Now the financial markets are voting

Submitted by gjohnsit on Mon, 11/14/2016 - 11:33pm

The stock market absolutely loves the idea of a Trump presidency.

The Dow jumped nearly 600 points -- a 3.2% gain -- in the three days after Trump's victory. It was up again Monday and hit a new all-time high in the process. The S&P 500 and Nasdaq also moved a bit higher after Trump's win.

A Republican in the White House and Republicans keeping control of Congress increases the chances of a bill being passed that would lead to more infrastructure spending. There may also be less regulations on health care stocks and financials.

Nothing like huge tax cuts for big corporation, plus slashing regulations, to drive up stock prices.

The equity bull is roaring.

However, there is another side to this expectation of a Trump presidency.

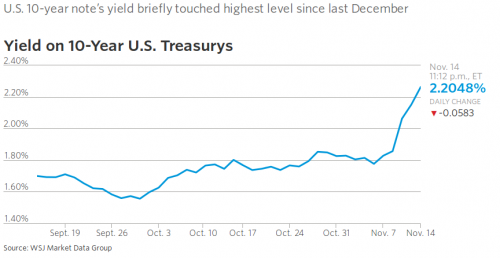

President-elect Donald Trump's White House victory was a surprise, and so is the ripping sell-off in global bond markets, which has quickly driven U.S. interest rates to the highest levels in a year. The rout has wiped out an estimated $1 trillion from global bond markets and has Wall Street scrambling to retool its forecasts.

The sell-off comes on the expectation that Trump's promised infrastructure spending and tax cuts will result in higher growth — but also higher inflation and higher amounts of U.S. government debt.

So far the rise in interest rates is not cause for alarm, but that could change soon.

Average rates on 30-year fixed conforming mortgages on Monday hit 4%, also the highest since January, according to MortgageNewsDaily.com, and up nearly 0.4 percentage point since the election. While still only roughly half the average over the past 45 years, according to Freddie Mac, the quick rise has lenders worried that home loans could become more expensive far sooner than anticipated.

Debt issued by U.S. companies has been hit as well. While the S&P 500 is up 1.2% since last Tuesday, the iShares iBoxx $ Investment Grade Corporate Bond ETF has fallen 2.5%. The iShares iBoxx $ High Yield Corporate Bond ETF, which tracks bonds issued by junk-rated companies, fell 2.2%.

The 41 basis point jump in 10-year Treasuries over the last three trading sessions marked the steepest climb in more than seven years.

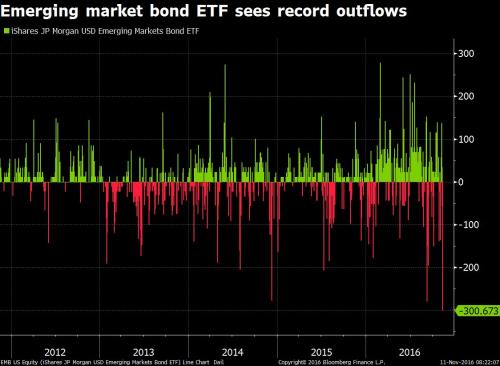

Probably the biggest impact is in the export-dependent emerging market, scared of Trump raising tariffs.

U.S. President-elect Donald Trump appears to have burst the bond bubble, putting emerging markets (EM) from Mexico to Indonesia at the sharp end of a sell-off.

Also the gains in the stock market have been uneven, to put it mildly.

Over the past month, the telecommunications sector is off 7.5%, real estate is down 4.2% and utilities have lost about 4%, the top three worst performers among the S&P 500’s 11 sectors, according to FactSet data.

However, the really big losers are the high-tech sector.

Tech stocks in the benchmark equity gauge have slumped 3.1 percent over four days, trailing the S&P 500 Index by 4.2 percentage points, the most since May 2009.

Comments

Tech sector's heavily invested in Obama and the Democratic Party

I've been writing about how the Democrats (particularly Obama) have been bought and paid for by the tech sector since Obama took office. They were the ONLY major business sector that contributed more to the Democrats than the Republicans in 2012. Here's more on this from Yves over at Naked Capitalism.

UMass Amherst political science professor Thomas Ferguson has been all over this story since day one. (See links above for more on that.)

