News Dump Sunday: Central Bank Insanity Edition

Submitted by gjohnsit on Sun, 03/20/2016 - 2:54pm

We've already joined Alice in Wonderland and no one noticed.

the unthinkable.

Faced with political intransigence, central bankers are openly talking about the previously unthinkable: "helicopter money".

A catch-all term, helicopter drops describe the process by which central banks can create money to transfer to the public or private sector to stimulate economic activity and spending.

Long considered one of the last policymaking taboos, debate around the merits of helicopter money has gained traction in recent weeks.

ECB chief Mario Draghi has refused to rule out the prospect, saying only that the bank had not yet “discussed” such matters due to their legal and accounting complexity. This week, his chief economist Peter Praet went further in hinting that helicopter drops were part of the ECB's toolbox.

"All central banks can do it", said Praet. "You can issue currency and you distribute it to people. The question is, if and when is it opportune to make recourse to that sort of instrument".

...

For some observers, the next phase in extraordinary central bank action is already upon us, and it is Japan which is leading the way.

The Bank of Japan’s move to impose a three tiered deposit rate on banks is a covert attempt to inject funds directly to the private sector, argues Eric Lonergan, economist and hedge fund manager.

He notes that the BoJ's decision to exempt some reserves from the negative rate represents a transfer of cash to commercial lenders at rate of 0.1pc.

The system "separates out the interest rate on reserves from that which affects market rates”, says Lonergan.

"It is taking the first step along the journey towards helicopter money and opens up a whole new avenue of stimulus”.

Helicopter money is the very last bullet in a central banker's weapon. There is simply nothing left.

The European Central Bank's negative interest rates are sparking demand for safe deposit boxes, where bank customers can store cash to avoid the prospect of paying the bank interest on their accounts, German bankers said.

The ECB last week cut its main interest rate to zero and dropped the rate on its deposit facility to -0.4 percent from -0.3 percent, increasing the amount banks are charged to deposit funds with the central bank.

"Lockboxes are in vogue," Hans-Bernd Wolberg, the chief executive of German regional cooperative lender WGZ, told a news conference on Thursday.

The Japanese already went there

Remember when we used to worry about this?

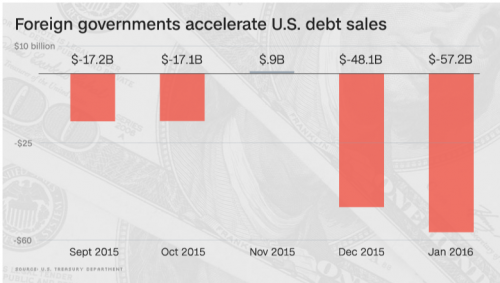

In a bid to raise cash, foreign central banks and government institutions sold $57.2 billion of U.S. Treasury debt and other notes in January, according to figures released on Tuesday. That is up from $48 billion in December and the highest monthly tally on record going back to 1978.

It's part of a broader trend that gathered steam last year when central banks sold a record $225 billion of U.S. debt.

For instance, China has been liquidating its holdings of foreign debt to pump money into its slowing economy, plummeting currency and extremely volatile stock market. China, the largest owner of U.S. debt, trimmed its Treasury holdings by $8.2 billion in January, the Treasury Department said. The actual decline was likely larger considering China reported selling $100 billion of foreign-exchange reserves in January.

Home prices in Beijing, Shanghai and Shenzhen have surged by 20-30% since the Lunar New Year in February, according to state-controlled media. In Shenzhen, prices have increased by more than 70% over the past 12 months.

This is not the first time China is facing a property bubble. But one thing makes this time around different – unregulated lending.

Previous upswings were not driven by leverage, McCord explains. The norm was that people did not finance the maximum allowable level. They financed, on average, half of the cost – even if 70% or 80% was allowed. Therefore, mortgages did not play a role in driving up demand or prices.

“Now, we believe there are more buyers using the maximum available leverage,” he says. “For homebuyers, it is easier than ever to get mortgages.”

But more important, McCord adds, the downpayment itself is today often being financed through peer-to-peer lending channels.

“This is not the norm yet, but it’s appearing and it makes us uncomfortable,” he says. “This means some buyers are buying with zero down.”

In his view, peer-to-peer lenders are basically another form of high-interest “loan shark.”

While current political polls and even online gamblers say that Donald Trump is a longshot for the Oval Office, a Stony Brook University professor says his calculations show the tycoon is almost certain to win the election.

Prof. Helmut Norpath, appearing on Fox and Friends this morning, says Trump’s odds of winning the presidency are between 97-99%. Norpath says his calculations are based on historical models of primaries that have proven largely accurate for over 100 years.

Norpath says his model has only fallen short on one election since 1912 – the Bush-Gore race of 2000 (when Gore, in fact, won the popular vote).

Comments

damn.... n/t

Please help the Resilience Resource Library grow by adding your links.

First Nations News

A perfect storm is on the horizon.

We all better hang on. This isn't going to be pretty or smooth.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

well my raggedy sister ann

you already know how I feel about money ... that it is one of the cruelest belief systems ever visited upon humanity. If you think about it, we are born into debt slavery to pay off the interest on money we haven't even earned yet.

