An echo of 2007

Many people seem unaware that the 2008 crash didn't start in 2008 with Lehman Brothers. Lehman Brothers was just the last straw for a financial system that had been under increasing stress for over a year.

It all started in the summer of 2007 with Bear Stearns..

On June 22, 2007, Bear Stearns pledged a collateralized loan of up to $3.2 billion to "bail out" one of its funds, the Bear Stearns High-Grade Structured Credit Fund, while negotiating with other banks to loan money against collateral to another fund, the Bear Stearns High-Grade Structured Credit Enhanced Leveraged Fund. Bear Stearns had originally put up just $25 million, so they were hesitant about the bailout; nonetheless, CEO James Cayne and other senior executives worried about the damage to the company's reputation.[9][10] The funds were invested in thinly traded collateralized debt obligations (CDOs). Merrill Lynch seized $850 million worth of the underlying collateral but only was able to auction $100 million of them.

The Bear Stearns crisis was different for a very basic reason - the assets of the funds would have to be liquidated because of the bankruptcy filing.

A sale would give banks, brokerages and investors the one thing they want to avoid: a real price on the bonds in the fund that could serve as a benchmark. The securities are known as collateralized debt obligations, which exceed $1 trillion and comprise the fastest-growing part of the bond market.

Because there is little trading in the securities, prices may not reflect the highest rate of mortgage delinquencies in 13 years. An auction that confirms concerns that CDOs are overvalued may spark a chain reaction of writedowns that causes billions of dollars in losses for everyone from hedge funds to pension funds to foreign banks....

"Nobody wants to look at the truth right now because the truth is pretty ugly," Castillo said. "Where people are willing to bid and where people have them marked are two different places."

The credit markets almost immediately froze up.

The market for mortgage bonds has become "very panicked and illiquid," CEO Michael Perry wrote in e-mail to employees yesterday..."Unlike past private secondary mortgage market disruptions, which have lasted a few weeks or so, our industry and IndyMac have to be prudent and assume that this present disruption, which appears broader and more serious, might take longer to correct itself," Perry wrote.

And that, in a nutshell, was the reason for the worldwide financial crisis - the mispricing of assets, mostly mortgage-backed securities, based on fictional financial models. Or to put it another way, much of the world's wealth was fictional.

Fortunately, that was 2007. This is today. We are all older and wiser. Washington passed Dodd-Frank and that fixed Wall Street.

We no longer have to worry about these Wall Street gambling junkies creating financial houses of cards based on fictional wealth, right? Right?

Yesterday Stone Lion Capital suspended redemptions and basically closed up shop.

Stone Lion Capital Partners L.P. said it suspended redemptions in its credit hedge funds after many investors asked for their money back.

The move, nearly unprecedented in the hedge-fund industry since the financial crisis, is the latest example of the sudden crunch facing traders across Wall Street looking to sell beaten-down positions. On Thursday, Third Avenue Management LLC stunned investors with the announcement it was barring withdrawals while it liquidates a high-yield bond mutual fund, a move that intensified a selloff sweeping the junk-bond world.

Stone Lion, founded in 2008 by Bear Stearns & Co. Inc. veterans Gregory Hanley and Alan Mintz, is in a similar malaise, facing heavy losses on so-called distressed investments including junk bonds, post reorganization equities and other special situations, people familiar with the matter said.

Say what!?! Bear Stearns again?

Now here's the real kicker:

Alan Jay Mintz, CPA, a co-founder of Stone Lion Capital was Co-Head of the Distressed Debt and High Yield trading group at Bear Stearns

Gregory Augustine Hanley, a co-founder of Stone Lion Capital was Co-Head of the Distressed Debt and High Yield trading group at Bear Stearns

These guys that just blew up a junk bond hedge fund weren't just Bear Stearns veterans, they were the architects of the Bear Stearns junk bond hedge funds that started the entire 2007-2008 financial meltdown.

You can't make this sh*t up!

