The NFT scam is over

Submitted by gjohnsit on Sun, 07/03/2022 - 4:40pm

Non-fungible tokens (NFT's) were always just the sidekick of the cryptocurrency hype.

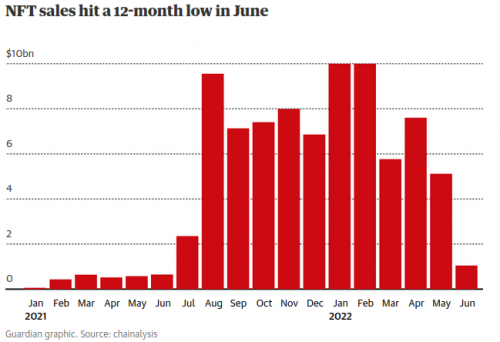

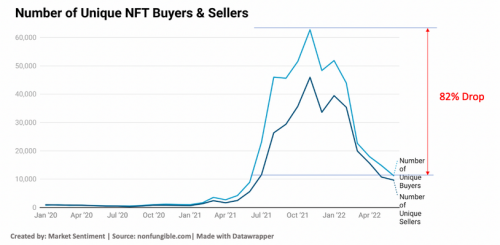

Now with the crash in cryptocurrencies, the NFT market has almost completely shut down.

Sales of NFTs totalled just over $1bn (£830m) in June, according to the crypto research firm Chainalysis, their worst performance since the same month last year when sales were $648m. Sales reached a peak of $12.6bn in January.

“This decline is definitely linked to the broader slowdown in crypto markets,” said Ethan McMahon, a Chainalysis economist...

The cryptocurrency market, worth about $3tn last November, is now worth less than $1tn.

As for Bitcoin, a majority of holders of Bitcoin are now underwater.

Comments

I never even looked into them enough to inform myself

I have a hard enough time investing in broad sectors of the economy, let alone a new currency that fluctuates. A brother in law was doing mining or something. Had computers that somehow stored info down in TX where electricity is cheap. Sounds like a way to polute.

No Shortage of Fools

If these people who invested in NFTs are looking for another "investment", they can purchase Cabbage Patch Dolls from 1978-1985 for $1,500-$1,800. At least they will have something they can hold.

I never understood nfts

And didn't work too hard on trying to understand! So I feel pretty good that I didn't waste my time

"It's internet dibs"

I can't find the video now, but I saw someone describe it like that about 2 years ago.

Dibs! Like when you are a kid and your brother called "dibs" on the front seat of the car, so you had to sit in the back.

It's like that.

One thinks --

of Robert Brenner, whose initial claim to fame was as a historian of the beginnings of capitalism, but who published two books, The Economics of Global Turbulence (originally published 1999 in NLR) and The Boom and the Bubble, in which he described the neoliberal economy of the early 21st century as characterized by a vast surplus of capital -- investment funds with nothing to invest in. So apparently the forces of capital were today so desperate to find an outlet for all that capital that they were "investing" in cryptocurrencies and NFTs. No wonder it's all for nothing, tho.

"The Resistance will be patchwork at first, but we’ll find each other

quickly, a constellation flickering to life.." -- Malcolm Harris

I thought

NFTs were sort of a purchased copyright, like on Mickey Mouse or bestowing an "original" designation for an item like the Mona Lisa. Then the holder of the NFT could hire an army of lawyers and going around suing people for unauthorized copies and making a fortune. We'll have to pay to watch cat playing piano videos on youtube.

Wait, forget you read that.