Dystopian Headlines

Sitting in my San Francisco apartment, my office closed for 3 weeks due to a pandemic, my mind has turned to the opening scenes of countless zombie movies.

I am not reassured from scanning the news.

Some media pundits are telling us to embrace the suck.

Whether Americans like it or not, Covid-19 is ushering in an era when big business will be more important than ever.

...For information on Covid-19, Twitter is a very useful stop. As hospitals become overcrowded, CVS and Rite Aid may become important as local health centers and sources of community information.

...

Whether Americans like it or not, after the worst of Covid-19 is over, theirs is going to be a nation where big business plays a larger role. The title of my most recent book gives some indication where I stand, and I predict more Americans will come to a new appreciation of big business over the coming months.

Twitter instead of actual news.

CVS instead of hospitals.

The big business that gutted public services and turned us into a 3rd world nation, and we will "come to a new appreciation over the coming months."

I'd like to get some odds on that bet.

Meanwhile Mom and Pop and Joe Sixpack are buying stocks during a crash.

As of last week, when the sell-off began to accelerate, BlackRock and Vanguard customers were net buyers every single day. By the end of the week, State Street’s customers turned into sellers. (We should get updated data on last week from all three fund managers later this week.)In other words, as the sell-off progressed, Wall Street pros panicked and sold while moms and pops stayed calm and bought.

Retail investors are the dumb money? I don’t think so.

Sure, the people buying index funds and that don't even open their statements are the smart investors.

One major fund had this to say: "Given the size of our economy relative to where it was 10–15 years ago, it would probably be appropriate for Congress to pass a TARP-style program of $2 trillion."

That would sense if you discount the fact that it would totally destabilize our political system.

The only reason to go to zerohedge is for the economics (skip their politics).

This article is worth reading.

moments ago the Fed announced that, just as we reported earlier, it will establish a Commercial Paper Funding Facility (CPFF) - the same facility that was unveiled during the last financial crisis - "to support the flow of credit to households and businesses."

...now that the Lehman playbook is in play, the bailout of Corporate America is suddenly very political.

As part of the CP facility, the Treasury will provide $10 billion of credit protection to the Federal Reserve in connection with the CPFF from the Treasury's Exchange Stabilization Fund (ESF). The Federal Reserve will then provide financing to the SPV under the CPFF.

Just $10 Billion from the taxpayer so far. Surely the media is asking "How are you going to pay for it?"

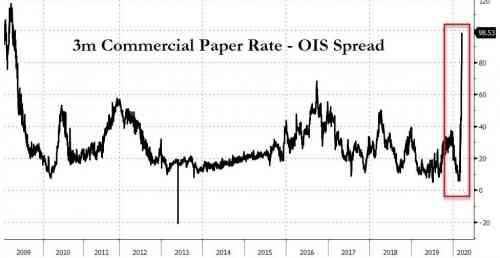

There's just one problem, and you can see it in this chart.

TD Securities rates strategist Gennadiy Goldberg said that the fact that the spread on the Federal Reserve’s resurrected commercial paper funding facility at 3-month OIS+200bp is larger than it was in 2008, when it was 3-month OIS+100bp, which "may limit the efficacy of the facility."

Why? Because according to Goldberg, "the Fed is probably hoping banks go to the discount window while non-financial corporates go to this facility."

The seemingly punitive rate may also "limit how much relief the facility provides to FRA-OIS. This is the exact opposite of the approach the have taken via the repo facility, where repo amounts on offer are effectively unlimited," and begs the question why does the Fed keep shooting itself in the foot when on one hand it appears to be offering unlimited liquidity at least until one reads the fine print.

Now the really bad news: by launching the Lehman playbook, the Fed is telegraphing that the US is now facing systemic risk crisis which also includes the banks and corporations, something which was missing until now.

Yeh, that failed to get on the TV news.

Comments

That was fast

Speaking of fast

Unbridled Greed

Will now sweep the globe, if Trump and people like him have there way with Mother Earth.

RIP

Crisis is also opportunity...

[video:https://www.youtube.com/watch?v=niwNTI9Nqd8]

“Until justice rolls down like water and righteousness like a mighty stream.”

Mom & Pop

I knew a crash was imminent when I saw this back in February: Trump administration considers tax incentive for more Americans to buy stocks, report says

The traditional role of the retail investor is to be the Greater Fool and this is being encouraged.

I just don't think there are enough of them anymore.

We wanted decent healthcare, a living wage and free college.

The Democrats gave us Biden and war instead.

Another Dystopian Story

I ran across this video:

https://twitter.com/i/status/1239702910881144833

And for the hell of it wrote this letter to sheriff@jpso.com:

Sheriff of Jefferson Parish,

Could you pass this message along to an appropriate information officer?

I just saw a rather disturbing video purporting to be from your jurisdiction.

The video appears to show an officer attempting to "plant" incriminating evidence at the scene of an arrest. Obviously, as I have no standing in this situation (as I am not anywhere near your jurisdiction) you have no obligation to respond to me in any way.

However, I would like to know if your department will be posting to your www.jpso.com website, or to any social, or broadcast media any statement for public information.

Sincerely,

Robert I. Price, concerned citizen.

Via return email I received this:

And other than that, how was the play, Mrs. Lincoln?

Also: would anyone else care to participate in this game?

RIP

fun stuff rip

would love to join on the playground

a brief round or two

unfortunately, have been playing this

game of injustice most my adult life

losing the taste of

confronting author it lies

and getting bashed for it

Zionism is a social disease

I know whereof you speak.

A retirement fund not as flush as it was supposed to be. Fighting a knock-down-drag-out with the dean prior to the final sign-out.

But in the end: it was all worth the effort. I have some good (excellent even) memories on the three and a half decade fight. And, with respect to some, I outlived the bastards.

So, all tolled, I think I came out ahead.

RIP

And here I was led to believe that all the banks passed

the stress test.....There is no fucking way that banks needed this money $9tril just cuz mr markit wasn't listening to tRumpolini's twiit about how great everything is.

Weird

Stocks saying AOK for today

Bonds routed as inflation is coming for today

Gold...shoulda been $1000 higher

Crude....still no demand for me

Dollar.....everyone wants me

With no correlation seemingly anywhere, are all markits a narrative?

https://jessescrossroadscafe.blogspot.com/

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

There's a lot going on

Gold is sluggish because it's the opposite of the dollar, and because we are having maybe the largest margin call in history, the dollar is strong.

Stocks are all over the place, and are still pricey.

The real action is in the bond market. We'll know more in the coming weeks

Actually irt Gold, I believe this to be the week

that the dollar died, and like w/everything irt this administration, they just don't know it.

I never knew that the term "Never Again" only pertained to

those born Jewish

"Antisemite used to be someone who didn't like Jews

now it's someone who Jews don't like"

Heard from Margaret Kimberley

The Fed has already used all of its ammo

Congress never even came close to balancing the budget.

So if things don't stabilize soon, we could be looking at a worse-case scenario.

Because anything else they try will hurt the dollar.

doubt the dollar can get much worse

even more sick than the health care industry

the high rollers are bailing

global currency is next

Zionism is a social disease

The dollar's strength is relative to other currencies

The Euro is about to have an Italian bond crisis and a Deutsche Bank failure.

The Yen remains a mess.

The Chinese Yuan still doesn't float and isn't entirely convertible.

All other economies are small.

except the ruble

the dollar's relative weakness

has much to do with the relative strengths

of other stable currencies invigorated by

sanctions from american 'interests'

doing without the dollar in international trade

has become the only sensible alternative

Zionism is a social disease

Russia's economy is still tiny

and heavily sanctioned.

They have the remarkable qualities of having almost no external debt, and little exposure to the U.S. dollar.

But it doesn't change the fact that almost no one outside of Russia uses Rubles.