"It reminds me of what happened in mortgage-backed securities in the run-up to the crisis"

This isn't 2008.

In 2008 we had one huge bubble in the economy burst. That's not what is happening today.

What is happening today is several smaller bubbles in the economy all imploding, or looking ready to implode.

The fracking bubble is in full-scale meltdown and will probably completely implode this year.

The Tech Bubble has been compared to the Titanic right after hitting the iceberg, but before the ship began sinking.

The student debt bubble, on the other hand, is getting unstable, but is still expanding.

There is one other bubble in the economy that doesn't get noticed as much, but it most resembles the subprime bubble of 2008 - subprime auto loans.

“What is happening in this space today reminds me of what happened in mortgage-backed securities in the run-up to the crisis,” U.S. Comptroller of the Currency Thomas Curry warned in October about the auto loan bubble.

And his warning is now becoming reality.

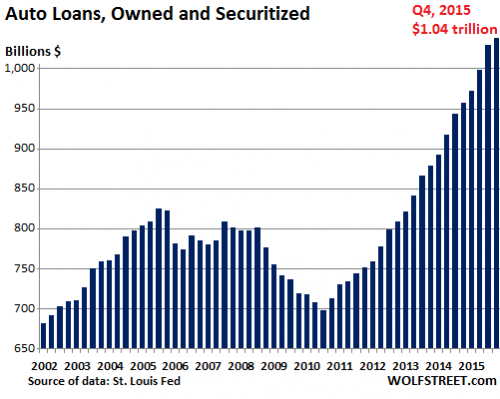

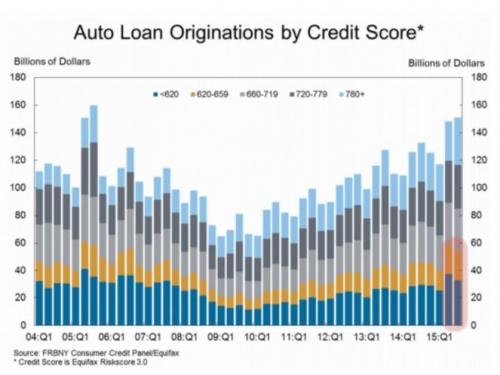

The reason that subprime auto loans of 2016 look a lot like subprime mortgages of 2007 is because the loans are going to increasingly more risky borrowers, in increasingly larger amounts, even while default rates climb.

It's a very familiar scenario.

This surge in the subprime auto ABS market is reminding some onlookers of the surge in the subprime mortgage-backed securities (MBS) market prior to the Financial Crisis.

In addition, the percentage of the total amount of auto loans going to borrowers with credit scores below 620 is currently at its highest level since before the Financial Crisis.

The subprime auto loans were structured and sold off into the market (probably into your 401k) in almost exactly the same way that subprime mortgages entered the bond market before the crash.

Much like the MBSs constructed during the mortgage bubble, subprime auto loan-backed securities are designed to withstand a certain level of defaults. However, the market runs into trouble when default rates exceed the estimated levels. Bloomberg reports that subprime auto default rates have also reached their highest level since 2010, climbing a staggering 1.0% month-over-month in January to 12.3%.

Not only are the overall numbers trending in the wrong direction, there is anecdotal evidence of loosening lending standards happening in the auto lending space that are nearly identical to the dynamics of the subprime mortgage bubble.

OK. So lots of bad loans. But they wouldn't have pushed all those loans off to unsuspecting investors again, right. They couldn't have possibly gotten away with that again.

Auto lender Skopos Financial recently packaged $154 million in auto loans to be sold to investors.

Incredibly, more than 84 percent of these loans were made to borrowers with credit scores under 600 or no credit scores at all. Despite the extremely low credit quality of the borrowers, the ABSs they comprised were expected to be rated as high as AA when marketed to investors by Citigroup.

Doh! I guess people with bonds in their retirement funds are about to take another bath.