Taxpayers subsidize billionaire real estate developers

What's a yacht-owning billionaire to do when he wants to take part in the booming buy-to-let market that has created an enormous rent affordability crisis? Why turn to the federal government, of course.

Barry Sternlicht’s Starwood Capital Group and Stephen Schwarzman’s Blackstone Group LP are in talks with Freddie Mac to finance two transactions totaling more than $10 billion, according to people with knowledge of the negotiations. Those discussions come after the government-owned mortgage giant already agreed to back Lone Star Funds’ $7.6 billion deal to buy Home Properties Inc. and Brookfield Asset Management Inc.’s $2.5 billion takeover of Associated Estates Realty Corp.

I know what you are thinking. "No sweat. We aren't anywhere near bubble prices, so it's a no risk loan."

Well, guess what?

U.S. multifamily-building prices are 33 percent higher than they were at the prior peak in 2007, according to Moody’s Investors Service and Real Capital Analytics Inc., a jump stoked partly by the abundant financing from Fannie Mae and Freddie Mac. That’s raised concerns that a bubble is forming that might pop when interest rates rise, according to Levy, the investment banker. Taxpayers could be on the hook for losses incurred by the mortgage companies if apartment values were to fall sharply.

Hmmm. Affordability at crisis levels. Prices at record highs. Fannie and Freddie subsidizing wealthy investors.

Where have I heard all this before?

Let's look deeper.

Fannie Mae, the US government owned mortgage giant has rolled out a new program called Home Ready.

Borrowers that they can obtain a 3% downpayment mortgage with no minimum cash contribution. And why not? If this doesn't work the taxpayer will pick up the tab.

Oh, wait. They got that covered too.

(MarketWatch) — Fannie Mae and Freddie Mac are at risk of needing an injection of Treasury capital after the latter reported its first quarterly loss in four years, the director of the Federal Housing Finance Agency said Tuesday.

FHFA Director Mel Watt issued a statement following mortgage-finance company Freddie Mac’s $475 million third-quarter loss, its first quarterly loss in four years.

“Volatility in interest rates coupled with a capital buffer that will decline to zero in 2018 under the terms of the senior preferred stock purchase agreements with Treasury will likely make both Enterprises increasingly susceptible to the possibility of quarterly losses that could result in draws going forward,” Watt said.

Freddie Mac said its loss was driven by interest rate changes that soured the value of derivatives it holds.

So Fannie and Freddie are subsidizing billionaire real estate developers at bubble prices, while at the same time getting bailed out by taxpayers due to losses on a largely unregulated derivatives market. Interesting.

This sounds vaguely familiar. Give me another hint.

Fannie Mae recently lowered lending standards.

No credit score? No pay stubs or tax records? No problem.

To put this into perspective, this is what Kevin Watters, CEO of Chase Mortgage Banking, had to say.

"FHA requirements are down to a 520 FICO (credit score) and you only have to put 3.5% down; that's subprime lending, and we're not in the subprime lending business," CNBC quotes Watters saying.

But what matters is that Fannie and Freddie are making homes for affordable to everyone, right? How's that working out.

It's on the tip of my tongue. Wait! Don't tell me. Let me guess. Give me another hint.

House flipping is back.

According to data from RealtyTrac’s Third Quarter 2015 Home Flipping Report, the percentage of flipped homes in the U.S. rose by 18 percent during Q3....Why so many properties being flipped? Quite simply, because it’s profitable now. According to RealtyTrac, there was an average $62,122 difference between the purchase price and flipped price, not including rehab costs.

I've almost got it. Just one more hint.

Commercial real estate prices are now officially higher than they were during the bubble years, Moody’s/Real Capital Analytics reported this week.

Led by solid increases in prices of multifamily and office buildings in Central Business Districts (CBDs), the adjusted Moody’s/RCA all-property price index rose 1.5 percent above a high-water mark established before commercial real estate prices collapsed eight years ago.

There are very big differences this time around. The biggest difference is that the poor and subprime have been left out of this echo bubble. Even at artificially low interest rates, the poor and first-time homebuyer has been unable to buy into this bubble.

This land rush is being done by the cash-flush wealthy. Which means that this bubble will play out in a very different way.

