Mea Culpa: Bankers admit to being responsible for global inequality

The IMF released a new report last week, and it was a stunning admission of guilt.

The world’s largest evangelist of neoliberalism, the International Monetary Fund, has admitted that it’s not all it’s cracked up to be.

Neoliberalism refers to capitalism in its purest form....

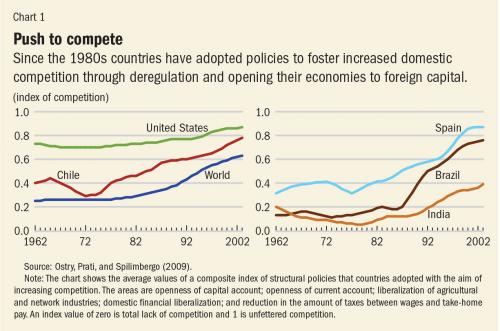

In analyzing two of neoliberalism’s most fundamental policies, austerity and the removing of restrictions on the movement of capital, the IMF researchers say they reached “three disquieting conclusions.”One, neoliberal policies result in “little benefit in growth.”

Two, neoliberal policies increase inequality, which produces further economic harms in a “trade-off” between growth and inequality.

And three, this “increased inequality in turn hurts the level and sustainability of growth.”

The top researchers conclude noting that the “evidence of the economic damage from inequality suggests that policymakers should be more open to redistribution than they are.”

Wow! Coming from the Church of the Free Market (i.e. the International Monetary Fund).

It's like the Pope saying, "we might have been wrong about that Jesus guy".

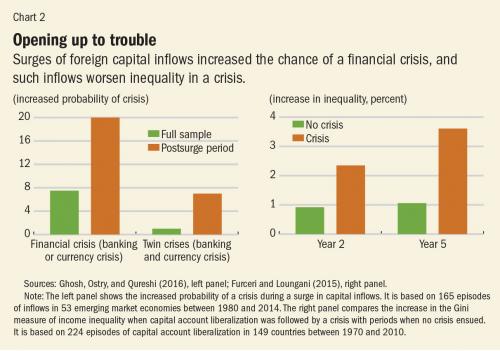

The report points out the damage that unrestricted capital flows can cause.

These boom and bust cycles are not merely “a sideshow… they are the main story,” the economists add.

“Capital controls are a viable, and sometimes the only, option,” the IMF concludes.

Then comes the real kicker. The one thing that was so obvious that even the man on the street understood.

“Austerity policies not only generate substantial welfare costs,” the IMF researchers continue, “they also hurt demand — and thus worsen employment and unemployment.”

“The increase in inequality engendered by financial openness and austerity might itself undercut growth, the very thing that the neoliberal agenda is intent on boosting,” the IMF researchers write. “There is now strong evidence that inequality can significantly lower both the level and the durability of growth.”

Duh!

The IMF couches it's criticism of neoliberal economics. “There is much to cheer in the neoliberal agenda,” they write.

The report points out the success of it in Chile. Of course, the IMF leaves off an important detail.

The IMF report cites Chile as a case study for neoliberalism, but never mentions once that the economic vision was applied in the country through the US-backed Augusto Pinochet dictatorship - a major omission which was no casual oversight on the part of the researchers. Across Latin America, neoliberalism and state terror typically went hand in hand.

But wait! There's more

The IMF report alone is a stunning admission. Yet it comes only days after a significant mea culpa by the Federal Reserve.

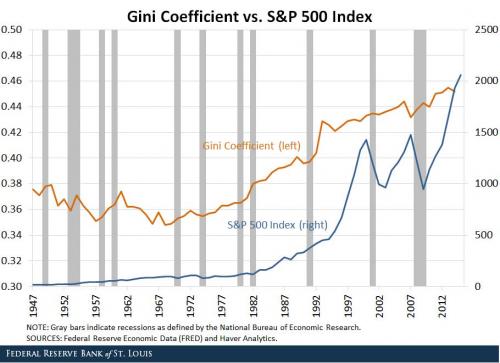

Assistant Vice President and Economist Michael Owyang and Senior Research Associate Hannah Shell noted that increases in stock prices and capital returns may benefit the wealthy more than others, as they have better access to markets. They wrote: “Thus, as stock prices and capital returns increase, the wealthy might benefit more than other individuals earning income from labor.”