"Freedom is something that dies unless it's used." --Hunter S. Thompson

Also, Hillary supported green cards for foreign STEM graduates.

Basically, Hillary was promising high tech an endless supply of cheap high tech labor without going through H1B visas by giving a green card to any foreign student who graduated with a STEM degree. This will flood the job market with low cost engineers. Right now, something like half of American STEM graduates cannot find a job in their area as it is. Most foreign STEM graduates actually attend 2nd level colleges and are not the cream of the crop as they are portrayed by high tech companies and the mass media. But mediocre cheap beats technically good.

Also, two large Indian outsourcing firms gave serious money to the Clinton Foundation, so of course there was to be your typical buying off of Clinton's policies to increase the number of H1B visas. They like high tech must be shitting bricks also not knowing exactly which way Trump may go.

Some Verification

My employer went on a hiring spree for engineers, as it's their theory that engineers should be doing work that I -a non-degreed unionized tech worker- have done for decades now. Few are Americans, with the majority being young SE or South Asian. I don't know how many are immigrants, so I can't attest to the Green Card allegation.

Vowing To Oppose Everything Trump Attempts.

Probably an H1B visa holder

Legally, companies who use H1B workers can legally pay them below market rates. Also, H!B visa holders are being used not only to replace software engineers (probably the biggest category), but also other types of engineers or categories of workers. Catepillar laid off a bunch of American mechanical engineers and imported a bunch of H1Bs to replace them.

The whole idea of H1B visas is that they are to be used when no Americans can be found. Through various loopholes they are being used to REPLACE current workers. I have seen videos of a seminar held by an lawyers from an immigration law firm teaching HR types how to circumvent the laws to prove the company can't find American candidates. One buddy was ready to file an ethics complaint when HR started changing his job requisition to make so it would eliminate any American candidate and fit what he suspected were H1B's in line for the job.

Also, as an aside, there are studies that show how H1Bs benefit the local economy, create jobs, etc. They are all bullshit. Nearly ever one has high tech companies sponsoring the study in various ways. Like directly or by contributing huge amounts of money to engineering departments of universities. We complain rightly that industry sponsored studies showing no human causes of global warming, but many accept without question high tech sponsored studies what show we need huge increases in H1B visas. By the way, one way to disprove the lack of qualified Americans is that a shortage should have resulted in higher and growing salaries--you know, low supply and high demand. No such increases have ever been shown. Guess the Law and Supply and Demand is just a business school fiction.

So now, H1Bs are being used to replace union jobs.

Deliberately weakening other countries by promoting brain drain?

STEM talent stays in the U.S. instead of returning home to build up the countries of their birth.

Lowers the pay for STEM jobs in the U.S. tech sector too, so for the billionaire globalizers it’s a twofer.

Interesting and thanks

This credit bubble is sort of amazing. A couple years ago it looked like Southern Europe was going to spiral into bankruptcy. Then after the " when it gets serious you have to lie" and the "what ever it takes" momentsit all calmed down and Greece, Italy , Spain and Portugal all had these stable low bond yields. But nothing was fixed. I convinced myself that central banks were just going to buy up everything, and disappear it. Vaporized... And then they would announce hey all fixed. We wrote it down. No worries. Nothing to see here. The dislocation is immense.

I am about to receive a large $$ sum on the sale of a second

home. It will first require transfer and exchange into $US from $CAD. I do not expect to pay capital gains, it's a loss. And I do not imagine moving into mutual funds, hoping that some can be parked in CDs at my credit union for later use. Does that sound reasonable? I will be going to Medicare, if it exists, in under 2 years.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

If interest rates are going up, yes that sounds reasonable.

The stock market will come back to reality soon. A Trump Presidency can't change fundamentals. We're already over due for correction. This has a markings of a short squeeze all over it. There were bets made on Hillary and now they are unwinding. Don't expect this to last forever. Now that I said that , expect the DOW to hit 30,000 by Christmas.

"Politics is the art of looking for trouble, finding it everywhere, diagnosing it incorrectly and applying the wrong remedies." - Groucho

Really? As a result of massive inflation?

Borrow and spend - It'll be a rerun of Reagan.

Obama and Yellen kept telling themselves 4.9% unemployment was full employment. They believed their own cooked numbers.