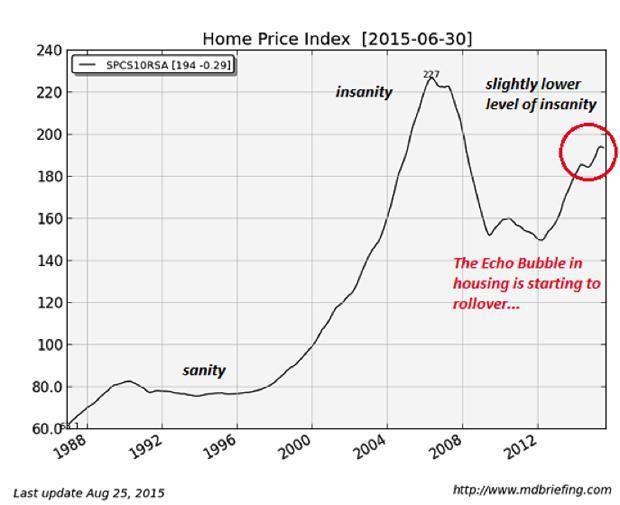

I know some will take offense at my using the term "bubble", especially since the price of single-family homes is significantly below the 2007 peak, but that misses two very big points.

First of all, this is a bubble by the wealthy, so the bubble prices are showing up first in commercial real estate and multi-family homes. In other words, larger, more expensive purchases.

Secondly, even if prices are below 2007 levels, they are only slightly less insane.

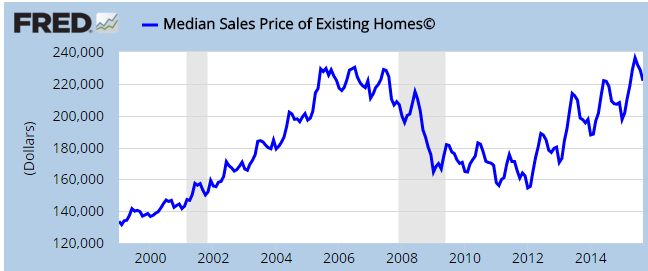

Home values have jumped 34 percent since reaching a bottom in early 2012, making purchases more expensive for entry-level buyers.

Home prices are increasing at 13 times the rate of wages. The Housing Affordability Index dropped 12% in just the first five months of 2015.

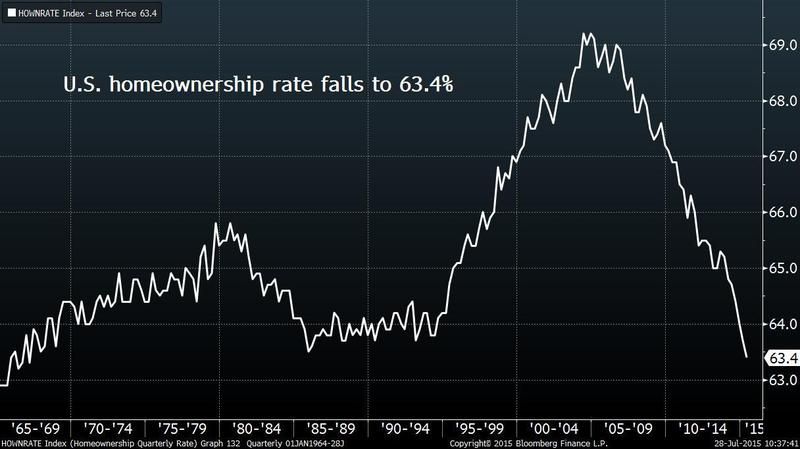

Fewer people owning homes should mean less pressure on prices to move up, but that's not what's happening. For that reason we need to look deeper into this story.

How is it possible that the price of a commodity (i.e. housing) can increase so much faster than the ability of people to afford it?

Enter the investor.In many markets, the housing recovery has "largely been driven over the last two years by buyers who are not as constrained by incomes -- namely the institutional investors coming in and buying up properties as rentals, and international buyers coming in and buying, often with cash," Daren Blomquist, vice president at RealtyTrac and author of the report, said in an interview.

In other words, inequality is driving this trend. The wealthy see housing as an investment, while the working class see it as a necessity. Blackstone alone owns 150,000 homes that it bought in order to rent to working people. Most of those homes were foreclosures, which Blackstone then rents to people who were often previously foreclosed on. Wealthy foreigners are also buying up tens of billions of dollars worth of houses every year.

It's not a coincidence. Housing is one of the most heavily, taxpayer subsidized sectors of the economy. The public benefits fall disproportionately upon the wealthy, while the poorest are left out almost entirely.

The rational decision would be to stop publicly subsidizing an asset class with disproportionately high prices that is causing general suffering amongst the working class. But politics dictate that this won't happen.

To be fair, this echo bubble has allowed Fannie and Freddie to pay back the entire cost of the 2008 bailout, and more. But these enormous companies have remained unreformed, and the taxpayer continues to be on the hook for almost the entire secondary mortgage market.

Most people have forgotten that in 2008 Fannie and Freddie failed the week before Lehman Brothers did, and in doing so they triggered the enormous financial dislocation that brought down the derivatives market.

