Central banking have the money taps wide open and why this is more important than any election

Chairman Lord Jacob Rothschild of Rothschild Investment Trust recently made an interesting announcement.

The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30% of global government debt at negative yields, combined with quantitative easing on a massive scale

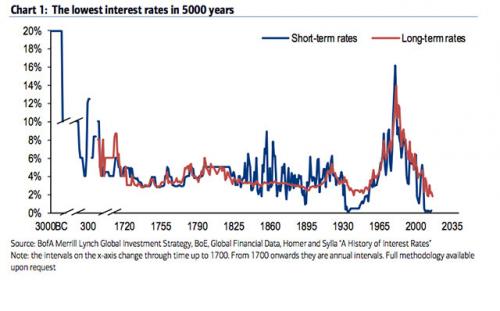

Bonds are trading at record highs. Meaning yields are at historic lows. Long-term interest rates are at the lowest levels in the 227-year history of rates in the United States.

That would normally signal an economy on the brink of ruin and investors panicking into government bonds.

But that isn't what is happening.

How big of a monetary policy experiment is this?

One so big that it is a challenge to even describe in a way that a non-econogeek can understand.

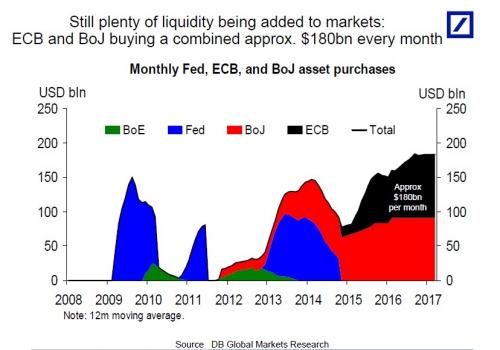

For instance when I say that global quantitative easing is running at a record $180 Billion every month, what does that mean to you?

It's like saying the Andromeda Galaxy is approximately 2.5 million light-years from Earth.

You know it's a lot, but without a point of reference $180 Billion a month is just a meaningless big number.

That is my challenge in this essay.

First of all, let's make a short-term comparison.

The current pace of purchases is higher than ever before, even during the depths of the financial crisis in 2009....

What was supposed to bolster economies temporarily during times of crisis has become a routine tool for policymakers, who long ago cut interest rates to zero

Actually, below zero. In some cases, well below zero.

“They won’t ever say they’re out of ammunition, but central bankers are starting to look like naked emperors,” Gallo wrote in an article for the World Economic Forum.

With rates at zero, QE became the central bank's main interest rate enforcement tool. With it they have managed to push a mind-boggling amount of bonds into negative yield.

The value of negative-yielding bonds swelled to $13.4tn this week, as negative interest rates and central bank bond buying ripple through the debt market.

The universe of sub-zero yielding debt — primarily government bonds in Europe and Japan but also a mounting number of highly-rated corporate bonds — has grown from $13.1tn last week, according to figures compiled by Tradeweb for the Financial Times.

“It’s surreal,” said Gregory Peters, senior investment officer at Prudential Fixed Income. “It’s clear that central banks are dominating markets. There’s a race to the bottom. Central banks are the main drivers of this, it’s not fundamental.”

The lack of fundamentals is the most alarming point, that I will circle back to later, but let's consider for a moment the $13.4 Trillion number.

Once again we have Just Another Big Number (JABN). Meaningless unless put into context.

Already a third of all sovereign debt yields a negative interest rate. That means that investors are effectively paying borrowers to lend to them. The Bank of Ireland and Royal Bank of Scotland already charge depositors interest, as opposed to paying depositors interest.

That's bizarre. Not to mention unsustainable.

How unsustainable? Short-term unsustainable.

At the current rate of decline, the entire global market will be in subzero land by the end of the year.

Why is this happening? Because this.

Bank of America's Barnaby Martin calculates, following the BOE relaunch of QE, "around 45% of the global fixed income market is now “compromised” by central bank buying."

Consider that nearly half of the bond buyers in the world don't care about price, because they print money out of nothing.

