What's wrong with this picture? Even more than normal

The world has turned upside down.

The nearly 13 percent gain this month means the S&P 500 is now up roughly 30 percent from its March 23 low...

Top Wall Street economists expect the second-quarter economic data to look, well, cataclysmic. J.P. Morgan economists, for example, believe the American economy will shrink at a previously unthinkable 40 percent annual rate in the second quarter. The Congressional Budget Office thinks unemployment could hit 16 percent by the third quarter.

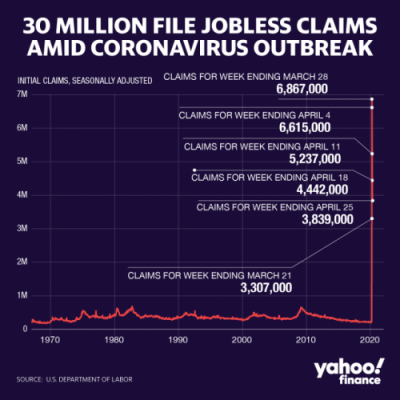

So 30 million lose their jobs, while stocks go up 30%.

Nothing like economic Armageddon to make someone think, "Now is a good time to buy stocks."

That in itself is loony tunes, but it gets even more bizarre when you look at who is buying.

"TD Ameritrade said last week that retail clients opened a record 608,000 new funded accounts in the quarter ended March 31, with more than two-thirds of those opened in March," WSJ reports.

"E*Trade saw a net gain of 363,000 accounts in the quarter — a company record — around 90% of which were retail."

"Charles Schwab Corp. reported a record 609,000 new brokerage accounts in the quarter, including individuals’ self-directed accounts and those managed by financial advisers."

So amateurs are buying. Poor people.

Probably many of the same people getting fired.

Huh!?!

It makes no sense...until you realize what ISN'T happening.

“This shoves us to a strange, but we think useful, conclusion,” Rabe writes. “The rush of retail investors into U.S. equities is at least partly a function of a world with no casinos, no sports betting to speak of (horses and ping-pong aside), and little to do outside the home.”The dopamine rush of having a full house, she says, is the same as “holding a hat-sized stock into an up 3% open on the S&P.”

It’s pretty far out, but there’s at least one example of this happening. Barstool Sports founder Dave Portnoy who said he switched from gambling to day trading and is down $647,000.

"I like betting on sports," Portnoy said on his radio show. "Sports ended, and this was something that was still going that I could do during the day."

This unprecedented dynamic creates a couple questions.

First of all, what do retail gamblers buy in stocks?

We have an answer to that.

The top stock right now on Robinhood is literally a penny stock, and 4 of the top 5 stocks owned on Robinhood are less than $7 per share. While there are occasional opportunities in low-dollar stocks, Robinhood customers systematically select stocks that are cheap, simply because they're cheap.

Gamblers like low-priced, risky stocks.

Not a surprise.

The second question we don't have an answer to yet.

But the data also leads him to wonder "what happens when the

US economy starts to reopen, and retail investors can go outside

and to work instead of sit at home trading?"

Comments

So many options.

Online gaming.

Casino's.

Lottery tickets.

Stock markets.

Home flipping.

The list goes on and on.

The only winning bet is to stay out.

Nice post gjohn.

Regardless of the path in life I chose, I realize it's always forward, never straight.

Great essay and analysis as always. n/t

The FED is pumping trillions of dollars into the stock market

IIRC $4.3 TRILLION, not billion in April alone. The NY Fed says they will buy stocks as neccessary to keep the market up. And rem,ember the FED has an unlimited supply of money. Unlimited. Like the Wiemar government.

Actually even easier because the Weimar government had trouble finding enough printing presses, but the FED can create quadrillions of dollars, quintillions of dollars with a few keystrokes.

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

You got a source for that?

I'm very curious. If true, why even have a stock market? You can't lose . . . You would think a stock market would need to have both winners and losers.

Fed

The NY Fed has said they will buy stocks as necessary to keep the market up, but they haven't actually done it yet.

Foreign central banks are buying stocks. For instance, the Swiss central bank was the largest holder of stocks in Apple at one time.

Paid newsletter

I've seen lots of changes. What doesn't change is people. Same old hairless apes.

It is essentially what has been happening since 2008

The ultra-low interest rates and quantitative easing coupled with the tax cuts for the wealthiest have distorted the economy. Stock prices have been pumped up artificially. Another way of looking at it is that the monetary policy has created inflation in stock prices.

Marketwatch

Don’t count on the Fed’s many emergency measures to rescue the stock market from coronavirus

" In the beginning, the universe was created. This has made a lot of people very angry, and is generally considered to have been a bad move. -- Douglas Adams, The Hitch Hiker's Guide to the Galaxy "

The stock market did the same thing in 1930

The crash of 1929 was followed by a huge gain, from a djia of 198 to 294 in April of 1930.

https://www.macrotrends.net/2484/dow-jones-crash-1929-bear-market

Then it continued to decline, but not without periods of gain. That's just the way it is in a crash. I guess some people can't believe that it's a crash and think that there is a buying opportunity.

If you don't know what you are doing you are going to lose a fortune. If you know what you are doing you are going to lose a fortune.

I think that the entire economic situation in the US is grim. We haven't seen anything yet.

Capitalism has always been the rule of the people by the oligarchs. You only have two choices, eliminate them or restrict their power.

Retail accounts for a tiny fraction of market activity

and, while trading (i.e. "actively" trading) is not a good idea for basically any individual, the notion that these newcomers are somehow propping the market or responsible for more than a small fraction of that 30% bump, is not something I see a lot of empirical support for.

The vast majority of contributing factors to the price of a stock are the large institutional traders making their almost entirely automated trades.

So what's going to happen when retail traders can get their gambling fixes elsewhere? Not much--they'll have lost some (most/all) of their money and likely not learnt a lesson, but the stock market itself won't even notice. Not even a little bit.

KISS, keep it simple - answer to your question: everything /nt

https://www.euronews.com/live