The Decline and Fall of Deutsche Bank

Submitted by gjohnsit on Sun, 07/10/2016 - 2:30pm

Yesterday the chief economist at Deutsche Bank called for a 150 Billion Euros bank bailout.

The chief economist of Deutsche Bank calls a multibillion dollar bailout for European banks. The institutions should be equipped American-style with fresh capital. At that time the government had stepped in 475 billion dollars. "In Europe, the program must not be so large. With 150 billion euros can be European banks recapitalize," said David Folkerts-Landau of the "Welt am Sonntag"...

The decline in bank stocks is only the symptom of a much larger problem, namely a fatal combination of low growth, high debt and a proximity to dangerous deflation. "Europe is seriously ill and needs to address very quickly the existing problems, or face an accident," said the chief economist.

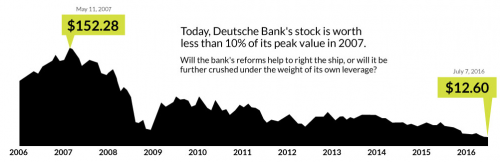

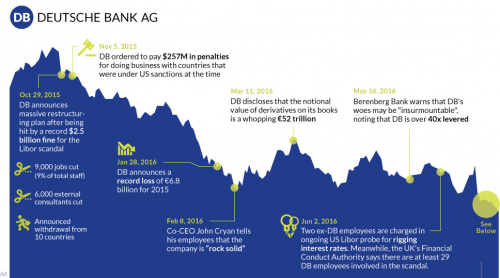

Deutsche Bank has been seriously ill since 2007, but now its getting critical.

Deutsche Bank – “the most important net contributor to systemic risks,” as the IMF put it last week after a lag of several years – is having a rough time. Shares dropped 4.2% today to close at a new three-decade low of €11.63, down 48% since July 31 last year, lower even than the low during the doom-and-gloom days of the euro debt crisis and the Global Financial Crisis.

It’s not the only European bank in trouble. Credit Suisse dropped 1.7% today to CHF 9.92, another multi-decade low, down 63% since July 31. Other European banks are getting mauled too. The European Stoxx 600 banking index dropped 3% today to 117.69, approaching the Financial Crisis low of March 2009.

Visualcapitalist has some good charts for this.

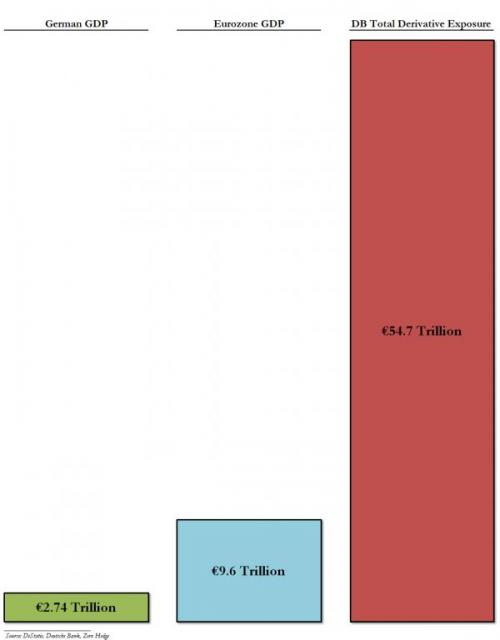

The real concern is Deutsche Bank's size.

It is the largest bank in Germany, which makes its trouble's scary.

But what should cause the most alarm is Deutsche Bank's derivatives portfolio .

DBK's outstanding derivatives exposure is 20x Germany's GDP and 5x greater than the Eurozone's.

Comments

So...Stock market up or freefall tomorrow?

If I still had assets transferable I would not hedge now (never did) but now I would put 5 pennies toward the US markets rabidly happy tomorrow. I now trade in seeds.

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

Good Choice...

Infinitely more valuable than these "Derivatives" the Casinos/Banks trade in...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

Here We Go Again...

Another Worldwide Round Of Bank Crashes, headed our way...

One country after another as the "Too Big To Fail Casinos" come to us with their hands out...

I'm the only person standing between Richard Nixon and the White House."

~John F. Kennedy~

Economic: -9.13, Social: -7.28,

Not anymore.

That's what central banks are for. Stealth bailouts.

I thoughout the German banks

always voted against bailouts. Right?

Life is strong. I'm weak, but Life is strong.

My WAG is that Germany

would flush the Eurozone before they would let DB tank.

They'll end up doing both eventually.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

Last time...

the European bank contagion scare started on the periphery. (Portugal, Ireland, Greece, )

This time the contagion is infecting the core. (Germany, Italy, Spain, France?)

Core is worse.

The current working assumption appears to be that our Shroedinger's Cat system is still alive. But what if we all suspect it's not, and the real problem is we just can't bring ourselves to open the box?

When will we get our heads out of our asses.....

..... and ban derivatives outright, worldwide?

"US govt/military = bad. Russian govt/military = bad. Any politician wanting power = bad. Anyone wielding power = bad." --Shahryar

"All power corrupts absolutely!" -- thanatokephaloides

WE can't. Make that fuse burn faster,

Hey! my dear friends or soon-to-be's, JtC could use the donations to keep this site functioning for those of us who can still see the life preserver or flotsam in the water.

China is going to get on the fun too

China's half trillion dollar bailout

Do you think the banks are manipulating the

situation deliberately to get the laws changed so that banks don't have to have a minimum level of capital?

dfarrah

so,this awful statistic made me finally look up what

"derviatives" are. (again, because I know I had done this years ago, but then never really understood and forgotten most of what I read). I hate all of these words. From this simple site for simpletons, "What are derivatives really?:

So, I am not investing into anything, if I put my money in a retirement annuuity account, it's the company issuing the annuity contract to me, who invests my money into something and I have no clue into what. So, I think it's an insult to blame little people to be uninformed investors, as if we would make those decisions ourselves. We rely on whoever the issuer of annuities retirement accounts are to invest it for us to guarantee us lifelong retirement income. How should I understand if those accounts are in danger to lose value to the point that the guaranteed payments they promise to make at the end of the annuity contracts so that they are not capable of making the a payments anymore. I can't figure out, if I should just start to withdraw now or wait the couple of years til the contract comes to term.

I hate the whole stuff. Let those banks crash. People need to know what banks and insurance companies are doing with their money and feel safe in their retirement. I wonder who the heck in the Deutsche Bank let it run so much out of control. NO mercy.

Who were the idiots to allow those derivatives to be used? Occupy those suckers and send them to prison.

https://www.euronews.com/live

Derivatives are nothing more than uninvolved bystander

investors betting on outcomes. If large financial companies want to engage in this stupid behavior I have no issue with that, but I do have an issue with any public funds being expended to save them when they bankrupt themselves.

Remember the saying that became popular during the meltdown - that these Masters of the Universe "privatize the profits and socialize the losses"? Well it's an excellent and concise summary of the game is played and the citizens of the world shouldn't stand for it. The bailouts for the 1% come from cutbacks and austerity for the 99%.

" “Human kindness has never weakened the stamina or softened the fiber of a free people. A nation does not have to be cruel to be tough.” FDR "