

I'm not seeing a problem. In fact we could go to ZIRP and a lot of problems would be solved.

No problem for several years

but when dollar demand falls enough, you'll see the problem.

@gjohnsit Dollars are always in

Dollars are always in demand because they are needed to pay taxes.

Furthermore, as I understand it, there weren't enough t-bills offered for the excess cash people had [worldwide] that led to some of the conditions of the crash of 2008.

At any rate, the deficit is not a problem, the US always pays its interest and consequently demand is steady. But the US doesn't need to do this, as I indicated above, ZIRP would make more sense. it's only large cash holders that see any benefit. It's a self made problem, easily eliminated.