Resilience: The Two-Income Trap - Reflections On Time And Money

Thinking clearly about money is one of the biggest challenges to personal and family resilience. Resilient families get the trade-off between time and money right. Lovie and I have made our mistakes along the way, but 25 years later, we know we had made the appropriate trade-off, right at the start of our relationship, between money and time. I would like to lay out our thinking in conjunction with then law professor, now U.S. senator, Elizabeth Warren.

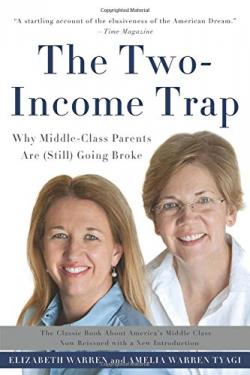

I first heard of Elizabeth Warren in 2003, when she, then a law professor at Harvard Law School, and her daughter, Amelia Warren Tyagi, a business consultant and co-founder of a successful health benefits firm, wrote an important book entitled The Two-Income Trap: Why Middle-Class Parents Are Going Broke.

I wrote a book review on it and then turned it into a personal reflection. I recently heard that the book has been updated (see the cover photo) and then dug out the essay from my old mac. I would like to hear your opinions of and experiences with the matter of time and money in your family.

A word before we proceed: the two-income trap is a sensitive topic, for it involves values, relationships, old choices, family dynamics, and so on. I discuss our family's choice, but it is not judgemental about anyone's personal situations.

Why today's families are less secure than 1970s families

Their book is a remarkable data- driven analysis with practical prescriptions for individuals and governments. One of its most trenchant and prescient analyses was an early warning signal on the unfolding disaster of subprime mortgages and other forms of predatory lending. Their most important contribution is to allow research data to show why, in 2003, more women will file for bankruptcy than graduate from college, and why 70% of Americans say that they are carrying so much debt that it is making their home lives unhappy. (Warren & Tyagi, p.xiv)

Warren & Tyagi say that by 2010, more than 5 million families with children will file for bankruptcy, which is nearly one of every seven families with children. (Warren & Tyagi, p.6, their italics)

The reason for this appalling statistic is not, they insist, because these families have over-consumed.

Data from the 2001 Consumer Bankruptcy Project showed that 87% of families with children filed for bankruptcy for one or a combination of only three reasons:

job loss, medical problem, and divorce or separation.

The other reasons combined accounted for just 13% of family bankruptcies: bad investment, crime victim, credit card overspending, natural disaster, other explanation, and no explanation. (Warren & Tyagi, p.81)

The data debunks two popular misconceptions about bankruptcy: the myth of the immoral debtor and the myth of over-consumption. At least as far as families with children go, job loss, medical bills, and divorce accounts for 87% of bankruptcies.

How have we arrived then at the point where one in seven families with children go bankrupt, while millions more totter precariously on the edge?

The main reason is that families spend their fixed expenditures mostly on trying to make a middle-class life with opportunities for their children in a financial environment that has become hostile to middle class interests.

Their fixed expenditures go toward: a house near a good school, pre-school expenses, day-care expenses, college expenses, cars, health insurance and taxes.

The discretionary income – that part of the budget to cover things like food, phone, heating, furniture, clothes, television and internet - for an average dual-income family in the 2000s is $17,045.

That figure is $800 less than for the average single-income family in the 1970s of $17,834 (in 2000 dollars). Todayʼs middle class families have $800 less discretionary income than those of the 1970s, despite having two incomes versus one.

Their fixed expenditures are a staggering $50,755 versus $20,866 in the 1970s. (Warren & Tyagi, p.51)

The largest component of their fixed expenditures is housing costs which have ballooned since the 1970s.

The major reason for house inflation since the 1970s has been the steady decline in the quality of public schools in the U.S, so that property values near the remaining decent schools have increased due to competition from parents trying to get their children educated.

Another component of the roughly $30,000 increase in fixed expenditures is the need for daycare and preschool, a second vehicle and the higher tax bracket, all necessitated by the second income, whereas single income 1970s families did not incur those costs.

In terms of financial risk, contemporary dual income families are in a much more precarious position than were single income families three decades ago.

Should the family experience a job loss, or incur medical costs, or go through a separation, they are already committed to numerous long term obligations.

In the 1970s, should a spouse lose a job, the other partner - usually the mother - could step into the workforce until a new job was found. Should a family member experience an illness or injury, there was a spouse at home to give care.

