It's been 10 years since the crash. What have we learned?

Nothing says fraud like "financial wizardry". And nothing says financial wizardry like a brand, new way to sell a risky financial product to the ignorant rubes.

After revolutionizing the way investors buy everything from equities to gold, ETFs are now threatening to disrupt the trillion-dollar market in credit derivatives.A decade on from the financial crisis, a London-based provider of passive products is testing whether the speculative trading strategy has appeal beyond a rarefied group of institutional debt investors.

...

The prospect of bringing speculative credit trading to more mainstream investors -- even the Mom and Pop crowd -- would displease Pope Francis, who rebuked the market in May as a “ticking time bomb."

Retail investors speculating in credit default swaps. The same derivatives that crashed the global financial system. What could possibly go wrong?

The buzz today is all about technology, because high-tech almost never has financial bubbles. Just consider all the borrowing by the consumers.

A Reuters analysis of U.S. household data shows that the bottom 60 percent of income-earners have accounted for most of the rise in spending over the past two years even as the their finances worsened - a break with a decades-old trend where the top 40 percent had primarily fueled consumption growth.

...The data shows the rise in median expenditures has outpaced before-tax income for the lower 40 percent of earners in the five years to mid-2017 while the upper half has increased its financial cushion, deepening income disparities.

It leaves only one question: who is it that is doing all this lending to the working poor at the worst time? (i.e. who will be asking for a taxpayer bailout in a year or two?)

Those guys are known as FinTech.

Ten years on from the credit crisis, Americans are again piling on debt in all its varieties, from credit cards to student loans to mortgages. These days, personal loans—a category turbocharged by fintech upstarts—are growing especially quickly. With an increasing number of shaky borrowers taking on this debt, the risks are growing for lenders during the next economic downturn.The stock of personal loans outstanding has grown to about $120 billion as of March, according to TransUnion data. That compares with $71.9 billion a decade ago—worth around $90 billion adjusted for inflation—when the subprime mortgage crisis crescendoed.

...

Upstart financial technology companies like Lending Club, Prosper, and Avant account for about a third of this lending, up from less than 1% in 2010.Until recently, personal loans were mainly used by borrowers with poor credit who may not have had access to credit cards or home equity loans, according to Jason Laky, TransUnion’s consumer-lending business lead.

If you're thinking "I've never heard of these guys before" then consider who backs them.

Goldman Sachs has jumped in with its Marcus online bank, which the Wall Street stalwart introduced in 2016. Goldman says Marcus has more than 1.5 million customers and has originated more than $4 billion in consumer loans since it launched.

Now you shouldn't get the idea that all the risky lending that is going on is just Wall Street banks again. Because the really risky lending wasn't the big banks before, and it isn't this time either.

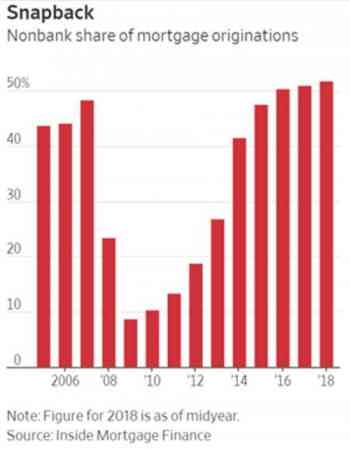

Freedom is nowhere near the size of behemoths like Citigroup or Bank of America; yet last year it originated more mortgages than either of them, some $51.1 billion, according to industry research group Inside Mortgage Finance. It is now the 11th-largest mortgage lender in the U.S., up from No. 78 in 2012.

...Postcrisis regulations curb bank and nonbank lenders alike from making the “liar loans” that wiped out many lenders and forced a wave of foreclosures during the crisis. What worries some industry participants is that little has changed about nonbank lenders’ structure.Their capital levels aren’t as heavily regulated as banks, and they don’t have deposits or other substantive business lines. Instead they usually take short-term loans from banks to fund their lending. If the housing market sours, banks could cut off their funding—which doomed some nonbanks in the last crisis. In that scenario, first-time buyers or borrowers with little savings would be the first to get locked out of the mortgage market.