Trump would not have been elected if the USA was at full employment.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Tweeterites are already calling him Saint Donnie

I'm just amazed at how gullible the Merican working class is. Thinking a billionaire real estate tycoon has the slightest interest in improving their situation. He paid his workers 59 cents an hour to build his Dubia golf course -- workers sizzling in the 120 degree desert sun. Sounds like a real populist. Hahahaha.

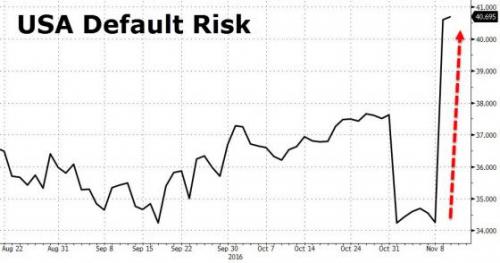

So he bankrupted his own businesses a few times. I'm sure he can quickly bankrupt a country. I have faith in him.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

You can't forget,

all entities are now hedge funds.

The only people that are worried about the stock markit

are the top 10%, no one else owns stocks.

Imagine now if America had to pay credit card vig on it's debt?

3% on $20 tril still adds up to a lot of dosh.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

How much longer can this go on

The facts from the article below (Oct 2015) can only have gotten worse. US Govt policies just keep generating more and more poor people.

I also read somewhere that US home prices are back to 2008 levels. Yay, bubble territory again.

Not to worry, when recession hits now the Fed can just lower interest rates to stimulate... Oh wait.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Your figures document the decimation of the middle class

and are a warning to those who want middle class wages: Don't even think about it.

It's not white supremacy that elected Trump: It's average people realizing that their lives are being ruined by those who control the political economy and Obama, who promised a better life for all, is the biggest reason for the continued slide of the population into poverty and despair.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Those of us with 401Ks and 403Bs are going to need it.

By the time Trump and his crazy cabinet, with the help of the same corrupt Dems that lost this election, destroy schools, SS, Medicare, and the safety net - we are all going to need every dime we can get.

"Religion is what keeps the poor from murdering the rich."--Napoleon

More than 50% of families have zero retirement savings. They

are counting on Social Security but the capitalists are counting on SS money to further fatten themselves.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

I bailed out of stocks in my IRA when I saw Trump might win

Very nail biting, because if you're in mutual funds you can't exit at the drop of a hat. You have to wait for end-of-day prices, so if you sell in the morning on the wrong day, you could be poor by 4:30.

Now I really don't know where things are headed.

On the one hand, the Republicans will reliably turn Keynesian once they are in power.

On the other hand, the banking system is in a shambles, held up only by central banks. And Italexit is on the horizon.

WTF.

You did the right thing

market is way overpriced because of what the Central Banks have done. It's a bubble waiting to burst. This irrational enthusiasm in the markets right now is temporary. At some point the bubble will burst, just as it did in 2008. Probably within the next two years is my guess. These prices are simply unsustainable.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Maybe, maybe not

If QE ends it will, but if they keep QE and add a big infrastructure bill for roads, bridges & tunnels and it may not. The structural problems have been there for over two years and maybe time has just run out looking at the auto sales and international shipping volumes.

In an infrastructure bill the corruption will be rife and omnipresent, so let's plan on catching them red handed!

Just don't sell!

Put your money into low-volatilty ETF's and/or solid consumer staple/utility stocks and keep reinvesting the dividends if you have a job. Spend only the dividends (If you can) if you are retired. Eight years from now, it will look better. Panic selling is for margin traders and speculators. Don't own anything that doesn't pay a dividend.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

ETF's are better.

Roll your 401K if you can.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

The thing to remember is that the stock market belongs to them.

They'll crash it, but theyll never destroy it. It is how they make their money.

"Religion is what keeps the poor from murdering the rich."--Napoleon

Deficits Don't Matter

Since the GOP now owns all three branches, suddenly deficits don't matter. That's why bond yields are up and bond prices are down. They are going to run up huge deficits as they usually do -- tax cuts for the wealthy and war spending. Maybe they will even fix the roads and bridges. Maybe.

deficits don't matter AGAIN

They didn't matter under Reagan or Bush, only under Clinton and Obama