The biggest risk back then was divorce, for there were not the same type of protections afforded to the single parent.

The two-income trap

Middle class mothers started flooding to the workplace in response to the cultural and societal changes achieved by the womenʼs movement in order to help their families achieve the middle class dream of a safe neighbourhood where their children receive a good education and are better placed to make the most of future opportunities. However, there is a limited stock of houses in good neighbourhoods and so prices escalated rather than decline with the boomer generationʼs retirement.

In 1975, Congress passed the Equal Credit Opportunity Act, which stipulated that lenders could not any more ignore a wifeʼs income when judging whether a family could qualify for a mortgage. Following massive doses of deregulation, banks also started to allow mortgages with much less than 20% down payment.

Therefore house prices did not reach the natural limit that would have been imposed by a single income family. They continued to escalate according to the laws of supply and demand.

Financial deregulation meant that families had financially doable but economically risky means of credit available to compete in the bidding wars for good homes. Whereas middle class mothers had initially flocked to the marketplace to help their families achieve the American dream, they now went to work to try to keep their dreams afloat in a rising tide of debt that only seemed to lift the passing yachts.

Middle class families today faced with increased fixed expenditures - housing, child care and education, medical insurance and taxes - have less discretionary income available than their counterparts in the 1970s, but more access to credit, and have increasingly sought to cover their discretionary needs with credit, a practice that is fraught with danger.

No one knows whether the market corrections involved in the largest recession since the Great Depression will force down prices permanently and bring actual instead of pretend reregulation to a crazed financial system. At the moment, all it presages for middle class parents is more dangerous conditions in which to raise their children.

No one thinks that mothers should return en masse to the home; most of them are already overcommitted to long term obligations such as mortgages, preschool and daycare positions, medical insurance schemes, or college payments, for the sake of their children.

What should they do then?

Warren and Tyagi have several suggestions for politicians to fix the school systems and the financial system so that they would once again serve middle class interests rather than their own stakeholders. A healthy dose of skepticism is in order, for the prescriptions from the authors all run contrary to the interests of the financial industry, which has a powerful lobby.

They also advise middle class parents to do what they call a financial fire drill, which is premised on that of firefighters, who teach that the best time to prepare for an emergency is before the house catches on fire. (2003, p. 164)

Their first piece of advice is to read a good book on financial planning. Read it preferably with a clear eye. Most financial planning books start from the premise that work is steady, everyone is healthy and there are no emergencies. However, as has been noted, job loss, medical treatment and separation are the cause of 87% of bankruptcies of families with children. Such items should feature prominently in family financial planning.

Warren and Tyagiʼs financial fire drill poses three questions.

The first is, “Can your family survive on one income for six months?"

If you are a single income family, the question is easier, “Could the stay-at-home parent enter the job market should s/he be required?"

The second question is, “Can you downshift the fixed expenses?”

There is little point in eliminating treats when times are good, for what will you eliminate when times are bad? Middle class problems arise out of their fixed expenditures. This means tough thinking about the very things you are working for: home, car, medical insurance plans, preschool costs, tuition bills, etc.

The time to think these through is now while you can still make reasonable choices.

Warren and Tyagi have some tough advice regarding mortgage costs:

If the only way you can meet the mortgage payments for your dream home is to tighten your belt and commit both incomes, donʼt do it. (2003, p.165)

The third question is, “What is your emergency backup plan?”

You need to consider possible disasters and make some contingency plans. If a grandparent falls ill, or one of you loses a job, or there is a separation, you need a plan and you need to be working on making that plan feasible.

Some of the most dangerous blockages will be your long term commitments, so be careful about the length of loan commitments in order to give yourself some financial flexibility. Consider for example, disability insurance from a reputable company.

In performing their financial fire drill, two income families have to understand that they are in a higher risk category than single income families. These have some economic security in the stay-at-home spouse, who can step in as caregiver when needed and can join the workforce in an emergency. Two income families cannot budget as tightly as single income families, for there is no margin of error for them.

The authors recommend that, if at all possible, think about that second income as a safety net.

Put some it in savings, splurge some of it or save it for childrenʼs college tuition, but if possible, do not commit it to the mortgage and the health insurance. This way you enjoy the benefits of a second income while staying secure. We take our leave now from the book and reflect on it's relation to my family's life together.