Ya think?

This isn't news, except to see the Fed acknowledge it. Standard & Poor’s recently said:

QE boosts asset prices through a “portfolio rebalancing effect”… However, ownership of such assets is highly concentrated. Before the financial crisis, the 10 per cent wealthiest UK households directly owned 77 per cent of all stocks and 64 per cent of bonds, according to the OECD Wealth Distribution Database… It was therefore the wealthier households that gained most from the strong rise in financial asset prices after the onset of QE.

Former Fed officials have noticed the very same thing recently.

Kevin Warsh, a former Fed board member and one of the Brookings panelists, held a different view explaining that quantitative easing as a policy works purely through an “asset price channel” enriching the few who own stocks or other financial products (and not the 96% of Americans who receive the majority of their income through labor).

This comes just two years after the Bank for International Settlements made the admission that "financial globalisation itself makes booms and busts far more frequent and destabilising than they otherwise would be".

Does this mean we are finally witnessing the long death of the neoliberal ideology? It's too early to say, but we can hope.

Comments

Don't miss the OECD report out today ...

http://www.commondreams.org/news/2016/06/01/oecd-latest-economic-bigwig-...

"

Less than a week after the International Monetary Fund (IMF) expressed reservations about neoliberal policies like austerity, the Organization for Economic Co-operation and Development (OECD) is urging governments to increase spending in order to "make good on promises to current and future generations."

Not doing so, OECD chief economist Catherine Mann told Reuters, deprives youths of job opportunities and means the elderly will not get the healthcare and pension benefits they expect. "We are breaking promises to young people and old people," she said.

"

It is too early to place bets. But I think over time, Keynes will rule again.

Would Not an Increase in Government Spending

as spoke of here, come from issuance of long-term debt? I don't see it as a solution, but it does help in the short-term. It seems like propping up a fundamentally flawed system that does great harm to people and pushing back the day of reckoning.

Long term debt is not always bad

National macroeconomics is not like personal finance. As long as the debt servicing (interest) is less than the triggered increase in tax receipts (probably proportional to economic growth) it is fine.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

Doesn't much matter where

the money comes from, when more of it goes into the pockets of workers more of it goes right back out into The Economy™.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Clara White Mission

When I lived in Jacksonville (while I went to a crappy law school) I volunteered at Clara White Mission. Clara White's feeds the homeless, but more than that, it has huge kitchens and trains the homeless and indigent in culinary skills, and then places them in local jobs.

This, of course, seemed brilliant, along the lines of, "You give a man a fish and you feed him for a day, but if you teach a man to fish you feed him for a lifetime."

But then I thought about it more ... If Clara White's is placing them at the Marriott, or the Sheraton, or what not, they would then really only be creating PROFIT for the shareholders, while the workers barely managed to survive. You know, the same ol', same ol' capitalist model. By working for corporations the workers would then really be helping ship the excess profit, earned from their labor, out of Jacksonville and to far off shareholders, the 1%, in London, and New York, and Abu Dhabi...

Worst than that, Clara White Mission is a non-profit, so why couldn't the 1% of the Marriott, or the Sheraton, or what not, donate to Clara White's, get a tax write off and trained labor (who would work for scraps), and basically be subsidized by tax payers dollars? They probably are, that's part of the magic of capitalism.

I'm obsessed with worker-ownership, from Mondragon, to Publix Supermarkets, to the John Lewis Partnership, etc, etc. So my thought was, if only they had those trained at Clara White's Mission directed toward worker-owned restaurants, then the profits would remain in Jacksonville and actually build the community rather than the 1%.

Obviously I am not a popular person, going around preaching that worker ownership is best for communities and other such claptrap, and was rather despondent [and still am, actually] until this kook politician, who supported worker ownership, came along and offered me a glimmer of hope that a few other people were thinking "we should build an economy that works for all of us and not just the 1%."

So, with that long tale in mind, my response to your comment (Doesn't much matter where the money comes from, when more of it goes into the pockets of workers more of it goes right back out into The Economy™.) would be, "It depends ... (Huge difference between Wal-Mart and Publix, one profits the Waltons, the other profits the workers.)"

