Trickle Down is Toxic

Since the 1980’s, part of the Conservative creed has been the belief that greater good would arise from giving our wealthiest even more wealth. The assumption was that it would eventually “trickle down,” to everyone’s benefit. But there’s evidence that the belief was wrong and the creed was harmful.

The government’s long experiment with “trickle down” economic policies has had one obvious result: it has created even greater inequality of income and wealth. Does it matter? It doesn’t matter to the nation’s wealthiest corporations and individuals, the “1%.” They’ve become even more wealthy. But what’s happened to the other 99%, to the country as a whole?

In 2011, epidemiologists Richard Wilkinson and Kate Pickett published The Spirit Level, in which they examined the degree to which differences in income inequality among the wealthiest nations could be associated with various social problems. They found that greater national income inequality was significantly related to several harmful social phenomena, including

• lower levels of trust,

• higher rates of mental illness,

• greater use of illegal drugs,

• greater infant mortality,

• lower average life expectancy,

• higher rates of obesity,

• lower education scores,

• higher rates of teenage pregnancy,

• higher homicide rates,

• greater rates of imprisonment, and

• lower social mobility.

Pickett and Wilkenson suggest that nations with extreme income inequality might be able to reduce their level of income inequality by acting to "plug tax loopholes, limit 'business expenses,' increase top tax rates, and even legislate to limit maximum pay in a company." However, Pickett and Wilkinson prefer an institutional solution: encouraging the creation and spread of corporations in which employees have a share in ownership and management.

Of course, their analyses have been criticized and questioned. Their responses can be found both here and at the end of their book’s latest edition.

They have just recently published a sequel, The Inner Level, in which they present research indicating how greater inequality also harms people psychologically.

Meanwhile, British economist Stewart Lansley has been busy analyzing how gross income and wealth inequality has hurt national economies. He’s published a book titled The Cost of Inequality about this, as well as several articles (see here, here and here). Lansley supports the view that the increasing inequality of income and wealth in the U.K. and the U.S. is due to their decades-old policies of deregulation, tax cuts and union-busting. Government leaders assumed that giving corporations and wealthy individuals more freedom and more wealth would lead, ultimately, to prosperity for all. Lansley says that the increasing wealth and income inequality actually created three major economic problems:

- In reality, not enough trickled down to maintain demand. Wages didn’t rise as much as production. The effect was a dramatic increase in indebtedness.

- The increased income and wealth enjoyed by corporations and a wealthy minority was NOT used to enhance production so much as to engage in financial speculation and corporate takeovers. This quest for quick profit led to asset “bubbles,” which increased the risk of a financial crisis.

- With their increased income and wealth, corporations and a wealthy minority were also able to increase their political influence and obtain government policies which favored their interests.

What should be done? Lansley says that “the great concentrations of income and wealth need to be broken up – just as they were in the 1930’s.” More specifically, he believes that governments need to add and monitor economic indicators for ratios of pay [going to the top 1%], for the share of profit going to wages, for concentration of income, and for patterns of average tax rates within the population.* For each indicator the government would set a target historically associated with economic stability, and deviations would trigger responsive government actions [presumably like the Federal Reserve does with respect to monetary conditions]. He suggests that nations can reduce their gross income and wealth inequality by also creating “social wealth funds.” He describes these as “collectively owned pools of wealth,” or “public ownership funds,” created on the basis of public sector assets. Lansley notes that social wealth funds could used for direct economic and social investment, to strengthen public finances, to ensure that gains from economic activity are shared by all, and even to provide citizens with dividend payments. He points to the Alaska Permanent Fund as an example of what he means.

Perhaps the strongest voice against gross inequalities of income and wealth is that of Joseph Stiglitz, the Nobel Prize-winning U.S. economist and author of The Price of Inequality: How Today's Divided Society Endangers Our Future. In this book, Stiglitz also identifies specific ways in which the government’s enactment of “trickle down” economic policies itself created national economic problems. As discussed earlier, the “trickle down” approach emphasized deregulation of industries and markets, as well as tax cuts for corporations and wealthy individuals. Our national economy has paid dearly for this experiment, he says:

- Deregulation enabled deceptive accounting, unconventional banking practices and riskier investments. These conditions enabled the rise of financial bubbles, which eventually burst, with devastating effects on the national economy. In their wake, the nation experienced deep financial losses and higher unemployment.