How then do all of this relate to family resilience? (apart from the obvious :=)

I cannot live a more resilient life, one that is freer, if I do not clearly understand my financial situation and let myself be at the mercy of inadequate financial planning.

I can also only live a freer live if I view financial institutions with an appropriately jaundiced eye. I need to realize that, with regards to the biggest purchase I will ever make, the financial institution nowadays has a vested interest in having me fail rather than succeed. For if I cannot pay the mortgage, the bank could resell the house at a profit.

I cannot simply drift along in a dangerous financial ocean without understanding the weather patterns, and knowing how to steer and trim the sails when necessary. I need to understand my financial situation, do sound planning, and monitor the institutions that offer me their "services."

If I am to understand my financial situation I need to examine my values and goals. One of the values to explore is the nexus between time and money.

Keeping time and money in balance is one of the trickier acts in life. Lovie and I talked at length about time and money when we first got together. It seemed to us that these two were like the ends of a see-saw on a playground. The heavier one end became the higher and farther out of reach went the other. The more we aspire to and raked in money, the less time we would have available.

We also figured that time, once it was gone, could never ever be had back, whereas enough money for real needs would always arrive when needed, if not a moment too soon :=) Folks, you either get this, or you don't. Those who have lived a life of service will understand. It arrives. It always does.

Time spent together is banked forever; no one can take it away. I am deep into middle age now and donʼt envy young people one bit. For as I have aged, I have accumulated time spent together with my wife and children in my memory banks where it cannot be taken away from me except by certain ravages of old age. Even if it is taken from me, it remains with them.

We solved the value question of time and money by having one parent home. For 25 years now, Lovie has worked as a homemaker. This was not a choice made from conservative family values, but from a conscious valuation of time over money. Lovie has a bachelorʼs degree and could easily have found her place in the paid workforce, but she chose to work with her family. In becoming a single income family we gained several things.

It allowed us to be intentional about time with each other and the children, while forcing us to be very clear-eyed about money, for there was always just enough and not a penny more.

The see-saw always balanced, but sometimes only just. Financially it meant that we had to be satisfied with living like a 1970s family and keep our fixed expenditures within those limits. Fortunately, we live in Canada with universal health care and we had health insurance through my job, so we were able to manage our fair share of medical crises financially and organize care-giving without stretching ourselves of family members to the breaking point.

It has meant that we have to be content with one very-second-hand vehicle and public transit. We have had to say no, regretfully, to some houses that were just outside our price range. Every time we could not afford something and had to wait to save up - in order to purchase it used - we had to remind ourselves of our value system and the prior choice we had made between time and money.

Somehow, things have always worked out and we have lived contented and more resilient lives. We have always been upfront with our children about our choice and they understand the difference between them and some other children in their school. We have had frank family conferences at critical junctures and during crises and we have generally been unified. The daily family supper table is where we discuss each family member's day and help each other work through things. I wrote about it here:

http://caucus99percent.com/content/personal-resilience-family-dinner-key...

We think that our children have a clear perspective on the choice their parents have made and the risk-reward ratios inherent in that choice. We are interested to see how this value choice plays out in their lives as they mature and become independent actors. They have been pleased with the fact that at least one parent was always available for every minor scrape and major crisis and we think it has helped them become securely attached persons.

"Infants become attached to their parents or other caregivers for the contact comfort the adults provide." According to psychologist John Bowlby, this attachment provides a secure base from which the child can explore the environment and it provides a haven of safety to which the child can return when s/he is afraid.

A sense of security allows children to develop cognitive skills and a sense of safety allows them to develop trust. (Bowlby, 1969, in Psychology, 1996, p.407-8)

When infants are consistently deprived of social care, contact, affection, and cuddling, the effects can be disastrous and long-lasting. (Psychology, 1996, p.409)

Insecurely attached infants often grow into children who have a number of behavioural problems and problems in cognitive functioning, such as deductive reasoning.

They may grow into adults who are anxious or avoidant in their own close relationships. (Psychology, 1996, p.409-410)

We agree that infants can become securely attached persons through good caregivers in daycare, but we made a conscious choice to invest time over money and give our children a sense of security and safety ourselves. Having both parents work and the children in daycare, preschool, and school is the majority choice in todayʼs culture, and it is a fine choice, given the network of paid caregivers that have grown around double income families, as long as parents have consciously deliberated over two things:

The first is the value question of time and money.

The second is the question of the two income trap.

We have avoided the two income trap for many reasons. One reason is that we see it as incompatible with our value choice of time over money. There is no way we could have spent the amount of time with each other or our children that we have banked to date, had we chosen the double income lifestyle.

We have so much precious unhurried time safely stored in memory banks where it is untouchable.

If we are correct about time and money, parents have to choose between giving to their children mainly of themselves through time or give to them the things that money can buy, such as sports and culture and college tuition. We have chosen the first and, so far, our children have approved of this choice.

We consider the double income lifestyle very risky for relationships. Relationships are tough sledding at the best of times and the success rate isnʼt overwhelming.

In 2004, the 50-year Canadian divorce rate was 413 per 1,000 marriages. That is 41.3% of marriages are likely to end in divorce.

The 50-year total divorce rate (TDR-50) represents the proportion of married couples who are expected to divorce before their 50th wedding anniversary. For example, a TDR-50 of 413 per 1,000 marriages for Canada in 2004 indicates that 41.3% of marriages are expected to end in divorce before the 50th year of marriage if the duration-specific divorce rates calculated for 2004 remain stable.

Source: Statistics Canada CANSIM table 101-6511 from Canadian Vital Statistics, Divorce Database and Marriage Database, http://cansim2.statcan.gc.ca/cgi- win/cnsmcgi.pgm)

Divorce rates in Canada are almost as high as in the United States, although the U.S. the picture is rather murkier because of different relationships between states and the federal government. Plus, the U.S. gathers data in a format that isnʼt terribly helpful; marriage and divorce rates per 1,000 population.

The U.S. marriage rate in 2006 was per 1,000 population was 7.5 and the divorce rate was 3.6 per 1,000. This translates to a divorce percentage of 48%.

In Canada, the equivalent crude statistic is a divorce rate of 220.7 per 100,000 population, which translates to 2.207 per 1,000 population.

Source: The population estimates used for divorce rate calculations come from the following sources: for 2004 data, "Annual Demographic Statistics, 2005", catalogue number 91-213-XIB/XPB; for 2005 data, "Demographic Estimates Compendium, 2006", catalogue number 91-213-SCB. http://cansim2.statcan.gc.ca/cgi- win/cnsmcgi.pgm

The interesting fact is that in the U.S. both marriage and divorce are down. The 1990 marriage rates were 9.8 per 1,000 and divorce rates were 4.7.

Source: Table 123. Marriages and Divorces—Number and Rate by State: 1990 to 2006. Source: U.S. National Center for Health Statistics, Births, Marriages, Divorces, and Deaths: Provisional Data for 2006, annual; Volume 55, Number 20, August 28, 2007; and prior reports.

http:// www.census.gov/compendia/statab/tables/09s0123.pdf)

My best guess is that both marriage and divorce are down because of the rise of common-law relationships. The basic point is that in Canada and the U.S. the percentage of marriages that end in divorce is 41% and 48% respectively. These are not encouraging indicators.

One of the biggest risk factors for relationships is money issues. Warren & Tyagi noted right off the bat that 70% of Americans say that they are carrying so much debt that it is making their home lives unhappy. (2003, p.xiv)

Seventy percent of unhappy homes related to debt is a big scary statistic. It is therefore understandable that one of the big three reasons behind 87% of family bankruptcies is divorce. Relationships falter because of money problems. The two-income trap appeared to Lovie and I as too risky to gamble our relationship in it.

The other big risk factor for relationships is lack of time. Relationships require time the way plants require sunlight. The two-income trap often means that couples are apart too much. Both have work obligations and because the goal of the double income family is to provide their children with all the benefits of a middle class lifestyle, they are often heading in different directions, each in their separate cars with separate children on their way to separate childrenʼs sporting or cultural events. Lovie and I thought it is too risky to gamble our relationship on a lifestyle that we consider to provide far too little time together than we think necessary for our relationship to flourish.

So we have chosen the single income lifestyle because we value time over money and we have avoided the double income lifestyle because it is too risky – there is not enough time or money in the two-income trap. Naturally, there are many families that have managed the time issue and the money problems and we rejoice with them. For us though, it appeared too risky.

These are difficult issues that require intentional reflection and conscious choices between value-laden options. I hope that this reflection is useful for you and that we could discuss these matters with great care and compassion.

