The Return of Trickle-Down

The CEO-elect Trump has released his tax reform plan that will “reduce taxes across-the-board, especially for working and middle-income Americans”.

There's just one little problem.

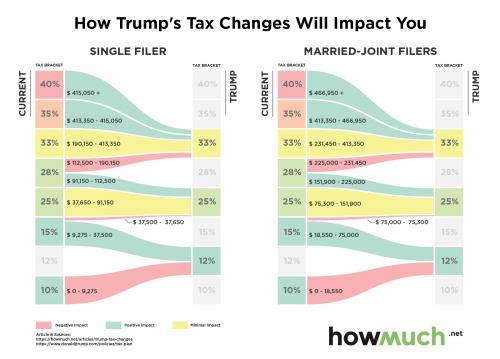

First and foremost, Trump’s income tax reform is a simplification: he wants to cut down the number of tax bands from seven to three. But simplifying is not necessarily the same as reducing taxes. As this graph demonstrates, some taxpayers would definitely benefit from Trump’s tax reform – especially those at the higher end of the income scale. There are others, however, who would see their tax rates go up. Especially those on lower incomes.

The current income tax bands range from 10% and 15% at the lower end of the scale over 25%, 28%, 33% and 35% in the middle to the top band of 40%. Under the Trump plan, only three tax bands would remain: 12%, 25% and 33%.

This would be good news for everyone currently in the top two brackets (35% and 40%). These taxpayers would see their effective rate drop down to 33%, by 2 and 7 percentage points respectively. Conversely, the simplification would bad news for the taxpayers in the lowest bracket (10%). These would see their effective tax rate go up by 2 percentage points, to 12%.

Comments

"Feeding the horses so that the sparrows may eat"

An old Chinese observation and we are the sparrows who have to probe the horse pucky to find edible morsels.

The tax code is very complex because it benefits the rich and the corporations to have it that way. There are lots of loopholes and plenty of ambiguity to make tax lawyers rich working for the Wealthers - working for us too because these costs are almost always tax deductible.

Reagan had to raise taxes several times because his Milton Friedman model didn't work out as advertised. Trump probably won't bother unless the bond underwriters see their businesses start to lose big time.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Reagan also raised fees--less noticeable than raising taxes.

When people talk about Clinton's having left office with a "modest budget surplus" they forget that he should have have left with a very large one, what with Reagan's many increases in taxes and fees, George H.W. Bush's infamous tax increase and ending "welfare as we know it."

Won't the change require...

60 votes in the senate? Or do they plan to do away with that? With 48 or 9 senate votes won't the dems block this? Or have they sold out to that degree?

“Until justice rolls down like water and righteousness like a mighty stream.”

I don't think so...

They can use budget reconciliation, just like the Bush tax cuts of 2001 and 2003

http://www.cbpp.org/research/federal-budget/introduction-to-budget-reconciliation

It's true right now like it was back then. The old devils are at it again. When I say devil you know who I mean these animals in the dark malicious politicians with nefarious schemes charlatans and crooked cops. - 'Old Devils' William Elliot Whitmore

Just as Obama could have used it for Obamacare had he done

things differently. https://www.washingtonpost.com/opinions/obamacare-was-not-passed-using-b...

According to the article linked above, Senate Rule 22 can be used to break a filibuster. I don't know much about Senate rules, but a description of Rule 22 are here, along with links to sources that explain it:

http://www.senate.gov/reference/reference_index_subjects/Cloture_vrd.htm

I'd like to see the real numbers

How many people will gain or lose how much. Percentages don't matter - people matter. In 1982 I was in the lowest income bracket and thanks to Reagan's "tax cut" my taxes (including FICA) doubled. If I gad been 1 of 10 oh well, but I was 1 of 10 million.

Back in the mid eighties (when the NYT was trustworthy, at least sort of) they ran a poll: "Are you better off than you were 4 years ago?" 2/3 of Americans said "yes", so they asked the IRS. 2/3were poorer, "but we got a tax cut and the stock market is booming!"

Damn lotus eaters, too lazy to count.

On to Biden since 1973

Short attention spans and pocketbooks...

They didn't realize how bad it had gotten, as wages went stagnate slowly. 30 yrs down the line we know we got the short end of the manure.

It's a club and we are not members of it.

DBA

Trickle-Down Economics: Where the idea came from

They've been laughing at our expense ever since

BTW Larry Summers is in that picture. Treasury Secretary under Bill Clinton, and President Obama appointed him to head the National Economic Council.

"We've done the impossible, and that makes us mighty."

Trumponomics: Neoliberalism on steroids

link