- Reduction of tax revenue, combined with a disdain for government spending, has led to reduced government investment in infrastructure, education and research. Stiglitz maintains that this has amounted to underinvestment in goods and services that benefit all of us.

- Reduced public investments, such as for education, have reduced economic mobility in our population. According to Stiglitz, the children of poor and middle-income families have a lower likelihood of getting a good education than children of the rich. For the nation, that means our population will not be as productive as it could be.

- A large portion of our income and wealth inequality has been due to “rent-seeking.” People and corporations have focused on ways of getting more money from ownership of something, rather than from producing something. Stiglitz says that this focus has increased the prices and fees we are charged for things like medicine, health care, credit cards and cell phone service. He notes that the rates we pay for these goods and services are higher than the rates paid in other countries for the same things.

- Studies which have analyzed economic growth in a range of countries and over long periods of time have found that higher levels of income and wealth inequality are associated with lower levels of economic growth.

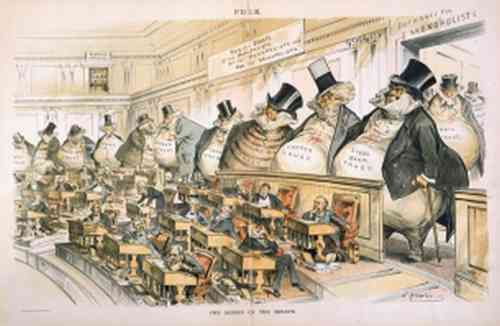

- The increased income and wealth of the top 1% of the population has allowed them to get laws, regulations and government actions which benefit them. The remaining 99% of the population often pays the price for that [for example, with more pollution]. But the corporations and individuals in the top 1% will have obtained a lot of concessions to minimize the harm to them.

- The increased income and wealth of the 1% has also allowed them to control information media to their benefit. As a result, there is less trust in the information provided about the economic and political system. That’s bad for a democracy. Voters are supposed to be able to make informed decisions.

- A majority of Americans perceive their economic and political system as favoring the wealthy, and therefore unfair. That perception decreases their trust, and negatively effects their economic and political activity. People are less willing to cooperate. Their cooperation may be compelled by force or threat of force, but having to compel them will diminish their productivity, efficiency and participation. They may be more inclined to agitate outside the system.

The remedies proposed by Stiglitz are basically legislative acts and regulations designed to end the privileges and advantages enjoyed by the nation’s wealthiest corporations and individuals, as described above. It’s a rather long and detailed list. Here’s an abbreviated, partial list of his suggestions:

- in the financial sector, restrict leverage and ensure liquidity, require transparency in derivatives, and limit the interest rates on consumer loans

- there also ought to be some control over international capital flows, especially those involved in short-term speculation

- stop the revolving door between working on Wall Street and working in Federal administrations

- follow a monetary policy which focuses on growth and full employment, rather than inflation

- make bankruptcy laws more debtor-friendly [rather than lender-friendly, as now]

- close off avenues for tax evasion and tax avoidance

- end government “giveaways,” corporate welfare, and subsidies hidden in tax code exemptions

- create a progressive tax code, one which taxes speculation and inhibits the maintenance of an oligarchy [AB: a “caste of the 1%”] with estate taxes

- “tax corporations that operate in the United States on the full basis of the profits they derive from their sales in the United States, regardless of where their production occurs”

- tax pollution

- grant tax credits for private investments that save jobs and save natural resources

- use public funds to increase opportunities for education [of the 99%], especially at public and non-profit institutions

- invest public funds in those areas which historically increased economic growth – infrastructure, education and technology

- ensure that health care is available to all

- strengthen the social safety net

- stop efforts to suppress voting, and make it easier to vote

- enact real campaign finance reform laws

- support labor unions

- create a “Chapter 11”-style bankruptcy provision for homeowners

I don’t know whether these actions will reduce income and wealth inequality and remedy the social and economic harms we’ve experienced, but I think they’re worthy of consideration. I am sure of one thing: recovery begins when you recognize the problem and resolve to stop doing what got you there.

* It could be a good idea for the Department of Labor also to monitor pay and employment rates associated with education levels and minority categories.