Fortunately, Donald Trump is in charge, and he's decided that all the financial regulation passed since 2008 can be

rolled back because we don't need it anymore.

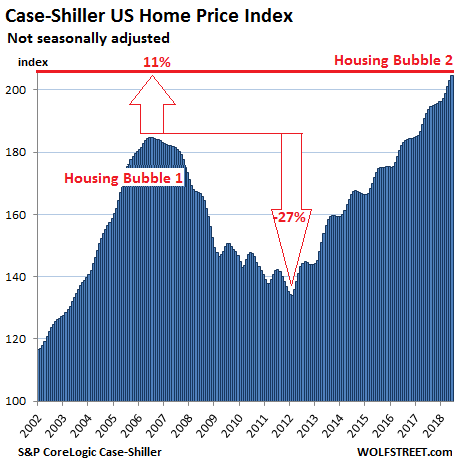

The 2008 financial crisis cost every American $70,000, according to the San Francisco Federal Reserve. An entire generation’s lifetime earnings will be lower because of it. Trillions of dollars in wealth were destroyed.And yet, we seemingly learned nothing from it — which means it could happen again, and sooner than you think.

And that's the reason why history repeats.

Comments

And apparently, the Democrats agree

How lucky for us Obama is back to tell us it is all up to us.

"Religion is what keeps the poor from murdering the rich."--Napoleon

guess he donated his comfortable shoes to st vinnies

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

Today I learned that it wasn't Barry's fault that the banks

weren't prosecuted. Yup. It was Holder's fault for not doing anything about that massive fraud they committed and continued to commit when they foreclosed on millions of houses. He also wasn't responsible for not passing legislation that would have helped main stream Americans. Nope. This was the republicans fault because they blocked him from passing the things he knew people needed. People knew that none of those things were his fault and that's why they reelected him.

That people believe that is mind boggling. But they do.

Scientists are concerned that conspiracy theories may die out if they keep coming true at the current alarming rate.

What I learned is

that crime pays in the United States (big time) if you are rich and powerful.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

We've learnt it will happen again

https://www.nytimes.com/2018/09/07/opinion/sunday/bernanke-lehman-annive...

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

I learned that Clinton, Greenspan and Clinton's

financial advisors were even worse than I thought and watch out for the crap they bury in bills allegedly passed to avoid and/or end a government shut down. Oh, and, between crap mortgage derivatives and Madoff, the SEC doesn't seem to be worth a warm bucket of spit.

heh, well...

the wall street crowd has learned that there's nothing better than a financial crisis to shore up their gains and solidify that transfer of wealth from the poor upwards.

now that they know how to profit from a crisis (now made much easier due to the precedent that obama set) we can expect the "business cycle" to accelerate.

What amazes me

is that many people today intend to die owing. Ive seen many take a equity loan on the homes they own free and clear to buy something they don't need but want. Hell will rule when they need something.

Consumerism is a disease.

Regardless of the path in life I chose, I realize it's always forward, never straight.

there is a balance

if you don't have offspring or other relations or close friends who need the money, you have two choices: use it, or donate it to a worthy cause.

there's no point in dying a millionaire if there are things you left undone because you "couldn't afford" them. (which of course is not the same as buying more useless stuff with which to clutter your time on this earth.)

The earth is a multibillion-year-old sphere.

The Nazis killed millions of Jews.

On 9/11/01 a Boeing 757 (AA77) flew into the Pentagon.

AGCC is happening.

If you cannot accept these facts, I cannot fake an interest in any of your opinions.

It’s all about appearances

Or that’s what I’ve learned. They can’t let this happen again on Trump’s watch. The plebes will ask too many questions. But get another smooth talking Obama type in who looks “in charge” and they can literally get away with robbery.

Idolizing a politician is like believing the stripper really likes you.