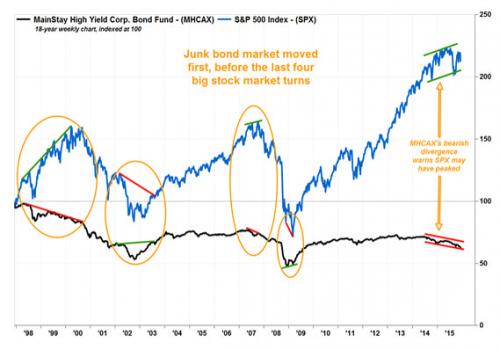

In the summer of 2007 the stock market was still going up, the economy was declared by everyone to be strong, and almost no one was predicting a recession. The only indications of trouble was in the credit market, specifically the somewhat illiquid and lightly-traded high-yield bond market.

It's nothing like what is happening today, right? Right?

With investors withdrawing from the riskier pockets of the bond market, the lockout by Third Avenue ignites fears that mutual funds that have loaded up on hard-to-sell securities like junk bonds, leveraged loans and emerging market debt may face a similar predicament...

The fund’s value had shrunk to about $790 million from about $2.5 billion, but other high-yield bond funds had lost more assets. Behind the scenes, though, the Focused Credit Fund’s large position in so-called Level 3 assets — securities that trade so infrequently that prices for them can only be estimated — was causing serious problems.

Hmmm. Infrequently traded? Can only be estimated? Where have I heard those terms before? I'm sure I'll remember one day.

As an indicator of how bad things have become in the high-yield market, Mr. Gundlach noted that the $10 billion high-yield exchange-traded fund managed by State Street, largely seen as a barometer for the junk bond market, was trading lower today than it did right after the Lehman Brothers crisis in 2008.

“When the market is pricing assets that low, you should worry,” he said.

That's crazy talk. Even suggesting something like that will get you labeled a "doom-and-gloomer" who are "always wrong".

This is probably only the start of trouble for Stone Lion Capital.

The firm continues to operate several other funds, including one that bets on Puerto Rico’s economic recovery.

Comments

2007 again

link

It's never going to stop, is it?

What does it take to stop these wackos from tanking the economy again?

dfarrah

It's going to stop. It really is.

And probably fairly soon. Most folks alive right now will probably see the transformation. At least the early years.

When historians look back at 2015, they will say:

I really like and learn a lot from your posts, Pluto,

but I never can figure out, if the quoted paragraph are your own words or that of someone else. That's the only thing I don't like. If those are your own words, they are pretty phenomenal...gimme some peace and tell me who formulated those words, is it you or someone else?

https://www.euronews.com/live

They are my words, mimi.

I have stepped just a few years into the future, and I am looking back on the current year, 2015 and how it might be described by an historian. That is the quoted part.

That scenario, however, is more illustrative than accurate.

I am not predicting the future in the quote. I am merely getting "distance" on the current reality and describing it with a more universal perspective, based on the repeating patterns of human history and social behavior. My quote is objectifying the current year that we have lived through, as if describing one bead on a string of beads that represents the stages of events that occur in a nation that attempts to establish a global empire through war and wealth.

All empires follow pretty much the same pattern: They economically gut their own core homeland to feed their far-flung armies attempting a conquest of rule in foreign lands. They establish self-serving trade along the way as the means for control over their conquests, with most profits going to Empire. Those profits never seem to benefit their now-crumbling homeland. This continues until, Empire's influence abruptly ends as a result of over-reach and abuse. The world no longer "believes" in the Empire's monetary worth, because the people in Empires own homeland are suffering. The world no longer wants Empire's "vision" and promised benefits. And Empire folds like a house of cards.

From that pattern, it's not hard to figure out what stage of Empire's countdown we are at in 2015.

aahhh, great, your illustrative word powers are

something to admire ! Thanks for your answer ! Very believable and convincing. I can follow you very well with your "paintings with words".

https://www.euronews.com/live

The environment will tank the economy

storms, droughts, rising cost of food, flooding, power outages, nobody can get to the mall and when they do, it's closed for lack of electricity.

To thine own self be true.

Excellent post, gj....