So what does that look like? Take Japan, for example.

Japan’s biggest banks are running out of room to sell their government bond holdings, pushing the central bank closer to the limits of its record monetary easing.

Finding willing sellers is a headache for Governor Haruhiko Kuroda as the central bank prepares to review policy at next month’s board meeting, amid growing concern among economists that he has few tools left to revive the economy. Record bond buying has already saddled the BOJ with more than a third of outstanding sovereign notes, draining liquidity from the market and making it more volatile.

Put simply, the Bank of Japan has bought up nearly every sovereign bond for sale.

Don't underestimate what is happening here, the BoJ is buying a lot more than just sovereign bonds.

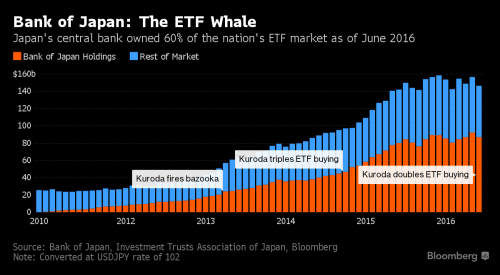

The Bank of Japan’s controversial march to the top of shareholder rankings in the world’s third-largest equity market is picking up pace.

Already a top-five owner of 81 companies in Japan’s Nikkei 225 Stock Average, the BOJ is on course to become the No. 1 shareholder in 55 of those firms by the end of next year, according to estimates compiled by Bloomberg from the central bank’s exchange-traded fund holdings.

Forget the economic questions of this move. Has anyone considered the moral and political consequences of having a central bank control basically all the financial assets of a major nation?

How can this situation NOT lead to a government-corporate partnership in both the economy and the political system? How can so-called capitalists refrain from denouncing this obviously non-capitalist situation to the economy, that they just happen to be profiting from?

Let's circle back to those questions later and remember how globalized the world is, and how all of this eventually washes up on our shores.

Last month, yields on U.S. 10-year notes turned negative for Japanese buyers who pay to eliminate currency fluctuations from their returns, something that hasn’t happened since the financial crisis. It’s even worse for euro-based investors, who are locking in sub-zero returns on Treasuries for the first time in history.

Japan may be the extreme example, but they are hardly alone.

The Swiss National Bank has gone and directly purchased American stocks to the tune of $61.8 billion.

Central banks have been at DefCon1 for eight years now.

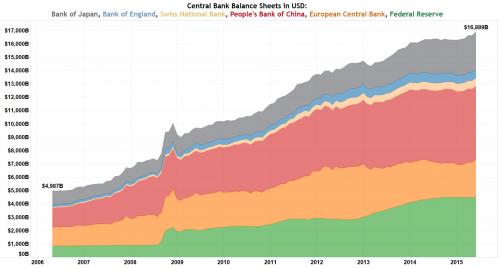

The balance sheet assets of the world's six major central banks hit a new all-time record, increasing to $16.9 trillion from $4.9 trillion 10 years ago, a 239 percent increase.

The balance sheet asset of the Fed, which has been leading the monetary policies of America, the world's largest economy, reached $4.495 trillion, equal to 25.41 percent of the country's combined GDP. This proportion was 6.17 percent in 2006.

All the major global central banks are buying up financial assets to the point that global liquidity is drying up. In other words, the central banks are becoming the markets.

Which means that it is unlikely that the central banks will ever be able to sell those assets.

Meanwhile, the Fed is preparing for negative rates to come to America.

It also means, that the markets lack economic fundamentals by definition. It's a condition that prompted the WSJ to say, "One answer to these disparities is that the markets have become so distorted by central bank activity that they are no longer transmitting very useful information about the economy at all."

Say goodbye to "market efficiency".

As I mentioned above, central bankers are starting to look like naked emperors. All this money printing has failed to stimulate growth or inflation.

Which is why, belatedly, they are finally starting to question their own monetary policies. Central bankers appear to be caught in a trap of their own making.

The global economy may now be trapped in a QE-forever cycle. A weak economy forces policymakers to implement expansionary fiscal measures and QE.

If the economy responds, then increased economic activity and the side-effects of QE encourage a withdrawal of the stimulus. Higher interest rates slow the economy and trigger financial crises, setting off a new round of the cycle.

If the economy does not respond or external shocks occur, then there is pressure for additional stimuli, as policymakers seek to maintain control. All the while, debt levels continue to increase, making the position ever more intractable as the Japanese experience illustrates.

However, this can't go on forever. Eventually the QE system will end in tears. The elements of it's demise are already being created.

“The combination of near-record credit flows and significant spread compression means that this year is unlike anything ever seen in the history of finance.”

- Brian Reynolds, chief market strategist at New Albion Partners

The epic bubble in sovereign bonds is doing what all bubbles do - make other normally risky investments look cheap in comparison.

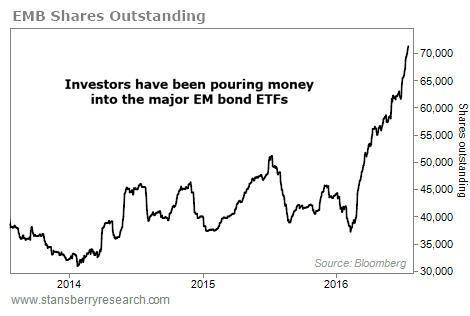

Investors are piling into emerging market bond funds at the fastest pace on record as pension funds, sovereign wealth funds, and other big institutions follow more seasoned specialists into riskier asset classes in search of yield....

“An individual investor might not realize it – but by buying these funds, he’s risking his life’s earnings on the governments of Brazil and Russia, among others,” wrote Steve Sjuggerud, at Daily Wealth:

The benefit is dubious. The largest emerging market bond ETF pays less than 5% interest. Five percent! Meanwhile, the price of this ETF could easily fall 5% in less than a week – wiping out a whole year’s worth of interest.

Well, it's not like Brazil or Russia have ever defaulted before.

And 5% seems like a "totally reasonable" compensation for that sort of risk, amirite? ROTFL

Emerging markets are just one example.

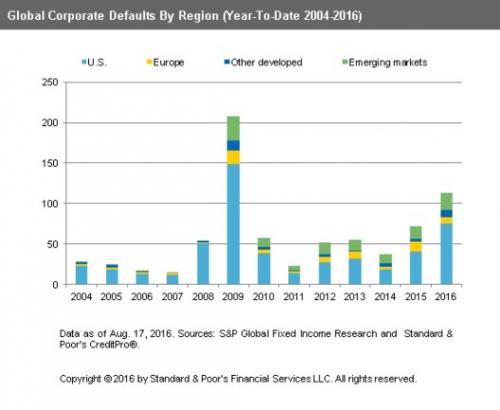

The search for yield has predictably led to junk bonds, which have rallied 48% this year, even while junk bond defaults have hit five year highs.

Corporations are issuing record amounts of debt, and investors are gobbling it up.

Companies worldwide are poised to raise more than $100 billion so far this month, the most for the period in Bloomberg data going back to 1999....

The average yield on sterling-denominated corporate bonds has fallen to a record-low 2.19 percent, according to Bank of America Merrill Lynch index data. Globally, the average is near the lowest ever at 2.3 percent, the data show.

More than $2.3tn of dollar-denominated debt has already been issued by companies and banks since the year began, including three of the ten largest corporate bond sales on record, Dealogic data show.

Which makes perfect sense...until you factor in that corporations are defaulting on debts at a near crisis level.

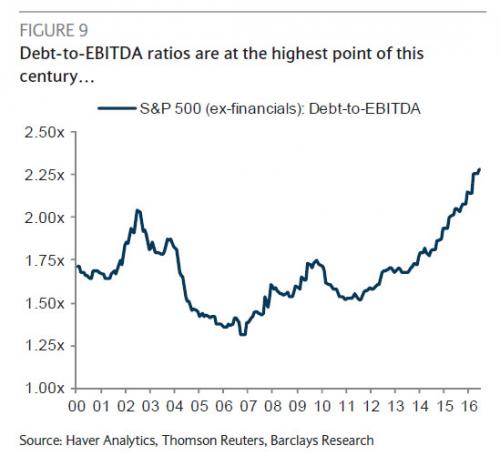

And that corporations are already saturated with too much debt.

According to a new report from Standard & Poor's Global Ratings, corporate debt around the world is massively on the rise and could skyrocket to $75 trillion from the $51 trillion it's at now....

What's more – S&P estimates that two out of five corporations are highly leveraged (meaning they've taken on too much debt). About 43% to 47% of corporations globally are at a financial risk level.

Here's the kicker: why are companies borrowing so much?

Because operating cash flow doesn’t cover it. In Q2, companies generated $425 billion in operating cash flows. Only $151 billion was invested in fixed assets. The lack of investment is the bane of the US economy. And:$110 billion went into dividend payments.

$61 billion was used for takeovers (OK, that’s down from last year)

$137 billion was blown on financially engineering their earnings via share buybacks.So operating cash flows were $35 billion short. That happened quarter after quarter. Hence debt ballooned to 32% of total assets at non-financial firms, the highest since 2008, another propitious year.

Kind of makes you want to go out and buy some heavily-indebted, probably-about-to-default, corporate stocks, right? No.

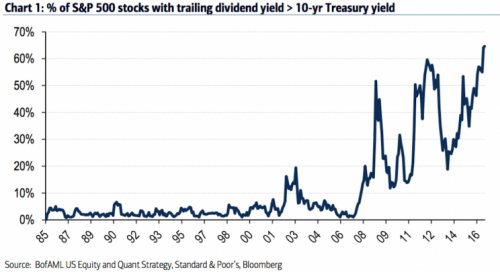

Well, it doesn't seem to bother investors, because stock markets all over are at all-time highs.

And why not, once you compare corporate dividends to bond yields.

You see, stock prices make sense if only you compare them to an historic bond bubble.

It doesn't take a genius to see that some market, somewhere, whether it be junk bonds, emerging market bonds, corporate bonds, equities, or subprime car loan bonds, is eventually going to blow up.

Especially when prices no longer account for risk anywhere in the world. The scale of this future crisis is difficult to imagine.

The World Bank estimates the ratio of non-performing loans to total gross loans in 2015 reached 4.3 percent. Before the 2009 global financial crisis, they stood at 4.2 percent.

If anything, the problem is starker now than then: There are more than $3 trillion in stressed loan assets worldwide, compared to the roughly $1 trillion of U.S. subprime loans that triggered the 2009 crisis.

When disaster finally happens there will be a rush for the exits everywhere, and that is where the fatal flaw in the system will be exposed: there is no liquidity in the markets.

No buyers will stand up in a crisis. Markets will simply hit an air-pocket, and do a Wile E. Coyote impression.

At this point central banks will have an important choice to make.

They could allow interest rates to normalize.

The situation with low-yielding debt has gotten so extreme that Fitch Ratings warned Tuesday that a simple normalization of yields to 2011 levels could cause investor losses of $3.8 trillion. The losses would come in the form of principal plunges, as prices fall when rates rise. The low-yielding debt is held almost exclusively by institutional investors, meaning it poses systemic risks.

Of course $3.8 Trillion in losses means a deflationary depression, something no one wants.

In addition, central banks hold many of those assets and those kinds of losses would make many of them insolvent.

Lastly, 2011 interest rates were still abnormally low historically. Real normalization would be much higher.

The alternative is to go 'all in' - Helicopter Money.

Normally when we say that a central bank like the Federal Reserve or European Central Bank creates money from thin air, it does so by buying up bonds or other assets from banks using money that is just an electronic accounting entry. Banks then spread money through the economy.

But what if those mechanisms aren’t effective for some reason (the banking system isn’t working well, for example), and the central bank wants to get money circulating through the economy anyway?

That was the thought experiment that Mr. Friedman dealt with in a 1969 paper titled “The Optimum Quantity of Money.” He offered this intentionally absurd hypothetical: “Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community.”

Helicopter money is what happens if your rich uncle makes you a “loan,” but says that you don’t have to pay any interest and never have to pay it back.

Of course it's only a thought experiment. No central banker would ever consider doing something so reckless because it could easily end in the destruction of the currency. The whole reason for the existence of a central bank is to protect the currency. Right?

As the country gears up for yet more stimulus, financial market speculation has swirled that the Bank of Japan may now go one step further and, by introducing direct funding of government with newly-minted notes, cross into the realm of 'helicopter money'...

"You could argue that there is some kind of soft form of helicopter money going on anyway," says Halpenny. "There's a very fine line between monetary policy for policy purposes and for impacting the debt levels."

To sustainably weaken its currency, then, a country may have to enter what Pictet Asset Management strategists have dubbed "credible irresponsibility"

Wow. "Credible irresponsibility"

Who makes up these terms?

Etsuro Honda, an advisers to Japan's prime minister, noted that Bernanke at an earlier meeting in April, had mentioned the option of "perpetual bonds." Which is really no different than the rich uncle scenario.

Comments

Where, indeed, does this money go ?

Certainly not into the "real" economy where most of us live. It is remarkable, if you think about it, that the trillions of QE dollars pumped into the financial system have not caused price or wage inflation. Weird, huh ?

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

This is why Jill student debt QE plan makes sense

She expanded on the reasons in the CNN town hall and pointed out that unlike a bank, when we buy student debt, the students go out and buy stuff.

I keep trying to see something wrong with this plan, and I got nothin. It certainly beats what the "competent, experience people" are doing...

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

The money is stuk in the banks

because like Japan in the 90's, the banks are mostly insolvent (or in Europe, totally insolvent).

The monetary transmission system is broken.

Food For Thought....

Great read - Thanks.

"Dissent is the highest form of patriotism." - Howard Zinn

Nice little economic system you have there . . .

Life is strong. I'm weak, but Life is strong.

my brother's clumsy, colonel!

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

just posted link on Naked Capitalism for this article

Wow!

You have done an incredible job!

A couple of years ago Thom Hartmann published "The Crash of 2016" It may happen this calendar year or next year, but the economy is shaky.

Maybe we will get some people from Naked Capitalism to drop by here.

So income inequality is a bad thing?

Who woulda thunk? Maybe it's time to go back to the tax rates we had in the 60's and take back what those scumbags took from us. Good thing $Hillary is on the case. -S-

The real SparkyGump has passed. It was an honor being your human.

Try the 1950s

The 1960s saw the first relaxing of those rates, and the beginning of the end.

Eisenhower(!) was to the left of Bernie Sanders(!!!) on a lot of issues - and he was only wrong when he underestimated the stupidity and gullibility of the American public (famous quote on Social Security assuming that no political party would ever succeed by attempting to impoverish the people).

There is no justice. There can be no peace.

This

The stupidity and gullibility of the American public is on broad display. Keep revering unchecked capitalism, the rich and the corporations while they hoard and plunder, leaving a wasteland behind with us in it while they retreat to their castles.

It makes me so angry.

Amazing And Scary Analysis

Nice piece of work gjohnsit. It doesn't look like it will be long before a gentle breeze blows down this house of cards. I wonder if Obama will escape his term before the crash. He's been crowing about how he 'fixed' the economy but has done nothing but inflate a massive bubble. And when this crash happens with rates already at ZIRP, the Central banks will have no arrows left in the quiver. Batten down the hatches.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Hillary is being set up?

link

Trump letting her have the poisoned chalice? That would be funny

Up till now I’d been thinking of Ender’s Game — Trump and Hillary as the two poisoned cups that the giant (the corruptocrat 1%-controlled D-and-R party duopoly) is offering the mouse (the American people; the 99%; you and me).

Of course, in Ender’s Game, the mouse (representing Ender) realizes both cups are poisoned and takes a third option, killing the giant — how do the American people manage that in real life?

Pages