Half of all Frackers will be dead this year

The Democrats in the House celebrated Earth Day by proposing a ban fracking on federal land. Texas Republicans celebrated the day by passing a bill to deny communities the ability to restrict fracking in their areas.

Meanwhile, the economics of fracking and oil is making all the political moves moot.

Half of the 41 fracking companies operating in the U.S. will be dead or sold by year-end because of slashed spending by oil companies, an executive with Weatherford International Plc said.

There has already been plenty of consolidation. At the start of last year there were 61 frackers.

Weatherford, which operates the fifth-largest fracking operation in the U.S., has been forced to cut costs “dramatically” in response to customer demand, Fulks said...

Oil companies are cutting more than $100 billion in spending globally after prices fell. Frack pricing is expected to fall as much as 35 percent this year, according to PacWest, a unit of IHS Inc.

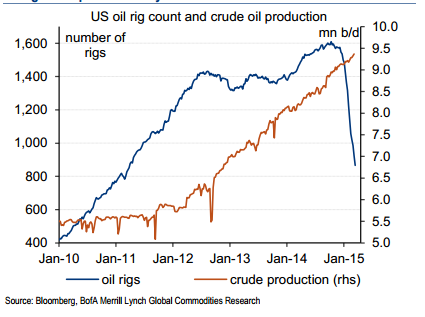

The frackers have been surprisingly resilient so far. Even while the oil rig count has dropped by half (i.e. which means lots of layoffs in the shale fields), fracking oil production has continued to climb.

Some continue to be bullish on the market.

Few of the oil barons in Houston believe market chatter about a V-shaped rally ahead. "Prices are not going to snap back. People are in denial," said Prince Nawaf Al-Sabah, head of Kuwait's explorer, KUFPEC.

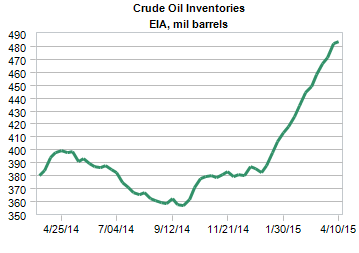

US oil inventories have risen to a record 480m barrels. The Chinese have filled their strategic petroleum reserves.

The world is awash in oil. As long as the laws of supply and demand still matter, there will be no price bounce in oil prices.

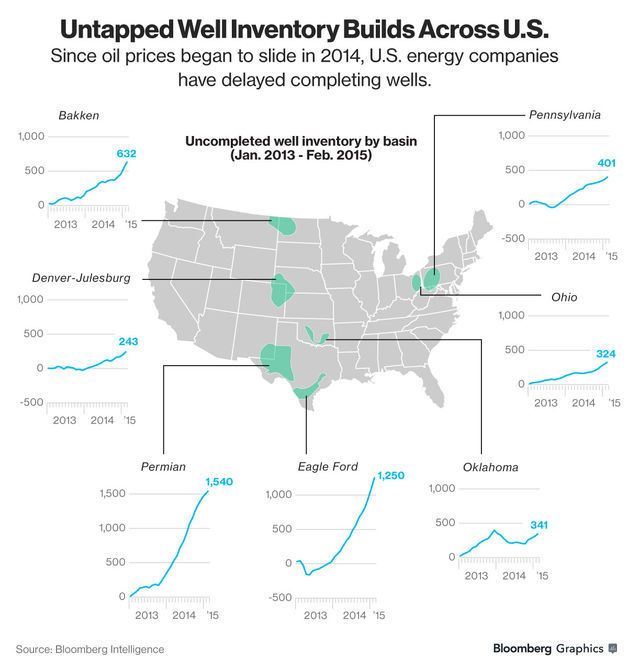

What's more, even if oil inventories do begin to fall, the shale industry is ready to fill those inventories right back up.

Drillers in oil and gas fields from Texas to Pennsylvania have yet to turn on the spigots at 4,731 wells they’ve drilled, keeping 322,000 barrels a day underground, a Bloomberg Intelligence analysis shows. That’s almost as much as OPEC member Libya has been pumping this year.

The number of wells waiting to be hydraulically fractured, known as the fracklog, has tripled in the past year as companies delay work in order to avoid pumping more oil while prices are low. It’s kept crude off the market with storage tanks the fullest since 1930. The fracklog may slow a recovery as firms quickly finish wells at the first sign of higher prices.

Unlike the United States, the Chinese and much of the developing world has taken advantage of the crash in energy prices by cutting fuel subsidies and raising gas taxes.

Banks have looked at the oil prices and moved to cut the frackers' credit lines. That normally signals the end of a business model, but not this time.

So how have frackers managed to stay in business? It's because the world is awash in more than just oil. It's awash in cash and negative interest rates. That makes any investment, even questionable ones, worth taking a second look at.

According to Thomson Reuters Deals Intelligence, there have been 29 U.S. oil and gas equity deals so far this year that raised $13.9 billion, the highest volumes for that period in 15 years.

And it isn't just the stock market that frackers have been able to tap. The bond market has been kind as well.

The firms are getting a lifeline as banks shrink credit lines that are tied to the value of oil reserves. They’ve been able to pile on new debt because their existing obligations -- most of which were issued at the height of the shale boom -- exclude borrowing restrictions typically demanded by junk-bond investors. Those debtholders are now being punished because the new creditors are getting a stronger claim on assets.

“It’s kind of the last bullet in the chamber for a lot of these companies in the most precarious situation,” John McClain, a money manager who helps oversee $16 billion at Columbus, Ohio-based Diamond Hill Investment Group, said in a telephone interview. “We saw weak covenants across the broader energy space, so the ability to do second liens was certainly there. It is a negative for unsecured holders, as it’s diluting your claim.”

The frackers have managed to stay alive in spite of the fundamentals because they've been able to tap into the global financial market which is also defying its underlying fundamentals.

There's no telling when it will end, but it will end sooner or later.

Comments

Only half?

Seriously, fracking is something that should have never been. It is just another symptom of a country that is unwilling to look at alternative clean and renewable energy sources. Other developed countries are investing in large scale alternatives such as solar, wind , and wave as sources for powering static uses. For transportation and commerce, they are investing in high speed rail which is far more fuel efficient than trucks for goods and automobiles for transportation.

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy

Fracking is a huge problem everywhere.

Virgin forests, school playgrounds, residential neighborhoods matters not to them. Red governors passing laws prohibiting cities and counties from passing laws restricting them. This is what the TPP looks like.

"Religion is what keeps the poor from murdering the rich."--Napoleon

You nailed it, dk!

I had to change Red Governors to elected officials since the TPP is so bipartisanally. Ugh!

Do I hear the sound of guillotines being constructed?

“Those who make peaceful revolution impossible will make violent revolution inevitable." ~ President John F. Kennedy