Comments

Trickle down is a myth

Defining "trickle down"

the elites shitting in their pants,

creates the highly touted "trickle down" effect.

As for the suggestions made to end trickle down

weren't they all in pretty much effect until raygun

started dismantling them hence the demise of amerika

That was early in the game, now we are reaching the end

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

No one really believes in "trickle down" economics

Saying that congressmen and conservatives 'believe' it, is scapegoating the real truth. The truth is that they are all corrupt and morally bankrupt and they are simply rigging the system to transfer wealth from the commoners to the rich (aka Tinkle Down).

They better build the gates high on their gated communities, cause when the shit hits the fan , it's gonna get ugly.

Donnie The #ShitHole Douchebag. Fake Friend to the Working Class. Real Asshole.

Ditto

"No one really believes in "trickle down" economics. ... The truth is that they are all corrupt and morally bankrupt and they are simply rigging the system to transfer wealth from the commoners to the rich."

Yes, it's a myth, it's a fantasy, it's a fairy tale. Like Santa Claus, there is no evidence it is real, the story is told to placate the ignorant. Those in power have always known the truth. And now that the play "Capitalism" is drawing to a close, figuring out the who-done-it-mystery at this point is merely stating the obvious and a rather moot point.

Reformed sentencing laws

would go a long way in stopping white collar crime.

Steal a;

Hundred dollars- 5 days in jail

Thousand dollars- 5 weeks in jail

Hundred thousand dollars- 5 years in jail

Million dollars- 20 years in jail

Hundred million- 50 years in jail

Billion dollars- capital punishment

And NO CEO immunity!

Slowly, but certainly, the "Greed Gene" will be excised from society.

IMHO

Thanks for the essay, Alex.

Neither Russia nor China is our enemy.

Neither Iran nor Venezuela are threatening America.

Cuba is a dead horse, stop beating it.

But so much

of the destructiveness that is foisted upon us by the wealthy is legal.

dfarrah

Trickle down, otherwise known as...

Thank the King when he passes, for he may throw gold to the crowd.

The question shouldn't be how to get the king to give more gold to the crowd.

Questions should be about why this jerk is calling the shots in the first place.

I do not pretend I know what I do not know.

This is sane and well thought out

and your final list is golden as far as it goes, but so much has been known, or at least intuited, this having gone on for decades. The one thing that comes up all the time is some form of socialism. If that can be redefined as something else...I don't have a name for it.....safety net? a collection of the things the most powerful unions gained for themselves, but for everyone, and portable. Employee owned companies are ok, but still chain the member/employee to the company, and they can fail, too. Having a bag of defined benefits, health care, maternity leave, generous unemployment, decent education, I dunno, fill it in, would give the people room to take a chance, on a move to another state, a chance to start a small business, reeducate for a new career. If you have to work for a living the minute you're out of work, you're essentially dead. If you are lucky you'll find another job at the same or better pay. If you don't it will deplete you forever. There are too many things that can flatline you before any help arrives.

Richard D Wolff

When and why capitalism will end

(17 min)

Stop Climate Change Silence - Start the Conversation

Hot Air Website, Twitter, Facebook

Mr. Wolff is not an economist

an economist is like an Oncologist and a Radiologist discussing a cancer. They don't take the patient, who this cancer belongs to, like economists don't take into consideration their machinations on the citizens of the countries they belong to. He looks through the right end of the telescope and sees it from the point of view of all citizens. He is "one of us". Economists are just as happy to evaluate how genocide will boost the GDP. F' em all.

I would add

bring back laws against price gouging, and consumer protection laws. Price controls for housing and health care/prescriptions need to be in place. Laws so people have some recourse if they buy a shitty product with defects (for example, used vehicles) that the company was proven to be deceptive about to make the sale.

This shit is bananas.

Capitalism is toxic.

[video:https://www.youtube.com/watch?v=XQe3e94PzWo]

Modern education is little more than toeing the line for the capitalist pigs.

Guerrilla Liberalism won't liberate the US or the world from the iron fist of capital.

Good one

They said the Greeks had a workable system of capitalism, before the Romans. Only couple of thousand years for them to refine it. Why are crimes against humanity only assigned to war criminals?