The country could use a lot more of such “kook politicians.” n/t

Worker-Owned businesses

are the way to go. Same with resident-owned apartment building co-ops.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

No, the Government does not need to collect money

to spend it. Not if it has its own currency. The reverse is closer to the truth, the government needs to spend money into existence to collect it. Issuance of long-term debt is the preferred method of assuring that private bankers profit from all public efforts, but it is a political, not an economic requirement that could be erased at will, were the financial sector to be dislodged from their deathgrip on the brainstem of the body politic. Repeat after me: a government budget is not like a household budget.

it's rare ...

... to find someone in blog-land who understands this. Thanks for bringing it out!

The governments' "debt" is the private sectors'

net gain, ie, net income.

All money is debt. But for a country that creates its' own currency, "debt" is in no way similar to household debt as households do not issue the national currency out of thin air, but must earn the government created currency to pay taxes, pay off their private bank debt - and if they're lucky to have enough government created dollars, they can invest in a treasury bond, which sit at our central bank in the form of savings that earn interest.

Would you advise against

People buying houses with mortgages for the same reason?

Dig within. There lies the wellspring of all good. Ever dig and it will ever flow

Marcus Aurelius

And isn't that the irony of comparing National Debt...

...to Household debt? How many Conservatives rail against the US Debt to GDP ratio approaching one, using the household debt analogy as the basis for their argument, while anyone with a mortgage, a couple of newer cars, credit card debt, student loan debt, etc. has a Household Debt to Income ratio of 2, 3, 4 or more? Now imagine if the US government was to increase the debt to GDP ratio to those levels by spending money on things that actually create lasting wealth (infrastructure, education, healthcare, direct jobs, etc.) Talk about your economic boom!

I want my two dollars!

yep. n/t

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Thanks for the Replies

They've given me much to think about.

Any chance of these bastards doing something about it?

Just asking.

Gëzuar!!

from a reasonably stable genius.

The same question put another way

"So all the billionaires it created are going to give back their money, right?"

- Naomi Klein

Answer: no

Count me unsurprised.

I hope they enjoy the feudal system they're building (and the required security).

Gëzuar!!

from a reasonably stable genius.

Speaking of a feudal system

low pay world

Instead of paying them more money, you can just cut out the payday loan vultures and be a payday loan vulture yourself.

Err, why not pay your employees more

than having to deal with all the admin that loans/credit entails.

These people must love paperwork.

Then again, the Company Store was always good for the Business.

Gëzuar!!

from a reasonably stable genius.

Yeah,

I saw this report and my first thought is that it is simply window dressing. In other words, it sounds good, but will anything change? Those who have benefitted from neo-liberalism are not about to let go of their easy money cash machine.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

True, but at least

the neolib stuff is being challenged widely (Pope, Bernie, protests around the world), and now these economic entities....something might change for the better after all!!!

dfarrah

I have been writing about neo-liberalism

for the last seven weeks on the Wed. Open thread. It is so deeply embedded into not only our economic system, but into our social system. It is going to take a lot to break it. The IMF is a neo-liberal creation, so that is why I am skeptical.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Yes, I believe the same way

much of the time. Those tentacles are everywhere.

dfarrah

You should be skeptical

These reports come from the research department. Not the policy making department.

It's like a bank teller sending a memo to the CEO saying, "maybe we shouldn't commit fraud on an industrial scale."

BTW, I had forgotten that I posted this last December.

True, but we're getting

ever so closer to Torches and Pitch Forks. And these fuckers know it.

the little things you can do are more valuable than the giant things you can't! - @thanatokephaloides. On Twitter @wink1radio. (-2.1) All about building progressive media.

Hillary is going to

tell them to "cut it out!"

That should fix things nicely.

Another Refugee from the Great Orange Purity Troll

Any commercial concern

needs customers who are able to pay for the product. If potential customers have less and less available money, sales will go down.

That seems so obvious to me but it has taken the bigwigs quite a while to realize that.

Life is strong. I'm weak, but Life is strong.

Sounds like another tragedy of the commons

Exploiting your workers is good for business but everyone else doing so is bad for business.