Comments

Taxpayers subsidize billionaire Middle East despots, too

From the U.S. State Department website: http://www.state.gov/s/d/2015/249031.htm

Meteor Blades' sig line would seem to apply:

"Don't tell me what America believes; show me what America does and I'll tell you what America believes."

Great article on housing gold rush by billionaires

I live in a suburb of Columbus, OH. The town is Worthington. It has a population of less than 20,000 and is inside the beltway so it is benefiting from the trend of people moving closer to the downtown of Columbus and other stuff inside the beltway.

The housing boom has hit our village (as it used to be called). Our subdivision was built in the 1950's and right near to us is a house that gives white elephant a bad name. It has white siding and fake rock glued on it and is gigantic. It stands out like a white elephant.

We just had a community action and a vote to limit development here. The developers were looking at multi story developments anywhere they could do it. A piece of property owned by the Methodist Church, a former children s home, right in the center of town has a proposal on the table to put 500 units in that space. That is going on.

Our zip code is at the top of the chart - the second fasted zip for home sales in the country. The excellent schools have made our neighborhood a safety hazard - you have to be on your toes to not be run over by a stroller filled with kids. The houses in the area are small, but anywhere they can it seems that the drive to a monster home (even small monster homes) and making $ on rising home prices, seems to bring out the gold seekers.

A book that is well written, but took me some time to get through because it is so complex, describes the last housing crisis. It is written by the NYT journalist who has a column on the Sunday business section. "Reckless Endangerment: How outsized ambition, greed and corruption created the worst financial crisis of our time" by Gretchen Morgenson and Joshua Rosner. Published in 2011 and signed by the author on Aug 4, 2012.

The politicians and the banks and the rating agencies, and yes Freddie and Fanny, were all mixed up in the mess.

And now it is happening all over again and being supported by the corporate state.

The journalist and environmental activist, George Monbiot, who publishes in the Guardian had an article on Nov 4 that was mostly about the global, corporate coup d'etat riding under the banner of "trade" deals.

Here is the subtitle of the article

Banks and corporations are being liberated from the rule of law, and are ripping the world apart.

And are the first three paragraphs. The first paragraph describes the issue we are facing

How to Build a Crisis

http://www.monbiot.com/2015/11/04/how-to-build-a-crisis/

Housing affordability

Check out this article.

Is this ever

a timely subject that hits close to home (literally) for me. Thanks gjohnsit. Crazy how our city government in cahoots with developers, bankster investors, and realtors from out of state or places like Shanghai is demolishing Portland for 'green' development. They use the need for housing density as a talking point but then tear down affordable housing rip out old trees and put up rabbit warren ugly toxic apts and condo's or gigantic urban tall Mac Mansions. A nother selling point they use for demolishing and rebuilding Portland is that this is green, as apparently we're going to have hoards of climate refugees flood the city. What kind of refugee can afford an 1,800$ single in a slapped up toxic 100 unit slum of the future? Global urban gentrification that is nothing but a r upping of the housing bubble machine. Our property have tripled in the last three years making our affordable mortgage payment affordable.

I belong to a FB group called Stop Demolishing Portland. It's membership is swelling as they are stepping up the process and the city refuses to do anything to slow this down. We get on the average about 4-5 letters a week that are from investors developers or realtor's that say 'A nice couple is interested in living in your neighborhood and want to buy your tired old house......' The bottom half of the letters are the giveaway they all say no fees or closing costs, as is, and we pay cash immediately. When they rip down the old buidling and put up the chain linked fences to start building it's enlightening to see the signs they display on the fence. Lot of too big global banks, law firms, investment companies, and builder's from out of state. You'd think they would not blanantly advertise on their 'projects' just who and what they are.

Commoditization of the basics of living

We have far too long silently subsidized development in this country through the provision of public services such as water, sewer, roads, and other public amenities. The reason given for this is it has been that cities (or other governmental entities) supposedly recover those costs through the expansion of the tax base. In a way, it is a pyramid scheme with those at the bottom being the ones who bear the largest brunt of those costs.

Because of our taxation policies in which we tax unearned income at a lower rate than income from labor, now we have created enormous wealth for a few. With all of this excess wealth highly concentrated in the investor class, they are heavily investing in the basics of living: our food, housing, health care, and even our water which leads to price manipulation and price gouging.

What we really need is a much more progressive system of taxation, fewer tax breaks which have amounted to subsidies of the investor class, taxation of unearned income at either the same rate or higher rates than income from labor, and greater regulation of development to prevent the demolition of existing affordable housing stock, among other things. Every human being should be entitled to food, water, health care and shelter without worrying if they can pay for it.

Governmental policies create wealth and the unequal distribution of wealth and it will take major changes in governmental policies and taxation to stop the commoditization of the basics of living.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy