Reform student debt or the system will break

To grasp the true scale of the problem let's consider a few numbers.

- The total outstanding student loan debt in the U.S. is $1.2 trillion, that’s the second-highest level of consumer debt behind only mortgages. Most of that is loans held by the federal government.

- About 40 million Americans hold student loans and about 70% of bachelor’s degree recipients graduate with debt.

- The class of 2015 graduated with $35,051 in student debt on average, according to Edvisors, a financial aid website, the most in history.

- One in four student loan borrowers are either in delinquency or default on their student loans, according the Consumer Financial Protection Bureau.

Let's take this in reverse order.

As a comprison, the value of U.S. subprime mortgages was estimated at $1.3 trillion as of March 2007, and it had a delinquency rate of 25% by May 2008.

So in other words, the student debt crisis is similar in both size and in delinquency rate to the peak of the subprime mortgage crisis.

The only difference is that you will never, ever be allowed to walk away from student loans. We, as a nation, would rather have debt slaves than allow bankruptcy.

Defaults at for-profit schools are looking familiar.

Borrowers who took out student loans to attend for-profit schools defaulted at the same or higher rate within five years as those with subprime mortgages, according to an analysis from Karen Pence, an adviser at the Federal Reserve Board of Governors, of data released by the Brookings Institution Thursday.

As a result, the federal government's wage garnishment business is exploding.

Approximately $1 billion in government-backed student loan debt has been garnished each year over the past several years, a 40 percent rise from 2006, according to the U.S. Department of Education.

“I’m not surprised by the uptick,” says Gail Gottehrer, a litigator in the New York City office of Axinn, Veltrop & Harkrider LLP, whose practice includes employment law. It’s gotten harder for young people to land and keep jobs, and there’s been a workforce shift to more part-time and seasonable work. The cost of rent, food and other necessities is also a key determinant of student loan default rates, she says.

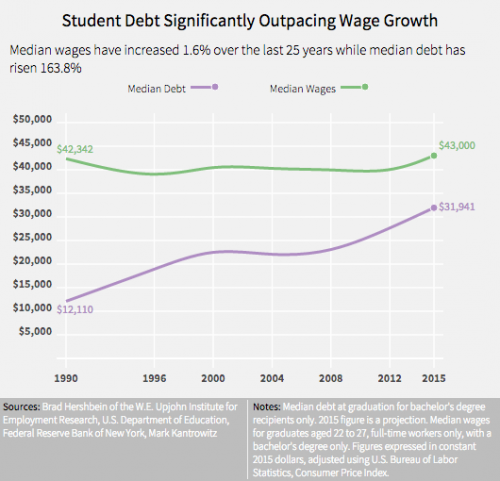

That's the real point here. The wages of students not keeping up with the cost of living and loans.

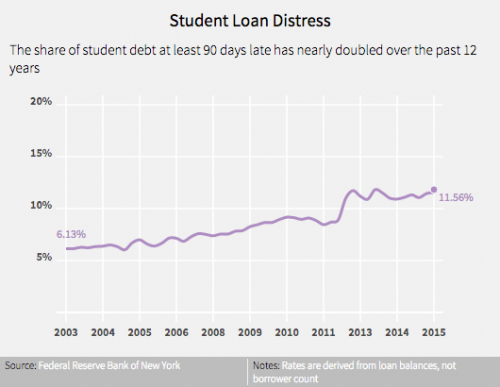

The fact that default rates are climbing despite there being an economic recovery is a flashing warning sign. What happens when we hit another recession?

This is not a sustainable trend, and it's only one of the unsustainable trends. Consider the rapidly growing Mt. Everest of student debt.

Student debt is increasing at the rate of almost $3000.00 per second.

Obviously those numbers are delusional. At the same time 2030 is not all that far away, which makes the idea of not reforming the system immediately delusional.

We can either completely reform the system immediately, or the system will crash the economy. That's it! There is no incremental solution available, nor is ignoring the problem an option. At least it's not an option without collapsing our public higher educational system first.

Even 65+ year old retirees are carrying student loan debt. That's insane.

It's amazing how badly the student loan industry is in need of reform. For instance, this is something I would never think of.

This is a common question we hear, “How am I suppose to pay my student loans while in prison?”.

This sort of "common question" is not a good sign.

Now you would think that student debts would automatically be put on hold while someone is in prison, but it isn't. Instead the prisoner is required to jump through many hoops just to request a forbearance or deferment, and if they don't do it right Gawd help them, because the federal government will come after them. Lord only knows how much taxpayer money has been wasted going after prisoners with no hope of repaying their student loans.

In these days of predatory capitalism, it turns out that the biggest, most ruthless shark in the ocean is the government.

when you do pay your loans, make sure you prioritize your federal loans above all other debts, because unlike other types of loans, the government only cares about your adjusted gross income and does not consider your cost-of-living expenses. Other lenders might be more understanding.

These are just some examples of how unreformed the student loan system is. Surely even Republicans could manage enough humanity to reform these parts of the system.

Comments

Perfect case study for a failed state.

How fitting that a state fails because it denies its citizens the most basic human and civil right — providing a full education for each as far as they can go. Investing in the human capital of education, is ironically the one human right that most rewards the state. This perverted exploitation of human rights and social well-being the US is the most poetic flavor of state self-destruction.

Do you know a strong nation where the people feel personally secure, and their children have a strong sense of well-being as they grow into adults? Do you know a nation where each generation is carefully nurtured and lifted up by the generation that came before; a society designed so that each new generation is provided with a secure foundation to become whatever they aspire to?

There are many nations that exist solely to benefit the citizens. The people write that idea at the very top of their constitutions. Many are rich nations, but many are not — and still they feed their people and provide shelter to those that need it. Nearly every nation on earth invests in the health of each and every citizen, because health is the source of freedom and the foundation for national strength and security. And, even the poorest nations put education front and center, not as a privilege of a few, not as a means to indenture a human life, but as a right and covenant a government makes to benefit the people as a whole.

I cannot imagine why people would form a government in the first place, if not to benefit themselves in every way possible.

This is crazy

link