We can’t save the world by playing by the rules, because the rules have to be changed.

- Greta Thunberg

this is exactly right ...

You don't necessarily need pitchforks to accomplish change. These two reports put together are beginning to say what Keynes and liberals said all along. Economies are demand sided, not supply sided. When you stop demanding goods because you're fearful, or poor, there is no reason to build more supply. You can only take from the poor and middle class for so long before the problem "trickles up" to the producers.

It turns out that "spreading the wealth" is not only moral, but economically correct. What would be nice is if we never had to go this far to prove it.

Right!

I'm not buying this.

Bankers don't concern themselves with how they hurt middle-class families, the environment and the civilized world. I smell shit brewing.

Well, they may prefer some change to

another French revolution. After all, they say liberalism saved capitalism from itself.

But then again, the governments are all now heavily armed, thanks to our taxpaying citizens.

dfarrah

Inequality is Hi-Larious

remember this?

(No subject)

The IMF and World Bank and BIS come out with reports

like these that are contradictory to their continued practices and purposely leave out the good parts to cover their crimes. It's part of the game, like the Federal Reserve. You go to their websites and you'd think you're dealing with Mother Teresa but then learn about how they completely manipulate, rig, blackmail, funnel wealth, etc., it's like listening to Obama talk about Peace.

Read

'The Creature From Jekyll Island"

Nice book about the creation of the Federal Reserve, fiat currency, etc. Ignorance is bliss, for the 99%.

Certainly have,

at least parts of it. Sure, I've been in on the Fed Reserve secrets for a long time now, but you're right, most the rest of our citizens are clueless.

But for those that want to know, that's a good book to start with.

Are you a gold bug?

Where does gold get it's value?

Pretty sure by placing a stamp on it out of thin air, just like we place a stamp on paper, clay tablets, or notches in sticks, etc...

Money, relying on numbers, just IS abstract. Just like numbers are.

You can use an abacus to count. Or, you can simply count.

All money is fiat - created at will - that's why fish don't use money, they don't have our ability to both think numerically and then decide to create money at will.

Excellent article on neo liberal economics

By the UK jopurnalist and activist George Monbiot from his new book and printed April 16, 2016. It had almost 4,000 comments.

Neoliberalism – the ideology at the root of all our problems Financial meltdown, environmental disaster and even the rise of Donald Trump – neoliberalism has played its part in them all. Why has the left failed to come up with an alternative?

I glanced at it when it came out but now I printed it off and read it. Recommend if you want to know about where it came from and that it is invisible and in the last 80 years the left has not come up with an alternative.

These 4 paragraphs give a sense of the solid material in the article

Hi Don!

For the last seven weeks (including today), I have been writing about neo-liberalism as part of the Wed morning Open Thread series. I know a lot of folks ignore the Open threads, but we have been trying to make them meaty. Monbiot has been one of my go to guys. In fact I used the last quote in my first post in this series. Click on my name and check it out. Also today's post is in the right hand box at least until about midnight or so.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

so in other words,

Bernie is right!

As usual...

Bernie 2016!!!!!!!!!!!!!!!!!!

The movement in perpetuity.

IMF is a like a trade group

that knows they have to put out something every once in a while to appease the mob so their members can keep scamming us.

"You can't just leave those who created the problem in charge of the solution."---Tyree Scott

Now someone just needs to connect the dots

to Sanders' campaign. Anyone up for writing letters to the editor of all the major publications in the upcoming states making those connections?

We are what we repeatedly do. Excellence, then, is not an act, but a habit.--Aristotle

If there is no struggle there is no progress.--Frederick Douglass

So taking everybody's money...

and giving it to a select few is not good for the economy?

Gee, who knew.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

You know,

when I read articles like this, while I greatly appreciate the truth coming to light, it just makes me mad/upset. We all know this nightmare is all around us, but we can't quite wake up. I'm awake, but I'm in the minority, you're in the minority. I just want everyone to wake up! It's in our best interest to wake up. Bernie's awake, we know that, but we still have so many in this country that are weak-minded.

I'm trying to keep thoughts about Tuesday, praying for zero shenanigans.

It's Bernie time!