BTW, I've noticed a new meme over at DK that Glass-Steagall had little or nothing to do with the financial crisis. (It seems to be coming from supporters of HRC, naturally.) I'm wondering if you have done or can do a diary on said subject, as we could all use a touch of enlightenment on this.

"Our society is run by insane people for insane objectives. I think we're being run by maniacs for maniacal ends and I think I'm liable to be put away as insane for expressing that. That's what's insane about it."

-- John Lennon

I couldn't help but notice

how the HRC fans are touting Krugman's backing of her economic proposals. No one actually looks at the details of the proposals, as if "Krugman" is a magic word.

I started reading his article and noticed this:

I don’t think people realize that he’s just substituting “shadow” for “investment”, and that destroys his point that Glass-Steagall isn't the solution.

I’m suspicious why they have substituted “shadow” for “investment”.

Is it because the word is more scary? Or implies it is more difficult to understand?

The problem is that just questioning Krugman will get the response of "Who are you to question Krugman?"

it wasn't the repeal of glass-steagall alone...

that caused the crash, it was the whole deregulatory climate created by the faithful of the "market religion," whose basic tenet is that "markets are self-regulating" which brought down our economy. there were a whole series of deregulatory actions that started in the carter administration and arguably climaxed in the clinton administration, which were then exacerbated by dubya's defenestration of the regulatory agencies. alan greenspan (a reagan appointee) was perhaps the most glaring example of a person whose ideology made him incapable of performing the regulatory function that he was responsible to perform - with disastrous consequences.

Financial deregulation went on for 20 years

and started under Carter. Gutting Glass-Steagall was just the last step, and its most negative effect was in shifting risk from private to public.

My problem with Dodd-Frank was that it wasn't actually reform, it was just regulation. It didn't change financial practices, it just brought them under the eye of regulators.

The obvious problem with that is that the regulators were still captured by the industry.

That meme goes

hand in hand with the many revised history memes that say the Clinton's policy's and agenda were good and better then what the worst evil ever would was trying to do. This two legs better nonsense is used from everything from Glass-Steagall and NAFTA to HRC's nasty defense of marriage act and the three strikes your out if your black/ welfare queens are gonna kill yer family. My favorite twisty meme is that the only reason the Clinton's implemented all these mendacious policy's was because the Republicans were going to be worse and the DLC /Third Way mitigated the damage that the great RW conspiracy that was out to get the Clinton's. This convoluted thinking applies to the Obomber administration. The Democrat's had to as Obama is not a white dude or Ostruction! Never mind that the Dems. in congress abdicated their majority and declared 60% and rising made up a majority. It belies any reality when you look at the economic appointees of the WH . Daley, Summers, Rahm, Goosbee, and assorted banksters and Clintonites. 'Savvy businessmen' who were and are doing god's work and are inevitable.

Just to dispel destructive new narratives

…here's a picture of banking regulation and deregulation across 100 years of US history.

The black line represents the concentration of wealth in the hands of the banking class and the .01 percent. (Look how "poor" they were from the '40s through the '80s when income equality was balanced across all quintiles. That's when the greatest middle class in the world was able to grow, and when the nation's infrastructure was a model for the entire world.)

Denial is flying fast and furious these days. Blatantly false narratives are thrown into the face of actual data. This signals an historic level of desperation in the lives and minds of Americans — and the desperation of their greedy leaders, who exploit them.

I'm putting together a critique of Hillary's plan

right now.

I'm thinking that it falls under the category of "baffle them with bullshit".

that is one awfully eye-opening chart ! /nt

https://www.euronews.com/live

Great chart! thanks Pluto

To thine own self be true.

thank you gjohnsit, another very interesting post

What initiated the fall in my mind is this vision of the new high-rises along Miami Beach (which is only a coral reef after all) toppling like dominoes.

Meetings were held for condo investors and they were refusing to show up forfeiting their investments of thousands of dollars because they knew the

market was going to collapse. I don't remember if that was in 2007 but I think I got the image from one of the documentaries on the subject.

"much of the world's wealth was fictional" - yes, among other things they used bad debts, toxic mortgages for collateral, how can you use a nothing to back up a something?

To thine own self be true.

Interesting coincidence