Peace be with us, if we work hard on getting the time versus money issue right for our family circumstances,

gerrit

Comments

we chose dual-income,

probably because we did not meet until he was working professionally and I was in graduate school, and that was my life. Also, 6 years and one house together before we got married (simplifying my legal rights as the lower-earner). Other than a brief dual-unemployment (1980's recession), resulting in a house sale and move, we were doing quite well, with disposable income, at least until house #2 went into construction. Architect-husband designed a 2 BR house, nothing fancy except design and "bones".

Then one child, then two. With child #1, I had banked enough vacation that I could take a 5-month leave of absence. Then another child, and we were confronted with 2 children, 2 bedrooms, 2 jobs. My job for about 6 years essentially paid for day care and health insurance for the entire family. The house enlarged to 4 bedrooms, another mortgage but only for 15 years after some refinancing while interest rates were dropping.

Then health issues appeared. My husband had a stroke, didn't work for about 6 months, and we dealt with one income, 2 kids, and my full time job plus doing everything. Lucky, I had a sympathetic supervisor (who had his own health crisis 2 years before), and sure as hell reduced work hours with no pay penalty. Still going along, a corporate buy of his firm giving us a nice cushion and then he lost his job. In his late 50's, single practice brought in "pin money". He took SS at 62, immediately got ill and died less than 9 months later. In that uproar, I lost my job (in my mid-50's), the Great Recession hit, and he died. He was the better financial planner.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Hello riverlover, I hope your day is going well. TY for your

description of how your family have dealt with the financial perils of this corporatist modern world and all its traps for us adults trying to make ends meet under trying circumstances.

We did all right within our single-income world until I got the ptsd. I went through a period of a few years where I racked up significant consumer debt through anxiety purchases. My word, how Lovie survived those crazy years is a grace from heaven. I'm steadily paying off my errors, but it has put us back a number of years. We've learned our lesson though. We changed how we did things and she now has permanent power of attorney and control over the banking, so that I can't do that again in a relapse. Those crazy years have been the only hiccup in our single-income life together.

The corporatists really did rig the game against us, eh? Look at how hard things were for you during the years of your husband's illness. The high cost of daycare, health insurance, losing a job, the penny-pinching of SS - all that in a wealthy country. Sigh. We need a basic minimum income, eh? So then when you lost your job right when things were so hard, you would have at least had a cushion during the hard times. You take good care my friend,

Resilience: practical action to improve things we can control.

3D+: developing language for postmodern spirituality.

Thanks Gerrit

Excellent diary. I think this captures a lot of the challenges facing working and middle class families today. The idea that competition for the best education is the primary driver of middle class distress is not intuitive. But it makes a lot of sense that education would drive the cost of housing in more desirable neighborhoods. Where I live, we have a neighborhood of mostly older houses with a neighborhood school that is rated as one of the best in Ohio. We live in the house where I grew up, and since I inherited it from my mother, we didn't have to carry a purchase mortgage. It's only been in the last few years when we made improvements that we started carrying more debt. But we just completed a refinance where it's going to be a lot more manageable. Home values have risen substantially since the Great Recession, above the peak of the last housing bubble. We have been a one-income family up to this point, since we haven't had the expenses of paying for a mortgage as middle-class families usually do. Now my wife has taken on a part-time job and is looking toward her teacher certification, to be able to work in her former profession (she was a teacher in the Philippines). I think Sen. Warren's book is a great guide to the perils of the two income trap. For us it will be a different challenge since I am over 50, my wife is about six years younger than I, and we have two daughters ages 8 and 6 who will be in college when I am in the last years of my working life. We will have to help them with college at the same time we are trying to save for retirement! I am grateful that we have been able to give our daughters more of our time in their early years-- I think it has made a difference for them.

For at least another hundred years we must pretend to ourselves and to everyone that fair is foul and foul is fair; for foul is useful and fair is not. Avarice and usury and precaution must be our gods for a little longer still.

John Maynard Keynes, 1930

Hi Kurt, you and your wife have shown how a family could plan

their financial life in appropriate stages, having a prior understanding of the two-income trap and using your leverage to have the best of both worlds. Your kids formed a sound basis with you parents in a single-income arrangement and now you're moving into the two-income scenario with the discipline of the single-income stage and are making things work for the betterment of your family. TY for your comments and review; it's real good to hear about how you have dealt with these concepts. Enjoy your day, mate,

Resilience: practical action to improve things we can control.

3D+: developing language for postmodern spirituality.