Money is just a belief system. It's just pretty pieces of paper that reflect your belief that is has value, rather than representative of value. The fact that people are locking up their cash is proof that people have decided that money, itself, has value, rather than representative of value.

All we have to do is STOP BELIEVING IN MONEY.

Sounds easy but alas, we are a funny species, we perpetuate our enslavement.

So true, angel d.

I used to teach my students about money. When we discussed that money only holds value because we say it does flabbergasted them every time. "In God We Trust" my ass!

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

Well, until Nixon you could take US$ to the bank and leave with

silver--said so right on the currency (the value of precious metals is, of course, also a matter of agreement). From Bretton Woods to petrodollars. Heads of state (status as tyrants or dictators seems irrelevant) who threaten to trade oil outside petrodollars, jeopardizing the US$ as the world's reserve currency, are dealt with summarily after such announcements. Examples: Saddam and Gaddafi.

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

Indeed.

My students all thought we were on the gold standard. Their readings were interesting and they would become quite animated about that Nixonion era.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

negative interest rates

but, but, but it can never, ever happen! Not sure this is the end game from refusing to properly address (jail, ruin, claw back) the banking, insurance, and rating fraud from the last crash. But then since this could never happen I have no idea what the end game might be besides financial market collapse. Interesting times indeed.

"Ah, but I was so much older then, I'm younger than that now..."

Bernanke's already floating the idea.

See here: Brookings

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

IIRC

one of the recent past Fed meetings had this as one of the topics. I don't remember the specifics but my take away is they understand there are some scary implications when a large portion of the developed world has gone negative, some quite a while ago. There was also consensus opinion that it was much danger of needing to go negative in the US and that we were not greatly threatened by it in the rest of the world. The problem with that thinking is that we are in uncharted waters with no understanding of what follows or how to get out of this mess. We already know we are all in it together so a threat to world financial security is always a threat to us.

"Ah, but I was so much older then, I'm younger than that now..."

It's bizarre to me

how little attention NIRP gets.

The one thing I've learned from following economics for the last 20 years is that when something makes no logical sense at all, then it won't last.

How it ends I can only speculate on, but it will end. Without a doubt.

Several topical links for any who are interested

This is a good conversation for input from katiec from The Other Place. I hope she finds her way here.

The Fed Wants to Test How Banks Would Handle Negative Rates:

http://www.bloomberg.com/news/articles/2016-02-02/rates-less-than-zero-i... [this interview is from early Feb.]

From Morgan Stanley at Davos: “We should move quickly to a cashless economy so that we could introduce negative rates well below 1%.”

And continuing advances toward a cashless society, with fees charged to access and spend data points designated as "money" in the absence of material currency and natural choke points that control all non-material wealth:

www.infowars.com/… The cashless society cometh

www.nytimes.com/… In Sweden, a cash-free future nears

"It is no measure of health to be well adjusted to a profoundly sick society." --Jiddu Krishnamurti

Sandernistas

List of candidates

Coat tails.

I've been advocating that for months. How could it not happens? People are dying to come out of their shackles. Bernie is showing them the way.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

I'm pretty sure I asked you

to stop scaring the crap out of me last week. If you're going to post this stuff, can't you at least throw some puppy and unicorn pictures in there to soften the blow?

The thing that amazes me is that the whole scaffolding hasn't already fallen to the ground, but it looks like all the spit and glue in the world isn't going to hold them up this time...I don't supposed you have any suggestions besides a safe deposit box? For those of us who understand the basics of this disaster but have no idea how to take care of themselves?

Thanks for another enlightening (and terrifying) post

gjohnsit...everytime you post one of these informative

$$$diaries, I pass my computer over to my hubby "my money guy" because I know it is important information. But, I always say him to "take it in, but don't tell me!" Thanks for these diaries...I think.

Truer words were never spoken....

I know just enough to be dangerous... and a lot of what this diary talks about causes my eyes to glaze over (I am mathematically challenged)....but I understood this...

Please help the Resilience Resource Library grow by adding your links.

First Nations News

Anybody else read "Killing the Host" ?

It's Michael Hudson's newest. From the Intro:

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

People are getting back on the

credit card bandwagon. It enslaves us. We must stop feeding that monster because it is insatiable.

"The “jumpers” reminded us that one day we will all face only one choice and that is how we will die, not how we will live." Chris Hedges on 9/11

I've not owned a credit card in 15 years or so...

I used to have them all...and a AAA credit. When I was downsized I paid them all off and canceled them. It is difficult to do things these days without credit, but it can be done. You just have to get creative and learn what you can do without.

Please help the Resilience Resource Library grow by adding your links.

First Nations News

It's staying afloat because the role is being passed . . .

. . . from economy to economy, from the US to Japan to China to Europe and around again. Like a hot potato, as long as no one central banker has to hold the strategy all by himself for too long, the fiction that it's okay will be preserved because in a couple of months it'll be another nation's central banker who holds a hotter potato. The bankers are convincing each other to go this far because (a) they have nothing else, and (b) they'll assuredly be relieved of any blame for their own complicity in nonsense when their hot potato is cooler than the next banker's.

And no, it cannot last. But none of this should have lasted this long. It's just a biding of time until some other schmuck has to singe his palms.

Gjohnsit, you were one of my favorite writers at TOP

I'm so glad to see that not only are you here, but you are are one of the main writers for the site.