Goldman Sachs fined 0.1% of profits for "criminal theft" of Fed data

Submitted by gjohnsit on Sat, 08/06/2016 - 1:04pm

There's a reason why Goldman Sachs is so profitable - they cheat.

Goldman Sachs will cash out $36.3 million in fines to settle an allegation that it used illegally leaked materials from the Federal Reserve.

The civil settlement was unveiled on Aug. 3 by the Fed, which claims that a Goldman Sachs executive orchestrated a system to get regulatory secrets and make use of them inside the bank.

According to the charges, the executive tapped into confidential Fed information between 2012 and September 2014. According to the Fed, Goldman's business directly benefited from the leaked confidential data.

Goldman fired the culprit Joseph Jiampietro in 2014, soon after the leak reached the media.

To put this fine in perspective, the firm’s 2015 revenue of $33.8 billion.

Jiampietro is accused of taking, using and distributing confidential regulatory information such as confidential documents, forthcoming enforcement actions and ratings. The Fed wants the former executive to pay a solid $337,500 fine and to ban him forever from working in the banking industry.

The leak that caused the settlement to take place started with a staffer at the Federal Reserve Bank of New York, Jason Gross. He repeatedly sent out secret info to a former Fed colleague, Rohit Bansal, who was with Goldman Sachs at the time. Bansal was in the same work group with Jiampietro. Both Jiampietro and Bansal were let go in October 2014.

Jiampietro, who began working with Goldman in January 2011, is suing the bank for legal fees in connection with the Fed's case.

Bansal took a guilty plea on account of stealing government property, and can no longer work in the banking industry. The Fed charged him with a $5,000 fine. Gross also pleaded guilty, but his fine was only $2,000...

Such "devastating" fines.

How does Goldman continue to get away with this?

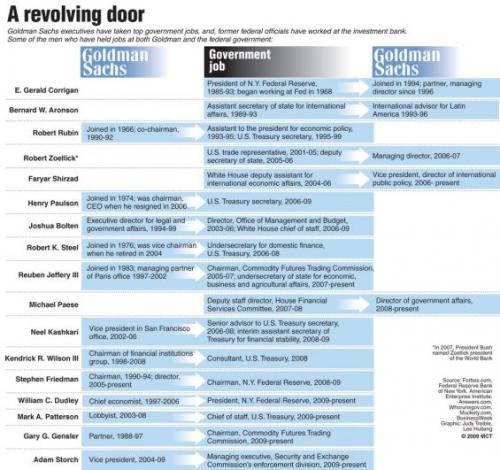

Oh yeah.

Goldman's financial agreement with the Fed lands after the bank shelled out $50 million last year, in order to settle with the New York State Department of Financial Services (NYDFS). Benjamin Lawsky, the head of NYDFS, warned banks in 2015 against the perils of having sensitive information leaked.

Comments

And in a related note

Remember the "Too-Big-To-Jail" Bank, HSBC?

I'm sure President Hillary will clean this right up

... as soon as she puts an end to Citizens United and kills the TPP.

Please help support caucus99percent!

"Cut it out," said Hillary Clinton. n/t

She "went down there and told them to cut it out."

Asking any more of Dear Leader would be disgusting. /sarcasm

Time to get serious about this.

I'm going to make sure they are punished as much as humanly possible.

I'm going to tell the DOJ that the corporations are actually an African American Teen in disguise. Who Sells pot.

I do not pretend I know what I do not know.

Who is armed

And threatening their lives.

She's going to put Kaine right on it

He'll investigate this terrible corruption and demand that it be stopped.

Beware the bullshit factories.

Yes, he'll go talk to them

And he'll be wearing his kneepads to do it.

How many "Minutes of Profit"...

Do the "Fines" represent?

The banks will continue to do "Business as Usual" until the fines are so large that there is "No Profit" derived from their criminal actions, and there is actually a punitive loss...

A "Perp Walk" for a CEO would do well too...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

No wonder hrc and GS are

buddies. Both liars and cheaters in order to satisfy their insatiable greed at the expense of EVERYONE else. Makes absolute sense!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

It's as though

fines are tax deductible.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

They Are...

But such arrangements are not for the little people...

You don't get to write the laws...

You can't deduct that speeding ticket you paid...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

Tax deductible fines is OBSCENE!

But, why am I surprised? I, I, ugh.

Think I should change my sig to 'Scotty, beam me up.' Except, I want to leave this whole realm, not just planet.

Corporate welfare.

Banks don't commit crimes, bankers do. Where is the

legal case against the bank officers? Coddling bankers - the DOJ gets off on it.

"The justness of individual land right is not justifiable to those to whom the land by right of first claim collectively belonged"

Wait a minute, I'm kind of confused.

So, these guys stole 'secret' government information for themselves and their bank and profit big time from it and all they get is a fine? And the bank has to fork over 15 minutes of profit.

BUT people like Edward Snowden, Chelsea Manning, or Julian Assange steal 'secret' government information about programs our own government is using AGAINST us and their lives are basically over.

It's all in one's priorities.

I'm tired of this back-slapping "Isn't humanity neat?" bullshit. We're a virus with shoes, okay? That's all we are. - Bill Hicks

Politics is the entertainment branch of industry. - Frank Zappa

At least we now know...

Hillary's Speeches at Goldman Sachs were covering the "Secret Government Information."

Now we know why we couldn't read the transcripts...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

John Edwards, hypocrite that he was, popularized the term

"Two Americas." Chelsea Manning tried to be a whistleblower in one of those Americas, Goldman Sachs committed crimes in hopes of enriching itself in the other.

Rigged system

Basically, GS deducts the fines paid on their tax return from Gross profit and wipes out the fine in their net profit. They simply did not pay a fine at all.

Corruption and fraud at its finest, all with the help of our decent, honest leaders in Government that continue to get elected.

TK

This is so true, these fines

This is so true, these fines are just window dressing, the only thing that would cause real change would be jailing the crooks and thieves who run GS and the other banks, but after Geithner (speaking for Obama himself no doubt) gave them all a get out of jail free card back in 2008, they're free to wreck the US economy all over again, knowing it's the lowly taxpayer who'll be there to bale them out again too.